FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

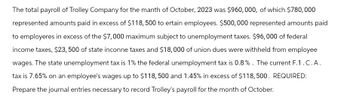

Transcribed Image Text:The total payroll of Trolley Company for the manth of October, 2023 was $960,000, of which $780,000

represented amounts paid in excess of $118,500 to ertain employees. $500,000 represented amounts paid

to employeres in excess of the $7,000 maximum subject to unemployment taxes. $96,000 of federal

income taxes, $23, 500 of state inconne taxes and $18,000 of union dues were withheld from employee

wages. The state unemployment tax is 1% the federal unemployment tax is 0.8%. The current F.1.C.A.

tax is 7.65% on an employee's wages up to $118,500 and 1.45% in excess of $118,500. REQUIRED:

Prepare the journal entries necessary to record Trolley's payroll for the month of October.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- On January 14, at the end of the second week of the year, the totals of Castle Company's payroll register showed that its store employees' wages amounted to $33,482 and that its warehouse wages amounted to $13,560. Withholdings consisted of federal income taxes, $5,110, employer's Social Security taxes at the rate of 6.2 percent, and employees' Social Security taxes at a rate of 6.2 percent. Both the employer's and employees' Social Security taxes are based on the first $118,500, and no employee has reached the limit. Additional withholdings were Medicare taxes at the rate of 1.45 percent on all earnings and charitable contributions withheld, $845. Required: a. Calculate the amount of Social Security and Medicare taxes to be withheld and prepare the general journal entry to record the payroll. If an amount box does not require an entry, leave it blank. If required, round your intermediate calculations and final answers to the nearest cent and use the rounded answers in…arrow_forwardUrban Window Company had gross wages of $310,000 during the week ended July 15. The amount of wages subject to social security tax was $310,000, while the amount of wages subject to federal and state unemployment taxes was $35,000. Tax rates are as follows: Social security 6.0% Medicare 1.5% State unemployment 5.4% Federal unemployment 0.6% The total amount withheld from employee wages for federal taxes was $47,000. Required: A. Journalize the entry to record the payroll for the week of July 15.* B. Journalize the entry to record the payroll tax expense incurred for the week of July 15.* *Refer to the Chart of Accounts for exact wording of account titles.arrow_forwardThe payroll register for the Puhl Company for the week ended January 15th showed the following : Wages-$800,000 Federal Income Tax withheld- 160,000 Roth IRA deductions- 5,000 United Way deductions- 1,200 Union dues deductions- 850 All wages were subject to FICA (6.2% social security and 1.45% medicare tax). In addition , 620,000 of wages were subject to federal and state unemployment taxes. The state unemployment rate 5.4% and the federal unemployment is 0.8%. 1. Journalize the entry to record the payroll for the week of January 15th. 2. Journalize the entry to record the payroll tax expense for the week of January 15tharrow_forward

- During the month of March, Sandhill Company's employees earned wages of $79,000. Withholdings related to these wages were $6,044 for Social Security (FICA), $13,100 for federal income tax, $5,500 for state income tax, and $530 for union dues. The company incurred no cost related to these earnings for federal unemployment tax, but incurred $1,140 for state unemployment tax. (a) Prepare the necessary March 31 journal entry to record wages expense and wages payable. Assume that wages earned during March will be paid during April. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. List all debit entries before credit entries. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) Date Account Titles and Explanation Mar. 31 Debit T Creditarrow_forwardOn January 21, the column totals of the payroll register for Great Products Company showed that its sales employees had earned $14,710, its truck driver employees had earned $10,300, and its office employees had earned $8,240. Social Security taxes were withheld at an assumed rate of 6.2 percent, and Medicare taxes were withheld at an assumed rate of 1.45 percent. Other deductions consisted of federal income tax, $3,990; and union dues, $540. Determine the amount of Social Security and Medicare taxes withheld and record the general journal entry for the payroll, crediting Salaries Payable for the net pay. All earnings were taxable. If necessary, round intermediate calculations and the final answer to the nearest cent. If an amount box does not require an entry, leave it blank.arrow_forwardThe payroll of Ivanhoe Company for September 2019 is as follows. Total payroll was $468,000, of which $104,000 is exempt from Social Security tax because it represented amounts paid in excess of $128,400 to certain employees. The amount paid to employees in excess of $7,000 (the maximum for both federal and state unemployment tax) was $406,000. Income taxes in the amount of $76,500 were withheld, as was $9,800 in union dues. The state unemployment tax is 3.5%, but Ivanhoe Company is allowed a credit of 2.3% by the state for its unemployment experience. Also, assume that the current FICA tax is 7.65% on an employee's wages to $128,400 and 1.45% in excess of $128,400. No employee for Ivanhoe makes more than $135,000. The federal unemployment tax rate is 0.8% after state credit. Prepare the necessary journal entries if the wages and salaries paid and the employer payroll taxes are recorded separately. (Round answers to 0 decimal places, e.g. 5,275. If no entry is required, select "No…arrow_forward

- On January 15, the end of the first pay period of the year, North Company's employees earned $40,000 of sales salaries. Withholdings from the employees' salaries include FICA Social Security taxes at the rate of 6.2%, FICA Medicare taxes at the rate of 1.45%, $3,100 of federal income taxes, $593 of medical insurance deductions, and $230 of union dues. No employee earned more than $7,000 in this first period. Prepare the journal entry to record North Company's January 15 salaries expense and related liabilities. View transaction list Journal entry worksheet 1 Record the employee payroll for period. Note: Enter debits before credits. Date January 15 General Journal Debit Credit Record entry Clear entry View general journalarrow_forwardsarrow_forwardRequired: Below is a payroll sheet for Riverbed Imports for the month of September 2025. The company is allowed a 1% unemployment compensation rate by the state; the federal unemployment tax rate is 0.8% and the maximum for both is $7,000. Assume a 10% federal income tax rate for all employees and a 7.65% FICA tax on employee and employer on a maximum of $142,800. In addition, 1.45% is charged both employer and employee for an employee's wages in excess of $142,800 per employee. Name B.D. Williams D. Raye K. Baker F. Lopez A. Daniels B. Kingston Earnings to Aug.31 $6,900 6,700 7,600 14,800 130,000 135,000 September Income Tax Earnings Withholding $900 800 1,100 1,800 13,900 16,500 FICA Unemployment Tax State Federal 1. Complete the payroll sheet in Excel and make the necessary entry to record the payment of the payroll. 2. Make the entry to record the payroll tax expenses of Riverbed Imports. 3. Make the entry to record the payment of the payroll liabilities created in parts a and b.…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education