Principles of Accounting Volume 1

19th Edition

ISBN: 9781947172685

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

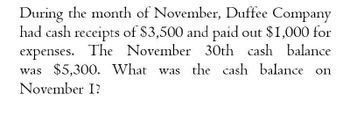

Transcribed Image Text:During the month of November, Duffee Company

had cash receipts of $3,500 and paid out $1,000 for

expenses. The November 30th cash balance

was $5,300. What was the cash balance on

November I?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Gregg Corp. reported revenue of $1,450,000 in its cash basis income statement for the year ended Dec. 31, Year 7. Additional information was as follows: Accounts receivable, Jan 1, Year 7 $400,000 Accounts receivable, Dec 31, Year 7 $530,000 Under the accrual basis, Gregg would report revenue of O $1,580,000 O $1,035,000 $1,335,000 O $1,505,000arrow_forwardDuring the year, Tempo Inc. has monthly cash expenses of $144,468. On December 31, its cash balance is $1,829,210. The ratio of cash to monthly cash expenses (rounded to one decimal place) is Oa. 13.7 months Ob. 12.7 months Oc. 6.4 months Od. 7.9 monthsarrow_forwardBailey Co earns $27,792 of revenue on account and in $6,256 cash revenue transactions in Year 1. Cash collections of receivables amount to $7,152 in Year 1 with the remainder being collected in Year 2. Based on this information alone the company’s financial statements would show Total Revenue in Year 1 of $_arrow_forward

- Holloway Company earned $6,200 of service revenue on account during Year 1. The company collected $5,270 cash from accounts recievable during Year 1. a. the balance of the accounts recievable that would be reported on the Decmeber 31,Year1,balance sheet b. the amount of net income that would be reported on the Year 1 income statement. c. the amount of net cash flow from operating activites that would be reported on the Year 1 statement of cash flows d. the amount of retained earnings that would be reported on the Year 1 balance sheetarrow_forwardWhat are the gross sales for the month of December on these accounting question?arrow_forwardGibson Company engaged in the following transactions for Year 1. The beginning cash balance was $28,100 and the ending cash balance was $74,991. 1. Sales on account were $283,100. The beginning receivables balance was $94,700 and the ending balance was $77,000. 2. Salaries expense for the period was $55,460. The beginning salaries payable balance was $3,815 and the ending balance was $2,180. 3. Other operating expenses for the period were $120,170. The beginning other operating expenses payable balance was $4,860 and the ending balance was $9,181. 4. Recorded $19,330 of depreciation expense. The beginning and ending balances in the Accumulated Depreciation account were $14,340 and $33,670, respectively. 5. The Equipment account had beginning and ending balances of $211,970 and $238,570, respectively. There were no sales of equipment during the period. 6. The beginning and ending balances in the Notes Payable account were $48,500 and $150,500, respectively. There were no payoffs of…arrow_forward

- I want to correct answer general accountingarrow_forwardThe financial statements of the Splish Brothers Inc. reports net sales of $360000 and accounts receivable of $48000 and $21600 at the beginning of the year and end of year, respectively. What is the average collection period for accounts receivable in days?arrow_forwardEl Dorado Inc. has monthly cash expenses of $168,500. On December 31, the cash balance is $1,415,400.a. Compute the ratio of cash to monthly cash expenses.b. Based on (a), what are the implications for El Dorado Inc.?arrow_forward

- Garden Gate, Inc. reported the following data in its August 31 annual report. Cash and cash equivalents $ 485,625 Cash flow from operations (630,000) Required: a. What is the company's "cash burn" per month? per month b. What is the company's ratio of cash to monthly cash expenses? Round your answer to one decimal place. monthsarrow_forwardThe following information relates to a company’s accounts receivable: gross accounts receivable balance at the beginning of the year, $300,000; allowance for uncollectible accounts at the beginning of the year, $25,000 (credit balance); credit sales during the year, $1,500,000; accounts receivable written off during the year, $16,000; cash collections from customers, $1,450,000. Assuming the company estimates that future bad debts will equal 10% of the year-end balance in accounts receivable. 1. Calculate bad debt expense for the year.2. Calculate the year-end balance in the allowance for uncollectible accounts.arrow_forwardYork Company engaged in the following transactions for Year 1. The beginning cash balance was $86,000 and the ending cash balance was $59,100. 1. Sales on account were $548,000. The beginning receivables balance was $128,000 and the ending balance was $90,000. 2. Salaries expense for the period was $232,000. The beginning salaries payable balance was $16,000 and the ending balance was $8,000. 3. Other operating expenses for the period were $236,000. The beginning other operating expenses payable balance was $16,000 and the ending balance was $10,000. 4. Recorded $30,000 of depreciation expense. The beginning and ending balances in the Accumulated Depreciation account were $12,000 and $42,000, respectively. 5. The Equipment account had beginning and ending balances of $44,000 and $56,000, respectively. There were no sales of equipment during the period. 6. The beginning and ending balances in the Notes Payable account were $36,000 and $44,000, respectively. There were no payoffs of…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College