Fundamentals Of Financial Management, Concise Edition (mindtap Course List)

10th Edition

ISBN: 9781337902571

Author: Eugene F. Brigham, Joel F. Houston

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Don't want

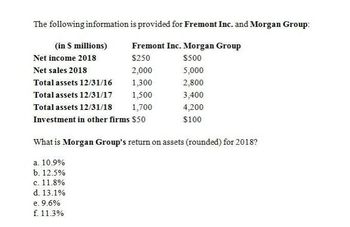

Transcribed Image Text:The following information is provided for Fremont Inc. and Morgan Group:

Fremont Inc. Morgan Group

(in $ millions)

Net income 2018

$250

$500

Net sales 2018

2,000

5,000

Total assets 12/31/16

1,300

2,800

Total assets 12/31/17

1,500

3,400

Total assets 12/31/18

1,700

4,200

Investment in other firms $50

$100

What is Morgan Group's return on assets (rounded) for 2018?

a. 10.9%

b. 12.5%

c. 11.8%

d. 13.1%

e. 9.6%

f. 11.3%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- The following information is provided for Oceanic Ventures and Pinnacle Holdings: Oceanic Ventures Pinnacle Holdings (in $ millions) Net income 2021 $280 $640 Net sales 2021 3,500 7,200 Total assets 12/31/19 2,400 4,600 Total assets 12/31/202,700 5,000 Total assets 12/31/21 3,000 5,500 Capital expenditures $150 $300 What is Pinnacle Holdings' return on assets (rounded) for 2021?arrow_forwardThe following information is provided for Oceanic Ventures and Pinnacle Holdings: (in $ millions) Oceanic Ventures Pinnacle Holdings Net income 2021 $280 $640 Net sales 2021 3,500 7,200 Total assets 12/31/19 2,400 4,600 Total assets 12/31/20 2,700 5,000 Total assets 12/31/21 3,000 5,500 Capital expenditures $150 $300 What is Pinnacle Holdings' return on assets (rounded) for 2021?arrow_forwardWant answerarrow_forward

- Ansarrow_forwardThe following information is provided for Sandhill Company and Indigo Corporation. (in $ millions) Sandhill Company Indigo Corporation Net income 2022 $125 $375 Net sales 2022 1540 4500 Total assets 12/31/20 1045 2010 Total assets 12/31/21 1220 3150 Total assets 12/31/22 1175 4070 What is Indigo's return on assets for 2022?arrow_forwardThe following information is provided for Company A and Company B. (in $ millions) Net income 2028 Net sales 2028 Total assets 12/31/26 Total assets 12/31/27 Total assets 12/31/28 What is Company B's return on assets for 2028? OA) 14.0% OB) 10.5% OC) 12.0% Company A $165 1,650 1,000 1,050 1,150 OD) 15.6% Company B $ 420 4,900 2,400 3,000 4,000arrow_forward

- Don't give me wrong answerarrow_forwardNeed helparrow_forwardThe following information is provided for Globe Enterprises and Summit Solutions: (in $ millions) Globe Enterprises Summit Solutions Net income 2020 $400 $720 Net sales 2020 3,200 8,100 Total assets 12/31/18 2,500 5,200 Total assets 12/31/19 2,800 5,800 Total assets 12/31/20 3,000 6,400 Revenue from investments $300 $600 What is Summit Solutions' return on assets (rounded) for 2020?arrow_forward

- The following information is provided for Cullumber Company and Bramble Corporation. (in $ millions) Cullumber Company Bramble Corporation Net income 2022 $145 $415 Net sales 2022 1755 4610 Total assets 12/31/20 1025 2330 Total assets 12/31/21 1260 3000 Total assets 12/31/22 1150 4080 What is Bramble's return on assets for 2022? (Round answer to 1 decimal place, e.g. 15.2.) 11.5% 13.8% 10.2% 11.7%arrow_forwardmework i 0 ences Mc Graw Hill INCOME STATEMENT OF QUICK BURGER CORPORATION, 2022 (Figures in $ millions) Net sales Costs Depreciation Earnings before interest and taxes (EBIT) Interest expense Pretax income Federal taxes (@ 21%) Net income Assets Current assets Cash and marketable securities Receivables Inventories Other current assets Total current assets Fixed assets Property, plant, and equipment Intangible assets (goodwill) Other long-term assets Total assets a. Free cash flow b. Additional tax c. Free cash flow million million million $ 27,571 17,573 1,406 $ 8,592 521 2022 8,071 1,695 $ 6,376 BALANCE SHEET OF QUICK BURGER CORPORATION, 2022 (Figures in $ millions) 2021 $ 2,340 1,379 126 1,093 $ 4,938 $ 24,681 2,808 2,987 $ 35,414 $ 2,340 1,339 121 620 $ 4,420 Saved $ 22,839 2,657 3,103 Liabilities and Shareholders' Equity Current liabilities Debt due for repayment Long-term debt Other long-term liabilities Total liabilities Total shareholders' equity $ 33,019 Total liabilities and…arrow_forwardPlease help mearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Fundamentals Of Financial Management, Concise Edi...FinanceISBN:9781337902571Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals Of Financial Management, Concise Edi...FinanceISBN:9781337902571Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals Of Financial Management, Concise Edi...

Finance

ISBN:9781337902571

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning