Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

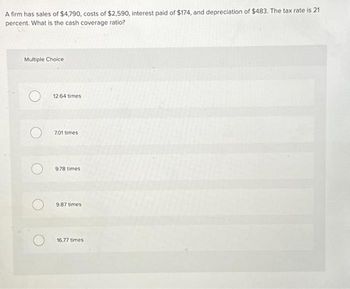

Transcribed Image Text:A firm has sales of $4,790, costs of $2,590, interest paid of $174, and depreciation of $483. The tax rate is 21

percent. What is the cash coverage ratio?

Multiple Choice

12.64 times

7.01 times

9.78 times

9.87 times

16.77 times

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- 6 Suppose Blooper's financials are as follows: See SPREADSHEET 9.1 Inputs Initial Investment Salvage value Initial revenue Initial expenses Inflation rate Discount rate ok Acct receivable as % of sales Investment as % of expenses Tax rate 150 Spreadsheet Name Investment 20 Salvage 150 Initial revenue 100 Initial expenses 5.0% 1.1% 1/4 15.0% 21.0% Inflation Discount rate AR Inv_pct Tax rate Calculate Blooper's working capital in each year of its project. Year Working Capital 0 1 23 4 5 6 COarrow_forwardI want to answer the questionarrow_forward4. We only have OMR 800,000 to invest. Which do we select based on Weighted average profitability index method ? Project NPV Investment PI A 430,000 500,000 B 241,250 225,000 C 394,250 375,000 D 262,000 575,000arrow_forward

- Right Answer?arrow_forwardConsider the following income statement for Larry & Harry drug stores: Revenue - 90mm Variable costs- 48mm Interest on debt- 6mm Depreciation- 0 mm It’s tax rate is 25% and the book value of its equity is 150mm. What is L&H’s coverage ratio? A) 0.18 B) 5.25 C) 6 D) 7 E) 8 F)15arrow_forwardA firm has a profit margin of 15 percent on sales of $20,000,000. If the firm has debt of $7,500,000, total assets of $22,500,000, and an after-tax interest cost on total debt of 5 percent, what is the firm's ROA? Group of answer choices 8.4% 10.9% 12.0% 13.3% 15.1%arrow_forward

- Firm K has a margin of 9%, turnover of 1.4, and sales of $1,610,000. Required: Calculate Firm K's net Income, average total assets, and return on Investment (ROI). Choose Factors: Choose Numerator: Net Income * Choose Factors: X Average Total Assets /Choose Denominator: = 1 Return on Investment Choose Numerator: /Choose Denominator: 1 1 Net Income Net Income Average Total Assets Average Total Assets 0 Return on Investment Return on Investment 0arrow_forwardHellarrow_forwardWhat is the discount rate at which the following cash flows have a NPV of $0? Answer in %, rounding to 2 decimals.Year 0 cash flow = -116,000Year 1 cash flow = 28,000Year 2 cash flow = 43,000Year 3 cash flow = 38,000Year 4 cash flow = 41,000Year 5 cash flow = 40,000Year 6 cash flow = 37,000arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education