Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN: 9781337115773

Author: Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

What will be ending balance in common stock next year?

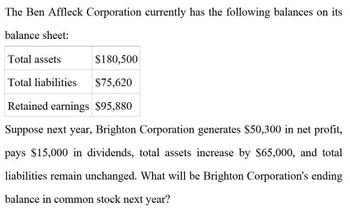

Transcribed Image Text:The Ben Affleck Corporation currently has the following balances on its

balance sheet:

Total assets

$180,500

Total liabilities

$75,620

Retained earnings $95,880

Suppose next year, Brighton Corporation generates $50,300 in net profit,

pays $15,000 in dividends, total assets increase by $65,000, and total

liabilities remain unchanged. What will be Brighton Corporation's ending

balance in common stock next year?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Rebert Inc. showed the following balances for last year: Reberts net income for last year was 3,182,000. Refer to the information for Rebert Inc. above. Also, assume that the market price per share for Rebert is 51.50. Required: 1. Compute the dollar amount of preferred dividends. 2. Compute the number of common shares. 3. Compute earnings per share. (Note: Round to two decimals.) 4. Compute the price-earnings ratio. (Note: Round to the nearest whole number.)arrow_forwardBalance in common stock next year?arrow_forward3. We have the following information on Costco (COST) on October 20th, 2020: the previous close price $375.56, market cap $166.92 billion, P/E ratio 41.94, and dividend yield of 0.75%. How many shares were outstanding? How much earnings was distributed in total? How much earnings was retained in the corporation?arrow_forward

- You are given the following information: Stockholder's Equity Price/Earnings Ratio Share Outstanding Market/Book Ratio $1,250 5 25 1.5 Calculate the market price of a share of the company's stock. Consider the summarized data from the balance sheets and income statements of Wiper Inc. If Wiper's stock had a price/earnings ratio of 12 at the end of 2020, what was the market price of the stock? Wiper Inc. Condensed Balance Sheets December 31, 2020, 2019, 2018 (in millions) 2020 2019 2018 Current assets $764 $981 $843 Other assets Total assets 2,424 1,931 1,730 $3,188 $2,912 $2,573 Current liabilities Long-term liabilities Stockholders' equity $588 $841 $734 1,582 1,034 910 1,018 1,037 929 Total liabilities and stockholders' equity $3,188 $2,912 $2,573 Wiper Inc. Selected Income Statement and Other Data For the year Ended December 31, 2020 and 2019 (in millions) 2020 2019 Income statement data: Sales $3,061 $2,924 Operating income 307 321 Interest expense 95 76 Net income 224 219 Other…arrow_forwardFollow the Instructionarrow_forward(Market value analysis) Lei Materials' balance sheet lists total assets of $1.17 billion, $197 million in current liabilities, $435 million in long-term debt, $538 million in common equity, and 50 million shares of common stock. If Lei's current stock price is $54.48, what is the firm's market-to-book ratio? The market-to-book ratio is (Round to two decimal places.)arrow_forward

- Suppose that in April 2019, Nike Inc. had sales of $36,367 million, EBITDA of $5,229 million, excess cash of $5,238 million, $3,804 million of debt, and 1,583.2 million shares outstanding. a. Using the average enterprise value to sales multiple in the table here,, estimate Nike's share price. b. What range of share prices do you estimate based on the highest and lowest enterprise value to sales multiples in the table above? c. Using the average enterprise value to EBITDA multiple in the table above, estimate Nike's share price. d. What range of share prices do you estimate based on the highest and lowest enterprise value to EBITDA multiples in the table above? Data table (Click on the following icon in order to copy its contents into a spreadsheet.) Average Maximum Minimum P 23.99 +81% - 45% Print Price Book 7.46 + 193% - 83% Done Enterprise Value Sales 2.17 + 96% - 80% Enterprise Value EBITDA 19.98 + 73% - 81% Xarrow_forwardGive me correct option? General accounting questionarrow_forwardCalculate the earnings per share (average of 418,000 shares outstanding for the year) for 2020. (Round answer to 2 decimal places, e.g. 2.55.) Earning per share $2.31 per share Calculate the price/earnings ratio (market price of $48 at year-end) for 2020. (Round answer to 1 decimal place, e.g. 2.5.) Price/earnings ratio ?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub