FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:On January 8, the end of the first weekly pay period of the year, Regis Company's employees earned $24,760 of office salaries and

$70,840 of sales salaries. Withholdings from the employees' salaries include FICA Social Security taxes at the rate of 6.2%, FICA

Medicare taxes at the rate of 1.45%, $12,860 of federal income taxes, $1,380 of medical insurance deductions, and $840 of union dues.

No employee earned more than $7,000 in this first period.

Required:

1-a. Calculate below the amounts for each of these four taxes of Regis Company. Regis's state unemployment tax rate is 5.4% of the

first $7,000 paid to each employee. The federal unemployment tax rate is 0.6%.

1-b. Prepare the journal entry to record Regis Company's January 8 employee payroll expenses and liabilities.

2. Prepare the journal entry to record Regis's employer payroll taxes resulting from the January 8 payroll. Regis's state unemployment

tax rate is 5.4% of the first $7,000 paid to each employee. The federal unemployment tax rate is 0.6%.

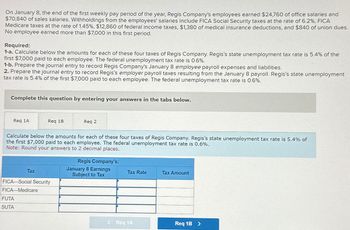

Complete this question by entering your answers in the tabs below.

Req 1A

Req 1B

Calculate below the amounts for each of these four taxes of Regis Company. Regis's state unemployment tax rate is 5.4% of

the first $7,000 paid to each employee. The federal unemployment tax rate is 0.6%.

Note: Round your answers to 2 decimal places.

Tax

FUTA

SUTA

FICA-Social Security

FICA-Medicare

Req 2

Regis Company's:

January 8 Earnings

Subject to Tax

Tax Rate

< Req 1A

Tax Amount

Req 1B >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Urban Window Company had gross wages of $310,000 during the week ended July 15. The amount of wages subject to social security tax was $310,000, while the amount of wages subject to federal and state unemployment taxes was $35,000. Tax rates are as follows: Social security 6.0% Medicare 1.5% State unemployment 5.4% Federal unemployment 0.6% The total amount withheld from employee wages for federal taxes was $47,000. Required: A. Journalize the entry to record the payroll for the week of July 15.* B. Journalize the entry to record the payroll tax expense incurred for the week of July 15.* *Refer to the Chart of Accounts for exact wording of account titles.arrow_forwardPeyton Company's payroll for the year is $741,150. Of this amount, $472,770 is for wages paid in excess of $7,000 to each individual employee. The SUTA rate in Peyton Company's state is 2.9% on the first $7,000 of each employee's earnings. Compute: Net FUTA taxarrow_forwardWilliam Corp. pays its employees every two weeks. Employee wages earned over a two-week period is $250,000. All wages are subject to social security and Medicare taxes, while $50,000 of wages are subject to federal and state unemployment taxes. Tax rates are the following: • Social security tax 6.0%• Medicare tax 1.5%• State unemployment compensation tax 5.4%• Federal unemployment compensation tax 0.8% Additionally, the total amount withheld from wages for federal income taxes is $75,000 and the total amount withheld for state income taxes is $12,500. ________________________________________ When William Corp. records the journal entry to recognize payroll every two weeks, Payroll Tax Expense will be: Question 30 options: Debited for $75,000 Credited for $12,500 Debited for $12,500 Credited for $75,000 Neither debited nor creditedarrow_forward

- The payroll register for the Puhl Company for the week ended January 15th showed the following : Wages-$800,000 Federal Income Tax withheld- 160,000 Roth IRA deductions- 5,000 United Way deductions- 1,200 Union dues deductions- 850 All wages were subject to FICA (6.2% social security and 1.45% medicare tax). In addition , 620,000 of wages were subject to federal and state unemployment taxes. The state unemployment rate 5.4% and the federal unemployment is 0.8%. 1. Journalize the entry to record the payroll for the week of January 15th. 2. Journalize the entry to record the payroll tax expense for the week of January 15tharrow_forwardThe following information pertains to a weekly payroll of Texera Tile Company: a. The total wages earned by employees are $17,500.b. The state unemployment insurance contribution rate is 3.5%.c. The entire amount of wages is taxable under FICA, FUTA, and SUTA.d. The amount withheld from the employees' wages for federal income taxes is $1,950; for state income taxes, $372.60; and for group insurance, $192.00. ournalize the payment of wages, and record the payroll taxes for this payroll. If an amount box does not require an entry, leave it blank. Round your answers to the nearest cent. Account Debit Credit Payment of wages Payroll taxesarrow_forwardThe chief executive officer earns $21,000 per month. As of May 31, her gross pay was $105,000. The tax rate for Social Security is 6.2% of the first $137,700 earned each calendar year and the Federal Insurance Contributions Act (FICA) tax rate for Medicare is 1.45% of all earnings. The current Federal Unemployment Taxes (FUTA) tax rate is 0.6%, and the State Unemployment Taxes (SUTA) tax rate is 5.4%. Both unemployment taxes are applied to the first $7,000 of an employee's pay. What is the amount of Federal Insurance Contributions Act (FICA) - Medicare withheld from this employee for the month of June? Multiple Choice $281.66 $651.00 $7,714.35 $1,302.00 $304.50arrow_forward

- XYZ Company had gross wages of $355,000 during the week ended November 30. The amount of wages subject to social security tax was $285,000, while the amount of wages subject to federal and state unemployment taxes was $18,000. Tax rates are as follows. Social security 6.0% Medicare 1.5% State unemployment 5.4% Federal unemployment 0.8% The total amount withheld from employee wages for federal taxes was $66,900. The full amount of gross wages is subject to Medicare tax. a. Journalize the entry to record the payroll for the week of November 30.arrow_forwardOn January 21, the column totals of the payroll register for Great Products Company showed that its sales employees had earned $14,710, its truck driver employees had earned $10,300, and its office employees had earned $8,240. Social Security taxes were withheld at an assumed rate of 6.2 percent, and Medicare taxes were withheld at an assumed rate of 1.45 percent. Other deductions consisted of federal income tax, $3,990; and union dues, $540. Determine the amount of Social Security and Medicare taxes withheld and record the general journal entry for the payroll, crediting Salaries Payable for the net pay. All earnings were taxable. If necessary, round intermediate calculations and the final answer to the nearest cent. If an amount box does not require an entry, leave it blank.arrow_forwardOn January 15, the end of the first pay period of the year, North Company's employees earned $40,000 of sales salaries. Withholdings from the employees' salaries include FICA Social Security taxes at the rate of 6.2%, FICA Medicare taxes at the rate of 1.45%, $3,100 of federal income taxes, $593 of medical insurance deductions, and $230 of union dues. No employee earned more than $7,000 in this first period. Prepare the journal entry to record North Company's January 15 salaries expense and related liabilities. View transaction list Journal entry worksheet 1 Record the employee payroll for period. Note: Enter debits before credits. Date January 15 General Journal Debit Credit Record entry Clear entry View general journalarrow_forward

- sarrow_forwardThe annual accounting period ends December 31. On December 31, calculated the payroll, which indicates gross earnings for wages ($88,000), payroll deductions for income tax ($8,800), payroll deductions for FICA ($6, 600), payroll deductions for American Cancer Society ($3, 300). employer contributions for FICA (matching), and state and federal unemployment taxes ($660). Employees were paid in cash, but payments for the corresponding payroll deductions have not yet been made and employer taxes have not yet been recorded Collected rent revenue of $6, 150 on December 10 for office space that Lakeview rented to another business. The rent collected was for 30 days from December 11 to January 10 and was credited in full to Unearned Rent Revenue. Required: Complete the required journal entries for the above transactions as shown below: Prepare the entries required on December 31 to record payroll. Prepare the journal entry for the collection of rent on December 10. Prepare the adjusting…arrow_forwardThe chief executive officer earns $21.500 per month. As of May 31, her gross pay was $107,500. The tax rate for Social Security is 6.2% of the first $137700 earned each calendar year and the Federal Insurance Contributions Act (FICA) tax rate for Medicare is 1.45% of all earnings. The current Federal Unemployment Taxes (FUTA) tax rate is 0.6%, and the State Unemployment Taxes (SUTA) tax rate is 5.4%. Both unemployment taxes are applied to the first $7,000 of an employee's pay. What is the amount of Federal Insurance Contributions Act (FICA) - Medicare withheld from this employee for the month of June? Multiple Choice O $666.50 $7,898.03 $288.37 $311.75 $1,333.00arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education