Principles of Accounting Volume 2

19th Edition

ISBN: 9781947172609

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

Question

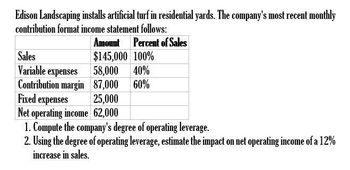

Transcribed Image Text:Edison Landscaping installs artificial turf in residential yards. The company's most recent monthly

contribution format income statement follows:

Sales

Variable expenses

Amount Percent of Sales

$145,000 100%

58,000 40%

Contribution margin 87,000 60%

Fixed expenses

25,000

Net operating income 62,000

1. Compute the company's degree of operating leverage.

2. Using the degree of operating leverage, estimate the impact on net operating income of a 12%

increase in sales.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Engberg Company installs lawn sod in home yards. The company's most recent monthly contribution format income statement follows: Sales Variable expenses Contribution margin Fixed expenses Net operating income Required: Percent of Amount Sales $ 88,000 100% 35,200 40% 52,800 60% 42,240 $ 10,560 1. What is the company's degree of operating leverage? 2. Using the degree of operating leverage, estimate the impact on net operating income of a 8% increase in unit sales. 3. Construct a new contribution format income statement for the company assuming a 8% increase in unit sales.arrow_forwardEngberg Company Installs lawn sod in home yards. The company's most recent monthly contribution format Income statement follows: Percent of Sales Amount Sales 100% $ 127,000 50,800 48% Variable expenses Contribution margin 76,200 60% Fixed expenses 19,000 Net operating income $ 57,200 Required: 1. What is the company's degree of operating leverage? 2. Using the degree of operating leverage, estimate the impact on net operating Income of a 27% Increase in unit sales. 3. Construct a new contribution format Income statement for the company assuming a 27% Increase in unit sales. Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Construct a new contribution format income statement for the company assuming a 27% increase in unit sales. Engberg Company Contribution Income Statement Amount Percent of Sales Sales ✔S 34,290 X 13,716 Variable expenses Contribution margin 20,574 Fixed expenses 19,000 Net…arrow_forwardSubject:- Accountingarrow_forward

- Engberg Company installs lawn sod in home yards. The company’s most recent monthly contribution format income statement follows: Amount Percent of Sales Sales $ 94,000 100% Variable expenses 37,600 40 Contribution margin 56,400 60% Fixed expenses 43,240 Net operating income $ 13,160 Required: 1. What is the company’s degree of operating leverage? 2. Using the degree of operating leverage, estimate the impact on net operating income of a 5% increase in unit sales. 3. Construct a new contribution format income statement for the company assuming a 5% increase in unit sales.arrow_forwardEngberg Company installs lawn sod in home yards. The company's most recent monthly contribution format income statement follows: Percent of Sales 100% 40% 60% Sales Variable expenses Contribution margin Amount $ 86,000 34,400 51,600 Fixed expenses 41,280 Net operating income $ 10,320 Required: 1. What is the company's degree of operating leverage? 2. Using the degree of operating leverage, estimate the impact on net operating income of a 8% increase in unit sales. 3. Construct a new contribution format income statement for the company assuming a 8% increase in unit sales. Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 What is the company's degree of operating leverage? (Round your answer to 2 decimal places) Degree of operating leverage 4.29 Required 2arrow_forwardEngberg Company installs lawn sod in home yards. The company's most recent monthly contribution format income statement follows: Percent of Sales 100% 40% 60% Sales Variable expenses Contribution margin Fixed expenses Net operating income Amount $ 82,000 32,800 49,200 38,540 $ 10,660 Required: 1. What is the company's degree of operating leverage? 2. Using the degree of operating leverage, estimate the impact on net operating income of a 6% increase in unit sales. 3. Construct a new contribution format income statement for the company assuming a 6% increase in unit sales.arrow_forward

- Engberg Company installs lawn sod in home yards. The company's most recent monthly contribution format income statement follows: Percent of Amount Sales Sales $ 134,000 53,600 100% Variable expenses 40% Contribution margin 80, 400 60% Fixed expenses 15, 000 $65,400 Net operating income Required: 1. What is the company's degree of operating leverage? 2. Using the degree of operating leveráge, estimate the impact on net operating income of a 12% increase in sales. 3. Construct a new contribution format income statement for the company assuming a 12% increase in sales. ces Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 What is the company's degree of operating leverage? (Round your answer to 2 decimal places.) Degree of operating leveragearrow_forwardEngberg Company installs lawn sod in home yards. The company’s most recent monthly contribution format income statement follows: Amount Percent of Sales Sales $ 145,000 100 % Variable expenses 58,000 40 % Contribution margin 87,000 60 % Fixed expenses 22,000 Net operating income $ 65,000 Required: 1. What is the company’s degree of operating leverage? 2. Using the degree of operating leverage, estimate the impact on net operating income of a 23% increase in sales. 3. Construct a new contribution format income statement for the company assuming a 23% increase in sales. PART 1: What is the company’s degree of operating leverage? (Round your answer to 2 decimal places.) Degree of operating leverage PART 2 Using the degree of operating leverage, estimate the impact on net operating income of a 23% increase in sales. (Do not round intermediate calculations. Round your percentage…arrow_forwardEngberg Company installs lawn sod in home yards. The company's most recent monthly contribution format income statement follows: Sales Variable expenses Contribution margin Fixed expenses Net operating income Amount $ 88,000 35,200 52,800 41,360 $ 11,440. Percent of Sales 100% 40% 60% Required: 1. What is the company's degree of operating leverage? 2. Using the degree of operating leverage, estimate the impact on net operating income of a 6% increase in unit sales. 3. Construct a new contribution format income statement for the company assuming a 6% increase in unit sales.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College