Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

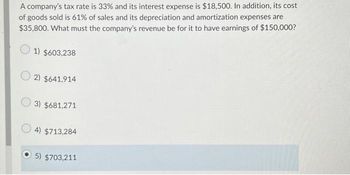

Transcribed Image Text:A company's tax rate is 33% and its interest expense is $18,500. In addition, its cost

of goods sold is 61% of sales and its depreciation and amortization expenses are

$35,800. What must the company's revenue be for it to have earnings of $150,000?

1) $603,238

2) $641,914

3) $681,271

4) $713,284

5) $703,211

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Nonearrow_forwardYour pro forma income statement shows sales of $1,006,000, cost of goods sold as $488,000, depreciation expense of $97,000, and taxes of $105,250 due to a tax rate of 25%. What are your pro forma earnings? What is your pro forma free cash flow? Complete the pro forma income statement below: (Round to the nearest dollar.) Sales Cost of Goods Sold Gross Profit Depreciation EBIT Taxes (25%) Earnings $ $ $ $ $ $ $arrow_forwardG. R. Edwin Inc. had sales of $5.88 million during the past year. The cost of goods sold amounted to $2.8 million. Operating expenses totaled $2.57 million, and interest expense was $30,000. Use the corporate tax rates shown in the popup window, Taxable Income Marginal Tax Rate $0−$50,000 15% $50,001−$75,000 25% $75,001−$100,000 34% $100,001−$335,000 39% $335,001−$10,000,000 34% $10,000,001−$15,000,000 35% $15,000,001−$18,333,333 38% Over $18,333,333 35% , to determine the firm's tax liability. What are the firm's average and marginal tax rates?arrow_forward

- Need Helparrow_forwardBlack River Adventures has net income of $3,518, interest expense of $1,715, sales of $24, 450, and costs of $10, 180. What is the amount of the depreciation expense if the firm's tax rate is 35 percent? Multiple Choice $7, 142.69 $2,503.57 $9, 037.00 $8,857.69arrow_forwardBenson, Inc., has sales of $44830, costs of $14,370, depreciatior and interest expense of $2,390. The tax rate if 23 percent. What is the operating cash flow, or OCF?arrow_forward

- Please do both of the questions below:- 1. Use the following information to work out the net profit before tax:Cost of sales. $60,000 Interest payable. $4000 expenses. $20,000. sales turnover. $100,000 2. Vindhya Limited earns $200,000 in sales, has expenses of $80,000 and cost of goods sold amount to $90,000. What is the firm's gross profit?arrow_forwardBelow are Income Statement data for Baker Corporation: Operating expenses $124,000, Other expenses $12,000, Income taxes $29,000, Cost of goods sold $101,000, and the Net revenue $333,000. What is the company's return on sales? A. 69.67% B. 16.92% C. 32.43% D. 20.12%arrow_forward12-7 A firm's annual revenues are $850,000. Its expenses for the year are $615,000, and it claims $135,000 in depreciation expenses. What does it pay in taxes, and what is its after-tax income?arrow_forward

- The web Corp has sales of $143489, cost of goods sold and other expenses (excluding depreciation) of $55491, depreciation of $16870, and a debt of $8000 on which it has to pay 4% interest. It's tax rate is 35%. Calculate its net incomearrow_forwardThe following information is available for Tamarisk Corp. for the year ended December 31, 2022. Other revenues and gains $23,800 Other expenses and losses 4,000 Cost of goods sold 292,000 Sales discounts 4,600 Sales revenue 760,000 Operating expenses 221,000 Sales returns and allowances 10,800 Prepare a multiple-step income statement for Tamarisk Corp. The company has a tax rate of 25%.arrow_forwardLantos Company had a 20 percent tax rate. Given the following pretax amounts, what would be the income tax expense reported on the face of the income statement? Sales revenue Cost of goods sold Salaries and wages expense Depreciation expense Dividend revenue Utilities expense Discontinued operations loss Interest expense $1,000,000 600,000 80,000 110,000 90,000 10,000 100,000 20,000 Example of Answer: 4000 (No comma, space, decimal point, or $ sign)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education