FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

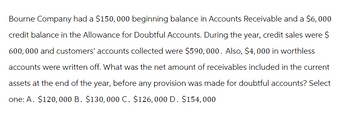

Transcribed Image Text:Bourne Company had a $150,000 beginning balance in Accounts Receivable and a $6,000

credit balance in the Allowance for Doubtful Accounts. During the year, credit sales were $

600,000 and customers' accounts collected were $590, 000. Also, $4,000 in worthless

accounts were written off. What was the net amount of receivables included in the current

assets at the end of the year, before any provision was made for doubtful accounts? Select

one: A. $120,000 B. $130, 000 C. $126,000 D. $154,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- At the beginning of the year, Mitchum Enterprises allows for estimated uncollectible accounts of $15,000. By the end of the year, actual bad debts total $17,000. Record the writeoff to uncollectible accounts. Following the write-off, what is the balance of Allowance for Uncollectible Accounts?arrow_forwardAt year end, Chief Company has a balance of $10,000 in accounts receivable of which $1,000 is more than 30 days past due. Chief has a credit balance of $100 in the allowance for doubtful accounts before any year end adjustments. Using the aging of accounts receivable method, Chief estimates that 1% of current accounts and 10% of accounts over 30 days past due are uncollectible. what is the amount of bad debt expense?arrow_forwardAt the end of the fiscal year, before the accounts are adjusted, accounts receivable has a balance of $200,000 and allowance for doubtful accounts has a credit balance of $2,500. Sales are $1,500,000. Bad debt expense is estimated to be 2% of sales. The amount of bad debt expense to be recorded is: Group of answer choicesarrow_forward

- At the beginning of the year, Kullerud Manufacturing had a credit balance in its allowance for doubtful accounts of $6,161, and at the end of the year it was a credit balance of $31,425. During the year, Kullerud made credit sales of $890,000, collected receivables in the amount of $812,000, and recorded bad debt expense of $33,750. Compute the amount of receivables that Kullerud wrote off during the year.?arrow_forwardAt the end of the current year, Accounts Receivable has a balance of $700,000; Allowance for Doubtful Accounts has a credit balance of $5,500; and net sales for the year total $3,500,000. Bad debt expense is estimated at 1/2 of 1% of net sales. Determine (a) the amount of the adjusting entry for uncollectible accounts; (b) the adjusted balances of Accounts Receivable, Allowance of Doubtful Accounts; and Bad Debt Expense; and (c) the net realizable value of accounts receivablearrow_forwardWant the Answerarrow_forward

- Use the following information to answer the next two questions: Lewis Company uses the allowance method for recording its expected credit losses. It estimates bad debts at 2% of credit sales, which were $900,000 during the year. On December 31, the Accounts Receivable balance was $150,000, and the Allowance for Doubtful Accounts had a balance of $12,200 before adjustments. What is the amount of bad debt expense Lewis Company will report on their Income Statement this year? Select one: a. 17,756 b. 3,000 c. 12,200 d. 18,000 e. 2,756arrow_forwardCortez Corporation uses the percentage of sales method to estimate its uncollectible accounts. Cortez has an ending balance of accounts receivable of $10,000. The allowance for doubtful accounts showed a balance of $1,000 in the beginning of the period. During the year, a total of $300 in accounts was written off as uncollectible. The company made credit sales of $100,000 in the current period. It estimates that 5% of sales will prove to be uncollectible. What is the ending balance of allowance for doubtful accounts of the company for the current period? Please don't provide answer in image format thank youarrow_forwardThe accounts receivable balance for Renue Spa at December 31, Year 1, was $88,000. Also on that date, the balance in the Allowance for Doubtful Accounts was $2,900. Total retained earnings at the end of Year 1 was $85,100. During Year 2, $1,900 of accounts receivable were written off as uncollectible. In addition, Renue unexpectedly collected $170 of receivables that had been written off in a previous accounting period. Services provided on account during Year 2 were $213,000, and cash collections from receivables were $214,954. Uncollectible accounts expense was estimated to be 1 percent of the sales on account for the period. Required a. Organize the information in accounts under an accounting equation. b. Based on the preceding information, compute (after year-end adjustment): 1. (1) Balance of Allowance for Doubtful Accounts at December 31, Year 2. 2. (2) Balance of Accounts Receivable at December 31, Year 2. 3. (3) Net realizable value of Accounts Receivable at December 31, Year…arrow_forward

- At the beginning of the current period, Flounder Corp. had balances in Accounts Receivable of $224,000 and in Allowance for Doubtful Accounts of $10,080. During the period, it had net credit sales of $896,000 and collections of $854,560. It wrote off uncollectible accounts receivable of $8,176. Uncollectible accounts are estimated to total $28,000 at the end of the period. (Omit recording cost of goods sold.) (a-c) Enter the beginning balances for Accounts Receivable and Allowance for Doubtful Accounts in a tabular summary. Use the summary to record transactions (a), (b), and (c) below. (a) Record sales and collections during the period. (b) Record the write-off of uncollectible accounts during the period. (c) Record bad debt expense for the period.arrow_forwardDatarrow_forwardAt the end of the year, two similar companies were in the process of calculating bad debt expense for the year. Each company had credit sales of P 1,000,000 and a debit balance in Allowance for Uncollectible Accounts of P 2,000 before any year-end adjustment. The amount of accounts receivable written off during the year for both companies was P 8,000. The balance of Accounts Receivable is P 180,000. A Company estimates that 5% of accounts receivable will not be collected over the next year. B Company estimates that 5% of credit sales will not be collected over the next year. Required: For each company, determine: a) The uncollectible accounts expense for the year. b) The adjusting entry to be made of December 31. c) The balance in Allowance for Doubtful Accounts after adjustmentarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education