FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

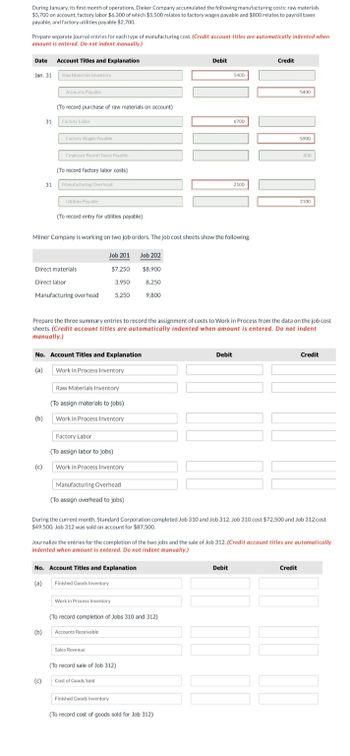

Transcribed Image Text:During January, its first month of operations, Dieker Company accumulated the following manufacturing costs: raw materials

$5,700 on account, factory labor $6,300 of which $5,500 relates to factory wages payable and $800 relates to payroll taxes

payable, and factory utilities payable $2,700.

Prepare separate journal entries for each type of manufacturing cost. (Credit account titles are automatically indented when

amount is entered. Do not indent manually.)

Date Account Titles and Explanation

Raw Materials Inventory

Jan. 31

31

31

(b)

Accounts Payable

(To record purchase of raw materials on account)

Factory Labor

(c)

Factory Wages Payable.

Employer Payroll Taxes Payable

(To record factory labor costs)

Manufacturing Overhead

Direct materials

Direct labor

Utilities Payable

Manufacturing overhead

(To record entry for utilities payable)

(b)

Milner Company is working on two job orders. The job cost sheets show the following.

Job 201 Job 202

$7,250

3,950

5,250

No. Account Titles and Explanation

(a)

Work in Process Inventory

(c)

Raw Materials Inventory

(To assign materials to jobs)

Work in Process Inventory

Factory Labor

(To assign labor to jobs)

Work in Process Inventory

Manufacturing Overhead

(To assign overhead to jobs)

No. Account Titles and Explanation

(a)

Prepare the three summary entries to record the assignment of costs to Work in Process from the data on the job cost

sheets. (Credit account titles are automatically indented when amount is entered. Do not indent

manually.)

Finished Goods Inventory

Work in Process Inventory

(To record completion of Jobs 310 and 312)

Accounts Receivable

$8,900

8,250

9,800

Sales Revenue

(To record sale of Job 312)

Debit

Cost of Goods Sold

During the current month, Standard Corporation completed Job 310 and Job 312. Job 310 cost $72,500 and Job 312 cost

$49,500. Job 312 was sold on account for $87,500.

Finished Goods Inventory

Journalize the entries for the completion of the two jobs and the sale of Job 312. (Credit account titles are automatically

indented when amount is entered. Do not indent manually.)

5400

Debit

(To record cost of goods sold for Job 312)

6700

2100

Debit

Credit

5400

5900

800

Credit

2100

Credit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Post the journal entries for the transactions to the following T-accounts, each of which started the month with a zero balance.arrow_forwardA company's Factory Overhead account shows total debits of $675,000 and total credits of $698,700 at the end of the year. 1. Compute the under- or overapplied overhead. 2. Prepare the journal entry to close the balance in the Factory Overhead account to Cost of Goods Sold. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Compute the under- or overapplied overhead. Total actual overhead cost Total applied overhead costarrow_forwardnkt.4arrow_forward

- During January, its first month of operations, Sheridan Company accumulated the following manufacturing costs: raw materials purchased $5,200 on account, factory labor incurred $6,600, and factory utilities payable $2,400. Prepare separate journal entries for each type of manufacturing cost. (List all debit entries before credit entries. Credit account titles are automatically indented when amount is entered. Do not indent manually.) Date Account Titles and Explanation Jan. 31 31 31 I (To record purchase of raw materials on account) (To record factory labor costs) (To record entry for utilities payable) eTextbook and Media Debit Creditarrow_forwardDuring the month, Barrera Manufacturing incurred (not paid) $49,000 in direct labor costs in Department 1, $24,000 in direct labor costs in Department 2, and $3,500 of indirect laber costs. Which of the following is NOT part of the summary journal entry to record these transactions? Process costing is used. OA. debit to Work-in-Process Inventory Department 1 for $40,000 OB. credit to Wages Payable for $76,500 OC. debit to Work-in-Process Inventory for $76,500 OD. debit to Manufacturing Overhead for $3,500 CHICarrow_forwardThe following financial information about the manufacturing plant of Continental Company for the year-to-date and the month of July appears on the company's records: Materials inventory, June 30 Work-in-process inventory, June 30 Finished goods inventory, June 30 Cost of goods sold through June 30 Accounts payable (materials suppliers), June 30 Manufacturing overhead through June 30 Payroll payable, June 30 Withholding and other payroll liabilities, June 30 Overhead applied through June 30 A count of the inventories on hand July 31 shows the following: Materials inventory Work-in-process inventory Finished goods inventory $ 44,500 ? 42,000 • Manufacturing overhead incurred through July was $233,900. Cost of goods sold through July 31 was $417,800. Interviews with various plant administrative employees August 1 reveal some additional information: • The company currently owes materials suppliers $54,600. • The company paid suppliers $40,800 cash during July. Plant payroll during July…arrow_forward

- Factory Overhead Costs During May, Salinger Company incurred factory overhead costs as follows: indirect materials, $910; indirect labor, $2,910; utilities cost, $1,920; and factory depreciation, $4,410. Journalize the entry to record the factory overhead incurred during May. If an amount box does not require an entry, leave it blank.arrow_forwardDuring May, Bergan Company incurred factory overhead costs as follows: indirect materials, $39,000; indirect labor, $89,200; utilities cost, $18,400; and factory depreciation, $50,800. Journalize the entry on May 30 to record the factory overhead incurred during May. Refer to the Chart of Accounts for exact wording of account titles. CHART OF ACCOUNTS Bergan Company General Ledger ASSETS 110 Cash 121 Accounts Receivable 125 Notes Receivable 126 Interest Receivable 131 Materials 132 Work in Process 133 Factory Overhead 134 Finished Goods 141 Supplies 142 Prepaid Insurance 143 Prepaid Expenses 181 Land 191 Factory 192 Accumulated Depreciation-Factory LIABILITIES 210 Accounts Payable 221 Utilities Payable 231 Notes Payable 236 Interest Payable 241 Lease Payable 251 Wages Payable 252 Consultant Fees Payable EQUITY 311 Common Stock 340 Retained Earnings 351 Dividends 390 Income Summary…arrow_forwardMorton Inc. has provided the following data for the month of November. The balance in the Finished Goods inventory account at the beginning of the month was $50,500 and at the end of the month was $46,500. The cost of goods manufactured for the month was $241,000. The actual manufacturing overhead cost incurred was $89,000 and the manufacturing overhead cost allocated to Work in Process was $85,000. The adjusted cost of goods sold that would appear on the income statement for November is: $241,000 $245,000 $237,000 $249,000arrow_forward

- Concord Company purchases $54,600 of raw materials on account, and it incurs $63,000 of the factory labor costs. Supporting records show that (a) the Assembly Department used $30,100 of raw materials and $40,100 of the factory labor, and (b) the Finishin Department used the remainder. Journalize the assignment of the costs to the processing departments on March 31. (Credit account titles are automatically indented wh amount is entered. Do not indent manually.) Date Account Titles and Explanation Mar. 31 31 (To record materials used) Debit Creditarrow_forwardduring the current month, carla vista company incurs the following manufacturing costs. (a) purchased raw materials of $17600 on account. (b) incurred factory labor of $ 38400. (C) factory utilities of $2840 are payable, prepaid factory insurance of $2560 have expired, and depreciation on the factory building is $9200. prepare the journal entries for each type of manufacturing cost.arrow_forwardTotal factory labor costs related to factory workers for Ivanhoe Company during the month of January are $77,400. Of the total accumulated cost of factory labor, 80% is related to direct labor and 20% is attributable to indirect labor. (a) (b) Prepare the January 31 entry to record the factory labor costs for the month of January. Prepare the January 31 entry to assign factory labor to production.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education