FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

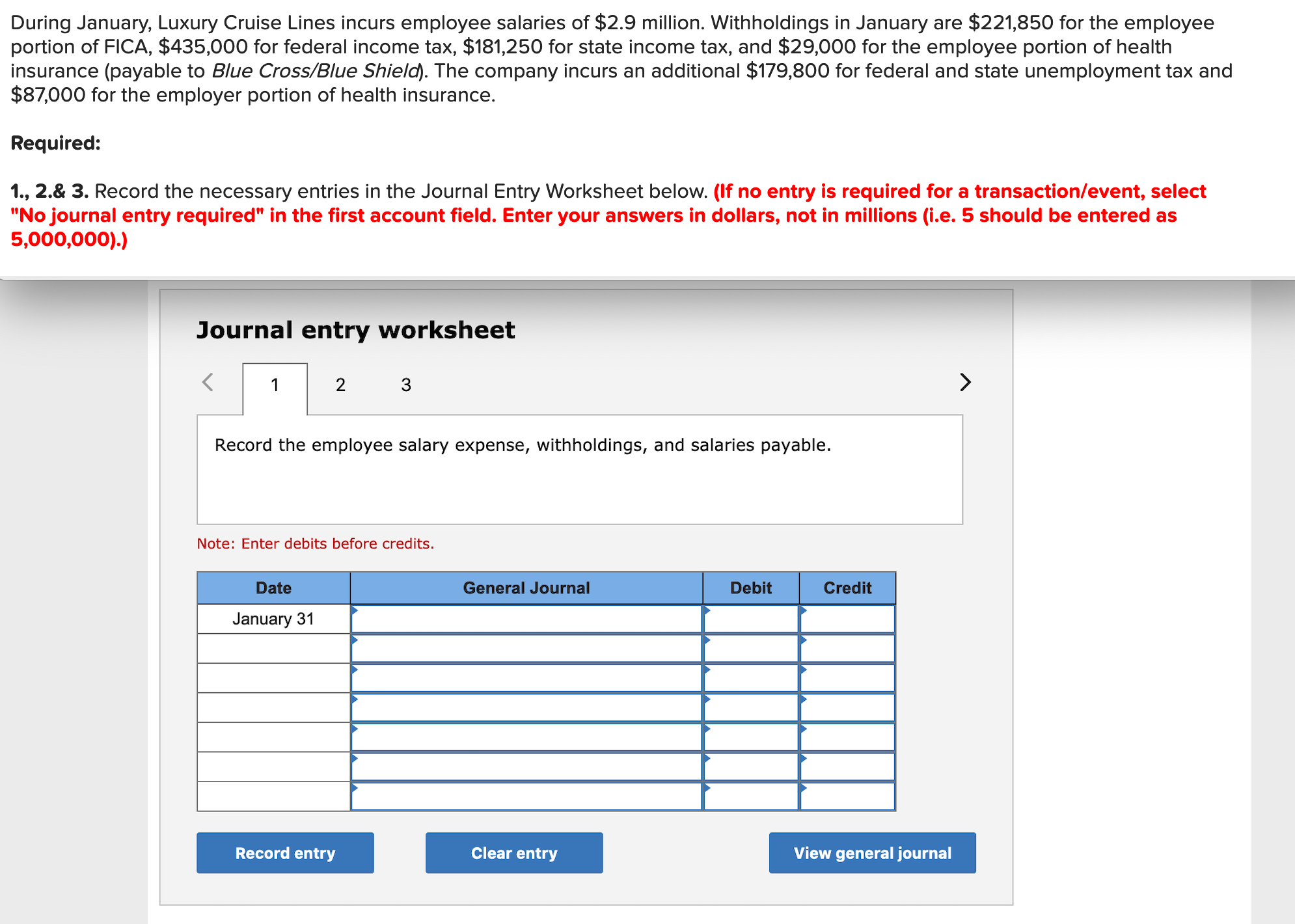

Transcribed Image Text:During January, Luxury Cruise Lines incurs employee salaries of $2.9 million. Withholdings in January are $221,850 for the employee

portion of FICA, $435,000 for federal income tax, $181,250 for state income tax, and $29,000 for the employee portion of health

insurance (payable to Blue Cross/Blue Shield). The company incurs an additional $179,800 for federal and state unemployment tax and

$87,000 for the employer portion of health insurance.

Required:

1., 2.& 3. Record the necessary entries in the Journal Entry Worksheet below. (If no entry is required for a transaction/event, select

"No journal entry required" in the first account field. Enter your answers in dollars, not in millions (i.e. 5 should be entered as

5,000,000).)

Journal entry worksheet

2 3

Record the employee salary expense, withholdings, and salaries payable.

Note: Enter debits before credits.

Date

General Journal

Debit

Credit

January 31

Record entry

Clear entry

View general journal

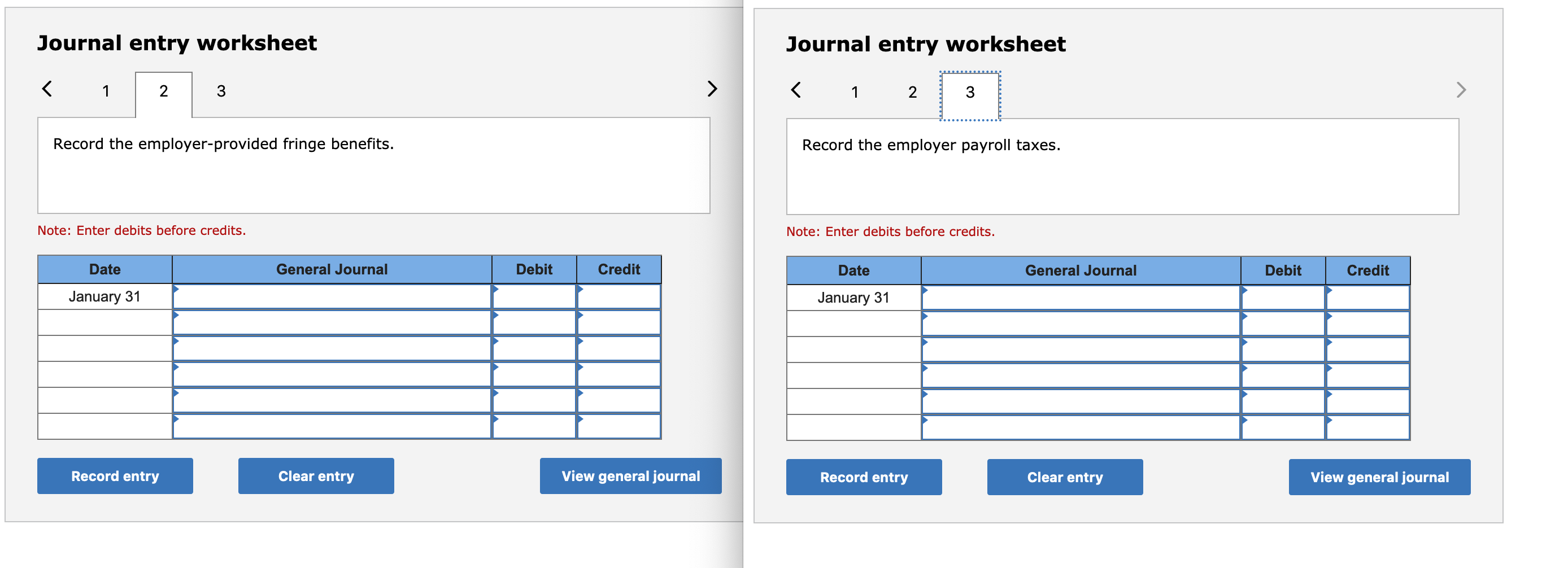

Transcribed Image Text:Journal entry worksheet

Journal entry worksheet

3

3

Record the employer-provided fringe benefits.

Record the employer payroll taxes.

Note: Enter debits before credits.

Note: Enter debits before credits.

Date

General Journal

Debit

Credit

Date

General Journal

Debit

Credit

January 31

January 31

Record entry

Clear entry

View general journal

Record entry

Clear entry

View general journal

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- On January 8, the end of the first weekly pay period of the year, Regis Company's employees earned $21,760 of office salaries and $70,840 of sales salaries. Withholdings from the employees' salaries include FICA Social Security taxes at the rate of 6.2%, FICA Medicare taxes at the rate of 1.45%, $13,060 of federal income taxes, $1,410 of medical insurance deductions, and $800 of union dues. No employee earned more than $7,000 in this first period. Required: 1-a. Calculate below the amounts for each of these four taxes of Regis Company. Regis's state unemployment tax rate is 5.4% of the first $7,000 paid to each employee. The federal unemployment tax rate is 0.6%. 1-b. Prepare the journal entry to record Regis Company's January 8 employee payroll expenses and liabilities. 2. Prepare the journal entry to record Regis's employer payroll taxes resulting from the January 8 payroll. Regis's state unemployment tax rate is 5.4% of the first $7,000 paid to each employee. The federal…arrow_forwardGreat Lakes Tours' total payroll for the month of January was $440,000. The following withholdings, fringe benefits, and payroll taxes apply: Federal and state income tax withheld Health insurance premiums paid by employer (payable to Blue Cross) Contribution to retirement plan paid by employer (payable to Fidelity) FICA tax rate (Social Security and Medicare) Federal and state unemployment tax rate $44,000 Required: 1. Record the employee salary expense, withholdings, and salaries payable. 2. Record the employer-provided fringe benefits. 3. Record the employer payroll taxes. 7,920 17,600 7.65% 6.20% Assume that none of the withholdings or payroll taxes has been paid by the end of January (record them as payables), and no employee's cumulative wages exceed the relevant wage bases. Record the necessary entry for the scenarios given above. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.)arrow_forwardWidmer Company had gross wages of $309,000 during the week ended June 17. The amount of wages subject to social security tax was $278,100, while the amount of wages subject to federal and state unemployment taxes was $39,000. Tax rates are as follows: Line Item Description Percentage Social security 6.0% Medicare 1.5% State unemployment 5.4% Federal unemployment 0.8% The total amount withheld from employee wages for federal taxes was $61,800. If an amount box does not require an entry, leave it blank. If required, round answers to two decimal places. Question Content Area a. Journalize the entry to record the payroll for the week of June 17. Date Account Debit Credit June 7 Question Content Area b. Journalize the entry to record the payroll tax expense incurred for the week of June 17. Date Account Debit Credit June 7arrow_forward

- Sheffield Corporation rings up cash sales and sales taxes separately on its cash register. On April 10, the register totals are pre-tax sales of sales $5,300 plus GST of $265 and PST of $424. 1. 2. Brenda Corporation receives its annual property tax bill in the amount of $8,700 on May 31. (1) During the month of March, Martinez Corporation's employees earned gross salaries of $65,100. Withholdings deducted from employee earnings related to these salaries were $2.750 for CPP, $964 for El, $7,300 for income taxes. (ii) Martinez's 3. employer portions were $2,750 for CPP and $1,350 for El for the month. Prepare the journal entries to record the above transactions. (List all debit entries before credit entries. Credit account titles are automatically indented when the amount is entered. Do not indent manually. Round answers to 0 decimal places, e.g. 5,275.) Sr no. Account Titles and Explanation Debit Credit 1. 2. 3 (i). 3 (ii).arrow_forwardDuring January, Luxury Cruise Lines incurs employee salaries of $3 million. Withholdings in January are $229,500 for the employee portion of FICA, $450,000 for federal income tax, $187,500 for state income tax, and $30,000 for the employee portion of health insurance (payable to Blue Cross Blue Shield). The company incurs an additional $186,000 for federal and state unemployment tax and $90,000 for the employer portion of health insurance.Required:1. Record the employee salary expense, withholdings, and salaries payable.2. Record the employer-provided fringe benefits.3. Record the employer payroll taxes.arrow_forwardces During January, Luxury Cruise Lines incurs employee salaries of $3 million. Withholdings in January are $229,500 for the employee portion of FICA, and $667,500 for employee federal and state. The company incurs an additional $186,000 for federal and state unemployment tax and $90,000 for the employer portion of health insurance (fringe benefits payable to Blue Cross Blue Shield). Required: 1. to 3. Record the necessary entries in the Journal Entry Worksheet below. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field. Enter your answers in dollars, not in millions (i.e. 5 million should be entered as 5,000,000).) View transaction list Journal entry worksheet 1 2 3 Record the employee salary expense, withholdings, and salaries payable. Date January 31 Note: Enter debits before credits. General Journal Debit Creditarrow_forward

- XYZ Company had gross wages of $355,000 during the week ended November 30. The amount of wages subject to social security tax was $285,000, while the amount of wages subject to federal and state unemployment taxes was $18,000. Tax rates are as follows. Social security 6.0% Medicare 1.5% State unemployment 5.4% Federal unemployment 0.8% The total amount withheld from employee wages for federal taxes was $66,900. The full amount of gross wages is subject to Medicare tax. a. Journalize the entry to record the payroll for the week of November 30. DATE Debit Credit X/X b. Using the information from the question above, journalize the entry to record the payroll tax expense incurred for the week of November 30. DATE Debit Credit X/Xarrow_forwardDuring January, Luxury Cruise Lines Incurs employee salaries of $1.7 million. Withholdings in January are $130,050 for the employee portion of FICA, $255,000 for federal income tax, $106,250 for state income tax, and $17,000 for the employee portion of health insurance (payable to Blue Cross Blue Shield). The company incurs an additional $105,400 for federal and state unemployment tax and $51,000 for the employer portion of health insurance. Required: 1.-3. Record the necessary entries in the Journal Entry Worksheet below. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field. Enter your answers in dollars, not in millions (i.e. 5 should be entered as 5,000,000).) View transaction list View journal entry worksheet Record the employee salary expense, withholdings, and salaries payable. Record the employer provided fringe benefits. Record the employer payroll taxes. Nate journal entry has been entered EXI Debit…arrow_forwardNonearrow_forward

- Wages paid for the second quarter for Ivanhoe Law Firm were $59,000.00. All wages were subject to FICA taxes (the 7.65% FICA tax rate consists of the Social Security tax rate of 6.2% on salaries and wages up to $128,400 and the Medicare tax rate of 1.45% on all salaries and wages). Federal income taxes withheld were $6,820.00. When Ivanhoe files Form 941, what amount should be reported on the following lines of the form? (Round answers to 2 decimal places, e.g. 52.75.) Line 3: Federal income tax withheld. $ Columns 1 Columns 2 Line 5a: Taxable social security wages $ $ Line 5c: Taxable medicare wages and tips $ $arrow_forwardVulcra, Inc., has a semimonthly payroll of $67,000 on September 15, 20--. The total payroll is taxable under FICA Taxes-HI; $63,850 is taxable under FICA Taxes-OASDI; and $10,300 is taxable under FUTA and SUTA. The state contribution rate for the company is 4.1%. The amount withheld for federal income taxes is $9,911. The amount withheld for state income taxes is $1,410. b. Assume that the employees of Vulcra, Inc., must also pay state contributions (disability insurance) of 1% on the taxable payroll of $62,100 and that the employees' contributions are to be deducted by the employer. Journalize the September 15 payment of wages, assuming that the state contributions of the employees are kept in a separate account.arrow_forwardToren Inc. employs one person to run its solar management company. The employee’s gross income for the month of May is $8,000. Payroll for the month of May is as follows: FICA Social Security tax rate at 6.2%, FICA Medicare tax rate at 1.45%, federal income tax of $440, state income tax of $80, health-care insurance premium of $210, and union dues of $50. The employee is responsible for covering 30% of his or her health insurance premium. A. Record the journal entry to recognize employee payroll for the month of May, dated May 31, 2017. Round your answers to the nearest whole dollar. If an amount box does not require an entry, leave it blank. May 31 B. Record remittance of the employee's salary with cash on June 1. Round your answers to the nearest whole dollar. If an amount box does not require an entry, leave it blank. June 1arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education