FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

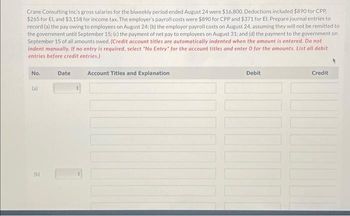

Transcribed Image Text:Crane Consulting Inc.'s gross salaries for the biweekly period ended August 24 were $16,800. Deductions included $890 for CPP.

$265 for El, and $3,158 for income tax. The employer's payroll costs were $890 for CPP and $371 for El. Prepare journal entries to

record (a) the pay owing to employees on August 24; (b) the employer payroll costs on August 24, assuming they will not be remitted to

the government until September 15; (c) the payment of net pay to employees on August 31; and (d) the payment to the government on

September 15 of all amounts owed. (Credit account titles are automatically indented when the amount is entered. Do not

indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. List all debit

entries before credit entries.)

No.

(a)

(b)

Date

Account Titles and Explanation

Debit

Credit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Calculation and Journal Entry for Employer Payroll Taxes Earnings for several employees for the week ended March 12, 20--, are as follows: Taxable Earnings Employee Name CurrentEarnings UnemploymentCompensation SocialSecurity Aus, Glenn E. $700 $200 $700 Diaz, Charles K. 350 350 350 Knapp, Carol S. 1,200 — 1,200 Mueller, Deborah F. 830 125 830 Yeager, Jackie R. 920 35 920 1. Calculate the employer’s payroll taxes expense for the week ended March 12, 20--, assuming that FUTA tax is 0.6%, SUTA tax is 5.4%, Social Security tax is 6.2%, and Medicare tax is 1.45%.arrow_forwardBonita Consulting Inc's gross salaries for the biweekly period ended August 24 were $15,000. Deductions included $743 for CPP, $282 for El, and $6,308 for income tax. The employer's payroll costs were $743 for CPP and $395 for El. Prepare journal entries to record (a) the payment of salaries on August 24; (b) the employer payroll costs on August 24, assuming they will not be remitted to the government until September; and (c) the payment to the government on September 15 of all amounts owed. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. List all debit entries before credit entries.) No. Date Account Titles and Explanation Debit Credit (a) (Ь) (c)arrow_forwardAlpine Company pays its employees time-and-a-half for hours worked in excess of 40 per week. The information available from time cards and employees’ individual earnings records for the pay period ended October 14 is shown in the following chart: Earnings at End Daily Time Income Tax Name of Previous Week M T W T F S Pay Rate Allowances or Amount Bardin, J. 43,627.00 8 8 8 8 8 2 21.30 2 Caris, A. 44,340.00 8 8 8 8 8 8 21.60 1 Drew, W. 43,845.00 8 10 10 8 8 0 21.50 1 Garen, S. 117,600.00 8 8 8 8 8 0 49.00 $227.83 North, O. 43,875.00 8 8 8 8 8 5 21.40 3 Ovid, N. 40,150.00 8 8 8 8 8 0 21.50 1 Ross, J. 6,430.00 8 8 8 8 8 4 20.50 1 Springer, O. 44,175.00 8 8 8 8 8 3 21.25 2 Taxable earnings for Social Security are based on the first $118,500. Taxable earnings for Medicare are based on all earnings. Taxable earnings for federal and state unemployment are based on the first $7,000. *Round to the nearest penny. Required: 1. Complete the payroll register…arrow_forward

- answer in text form please (without image), Note: .Every entry should have narration pleasearrow_forwardDuring the month of January, an employee earned $4,400 of salary. Withholdings from the employee's salary consist of FICA Social Security taxes of $272.80, FICA Medicare taxes of $63.80, federal income taxes of $468.60, and medical insurance deductions of $187.00. Prepare the journal entry to record the employer's salaries expense and related liabilities assuming these wages will be paid in early February. Note: Round your final answers to 2 decimal places. View transaction list Journal entry worksheet 1 Record payroll for period. Note: Enter debits before credits. Date January 31 + General Journal Debit Credit Xarrow_forwardFarm has 28 employees who are paid biweekly. The payroll register showed the following payroll deductions for the pay period ending March 23, 2021. Gross Pay 85,950.00 EI Premium Income Taxes 1,426.77 11,855.00 View transaction list Journal entry worksheet < 1 Required: Prepare a journal entry to record payment by the employer to the Receiver General for Canada on April 15. (Do not round intermediate calculations. Round the final answers to 2 decimal places.) Note: Enter debits before credits. Date April 15 CPP 4,067.95 Record the remittance to the Receiver General for Canada. Medical Ins. 1,650.00 General Journal United Way 1,819.00 Debit Creditarrow_forward

- During the month of January, an employee earned $5, 800 of salary. Withholdings from the employee's salary consist of FICA Social Security taxes of $359.60, FICA Medicare taxes of $84.10, federal income taxes of $617.70, and medical insurance deductions of $246.50. Prepare the journal entry to record the employer's salaries expense and related liabilities assuming these wages will be paid in early February. Note: Round your final answers to 2 decimal places.arrow_forwardOn January 14, at the end of the second week of the year, the totals of Castle Company's payroll register showed that its store employees' wages amounted to $40,660 and that its warehouse wages amounted to $12,600. Withholdings consisted of federal income taxes, $6,391, employer's Social Security taxes at the rate of 6.2 percent, and employees' Social Security taxes at a rate of 6.2 percent. Both the employer's and employees' Social Security taxes are based on the first $118,500, and no employee has reached the limit. Additional withholdings were Medicare taxes at the rate of 1.45 percent on all earnings and charitable contributions withheld, $720. Required: a. Calculate the amount of Social Security and Medicare taxes to be withheld and prepare the general journal entry to record the payroll. If an amount box does not require an entry, leave it blank. If required, round your intermediate calculations and final answers to the nearest cent and use the rounded answers in…arrow_forwardA company's payroll records report $3,460 of gross pay and $484 of federal income tax withholding for an employee for the weekly pay period. Compute this employee's FICA Social Security tax (6.2%), FICA Medicare tax (1.45%), state income tax (1.0%), and net pay for the current pay period. Note: Round your final answers to 2 decimal places. Gross pay FICA Social Security tax deduction FICA Medicare tax deduction Federal income tax deduction State income tax deduction Total deductions Net payarrow_forward

- During the month of March, Oriole Company's employees earned wages of $80,000. Withholdings related to these wages were $6,120 for FICA $9,600 for federal income tax, $4,000 for state income tax, and $480 for union dues. The company incurred no cost related to these earnings for federal unemployment tax but incurred $800 for state unemployment tax. (a) Prepare the necessary March 31 journal entry to record salaries and wages expense and salaries and wages payable. Assume that wages earned during March will be paid during April. (Credit account titles are automatically indented when amount is entered. Do not indent manually) Date Account Titles and Explanation Mar. 31 Debit Credit NOarrow_forwardAccounting Assume that the payroll record of Riverbed Oil Company provided the following information for the weekly payroll ended November 30,2020. Employee Hours Worked Hourly Pay Rate Federal Income Tax Union Dues Year- to-Date Earnings Through Previous Week T. king 44 58 442 9 133,900 T. Binion 46 23 97 5 23,200 N.Cole 40 28 148 5,700 C. Hennesey 42 33 230 7 49,500 Additional information: All employees are paid overtime at time and a half for hours worked in excess of 40 per week. The FICA tax rate is 7.65% for the first 132,900 of each employee's annual ear earnings and 1.45% on any earnings over 132,900. The employer pays unemployment taxes of 6.0% (5.4% for state and .6% for federal) on the first 7,000 of each employee's annual earnings. Prepare the payroll register for the pay period.(Round answers to 2 decimal places, e.g. 15.25)arrow_forwardAlpesharrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education