FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

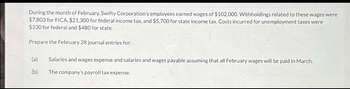

Transcribed Image Text:During the month of February, Swifty Corporation's employees earned wages of $102,000. Withholdings related to these wages were

$7,803 for FICA, $21,300 for federal income tax, and $5,700 for state income tax. Costs incurred for unemployment taxes were

$330 for federal and $480 for state.

Prepare the February 28 journal entries for:

(a)

(b)

Salaries and wages expense and salaries and wages payable assuming that all February wages will be paid in March.

The company's payroll tax expense.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- The following totals for the month of June were taken from the payroll register of Concord Company. Salaries and wages FICA taxes withheld Income taxes withheld Medical insurance deductions Federal unemployment taxes State unemployment taxes$640004896 17600 3200 384 3456 The entry to record the accrual of Concord's Company's payroll taxes would include a credit to FICA Taxes Payable for$3840. credit to Payroll Tax Expense for$3840. debit to Payroll Tax Expense for$8736. credit to Payroll Tax Expense for$8736arrow_forwardLakeview Company completed the following two transactions. The annual accounting period ends December 31. a. On December 31, calculated the payroll, which indicates gross earnings for wages ($80,000), payroll deductions for income tax ($8,000), payroll deductions for FICA ($6,000), payroll deductions for American Cancer Society ($3,000), employer contributions for FICA (matching), and state and federal unemployment taxes ($600). Employees were paid in cash, but payments for the corresponding payroll deductions have not yet been made and employer taxes have not yet been recorded. b. Collected rent revenue of $6,000 on December 10 for office space that Lakeview rented to another business. The rent collected was for 30 days from December 11 to January 10 and was credited in full to Deferred Revenue. Required: 1. & 2. Prepare the journal entries to record payroll on December 31, the collection of rent on December 10 and adjusting journal entry on December 31. 3. Show how any of the…arrow_forwardWidmer Company had gross wages of $309,000 during the week ended June 17. The amount of wages subject to social security tax was $278,100, while the amount of wages subject to federal and state unemployment taxes was $39,000. Tax rates are as follows: Line Item Description Percentage Social security 6.0% Medicare 1.5% State unemployment 5.4% Federal unemployment 0.8% The total amount withheld from employee wages for federal taxes was $61,800. If an amount box does not require an entry, leave it blank. If required, round answers to two decimal places. Question Content Area a. Journalize the entry to record the payroll for the week of June 17. Date Account Debit Credit June 7 Question Content Area b. Journalize the entry to record the payroll tax expense incurred for the week of June 17. Date Account Debit Credit June 7arrow_forward

- During the month of March, Blossom Company's employees earned wages of $83,000. Withholdings related to these wages were $6,350 for FICA, $9,727 for federal income tax, $4,020 for state income tax, and $519 for union dues. The company incurred no cost related to these earnings for federal unemployment tax but incurred $908 for state unemployment tax. (a) (b) Prepare a tabular summary to record salaries and wages expense and salaries and wages payable on March 31. Assume that wages earned during March will be paid during April. Prepare a tabular summary to record the company's payroll tax expense. Include margin explanations for changes in revenues and expenses. (If a transaction causes a decrease in Assets, Liabilities or Stockholders' Equity, place a negative sign (or parentheses) in front of the amount entered for the particular Asset, Liability or Equity item that was reduced.) Mar. 31 Mar. 31 $ Assets Cash Salaries & Wages Payable 69 67 Federal Income Taxes Payable + tA FICA Taxes…arrow_forwardOn January 14, at the end of the second week of the year, the totals of Castle Company's payroll register showed that its store employees' wages amounted to $40,660 and that its warehouse wages amounted to $12,600. Withholdings consisted of federal income taxes, $6,391, employer's Social Security taxes at the rate of 6.2 percent, and employees' Social Security taxes at a rate of 6.2 percent. Both the employer's and employees' Social Security taxes are based on the first $118,500, and no employee has reached the limit. Additional withholdings were Medicare taxes at the rate of 1.45 percent on all earnings and charitable contributions withheld, $720. Required: a. Calculate the amount of Social Security and Medicare taxes to be withheld and prepare the general journal entry to record the payroll. If an amount box does not require an entry, leave it blank. If required, round your intermediate calculations and final answers to the nearest cent and use the rounded answers in…arrow_forwardDuring the month of March, Oriole Company's employees earned wages of $80,000. Withholdings related to these wages were $6,120 for FICA $9,600 for federal income tax, $4,000 for state income tax, and $480 for union dues. The company incurred no cost related to these earnings for federal unemployment tax but incurred $800 for state unemployment tax. (a) Prepare the necessary March 31 journal entry to record salaries and wages expense and salaries and wages payable. Assume that wages earned during March will be paid during April. (Credit account titles are automatically indented when amount is entered. Do not indent manually) Date Account Titles and Explanation Mar. 31 Debit Credit NOarrow_forward

- XYZ Company had gross wages of $355,000 during the week ended November 30. The amount of wages subject to social security tax was $285,000, while the amount of wages subject to federal and state unemployment taxes was $18,000. Tax rates are as follows. Social security 6.0% Medicare 1.5% State unemployment 5.4% Federal unemployment 0.8% The total amount withheld from employee wages for federal taxes was $66,900. The full amount of gross wages is subject to Medicare tax. a. Journalize the entry to record the payroll for the week of November 30. DATE Debit Credit X/X b. Using the information from the question above, journalize the entry to record the payroll tax expense incurred for the week of November 30. DATE Debit Credit X/Xarrow_forwardAt the end of October, the payroll register for Garden Marbles Corporation contained the following totals: wages, $742,000; federal income taxes withheld, $189,768; state income taxes withheld, $31,272; Social Security tax withheld, $46,004; Medicare tax withheld, $10,759; medical insurance deductions, $25,740; and wages subject to unemployment taxes, $114,480. Determine the total and components of the (1) monthly payroll and (2) employer payroll expenses, assuming Social Security and Medicare taxes equal to the amount for employees, a federal unemployment insurance tax of 0.8 percent, a state unemployment tax of 5.4 percent, and medical insurance premiums for which the employer pays 80 percent of the costarrow_forwardXYZ Company is processing payroll for the week ending January 9th. Employee earnings total $5,000. Federal income tax withheld from employee paychecks totaled $1,100. The social security tax rate is 6%, the Medicare tax rate is 1.5%, the state unemployment tax rate is 5.4% and the federal unemployment tax rate is .8%. a) Journalize the payroll entry for the week. DATE Debit Credit X/X b) Journalize the payroll tax entry for the week. DATE Debit Credit X/Xarrow_forward

- During the month of January, an employee earned $4,800 of salary. Withholdings from the employee's salary consist of FICA Social Security taxes of $297.60, FICA Medicare taxes of $69.60, federal income taxes of $511.20, and medical insurance deductions of $204.00. Prepare the journal entry to record the employer's salaries expense and related liabilities assuming these wages will be paid in early February. (Round your final answers to 2 decimal places.) View transaction list Journal entry worksheet 1 Record payroll for period. Note: Enter debits before credits. Date January 31 General Journal Debit Credit >arrow_forwardOn January 14, at the end of the second week of the year, the totals of Castle Company's payroll register showed that its store employees' wages amounted to $33,482 and that its warehouse wages amounted to $13,560. Withholdings consisted of federal income taxes, $5,110, employer's Social Security taxes at the rate of 6.2 percent, and employees' Social Security taxes at a rate of 6.2 percent. Both the employer's and employees' Social Security taxes are based on the first $118,500, and no employee has reached the limit. Additional withholdings were Medicare taxes at the rate of 1.45 percent on all earnings and charitable contributions withheld, $845. Required: a. Calculate the amount of Social Security and Medicare taxes to be withheld and prepare the general journal entry to record the payroll. If an amount box does not require an entry, leave it blank. If required, round your intermediate calculations and final answers to the nearest cent and use the rounded answers in…arrow_forwardUrban Window Company had gross wages of $310,000 during the week ended July 15. The amount of wages subject to social security tax was $310,000, while the amount of wages subject to federal and state unemployment taxes was $35,000. Tax rates are as follows: Social security 6.0% Medicare 1.5% State unemployment 5.4% Federal unemployment 0.6% The total amount withheld from employee wages for federal taxes was $47,000. Required: A. Journalize the entry to record the payroll for the week of July 15.* B. Journalize the entry to record the payroll tax expense incurred for the week of July 15.* *Refer to the Chart of Accounts for exact wording of account titles.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education