FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

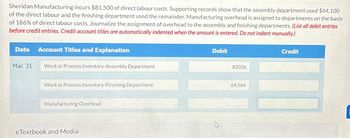

Transcribed Image Text:Sheridan Manufacturing incurs $81,500 of direct labour costs. Supporting records show that the assembly department used $44,100

of the direct labour and the finishing department used the remainder. Manufacturing overhead is assigned to departments on the basis

of 186% of direct labour costs. Journalize the assignment of overhead to the assembly and finishing departments. (List all debit entries

before credit entries. Credit account titles are automatically indented when the amount is entered. Do not indent manually.)

Date Account Titles and Explanation

Mar. 31

Work in Process Inventory-Assembly Department

Work in Process Inventory-Finishing Department

Manufacturing Overhead

eTextbook and Media

Debit

82026

69,564

Credit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- During December, Moulding Corporation incurred 26,000 of actual Manufacturing Overhead Cost. During the same period, the Manufacturing Overhead applied to work in process was $24,000. # Prepare Fournal entries to record the incurrence of manufacturing Overhead and the application of Manufacturing Overhead to work in process.arrow_forwardDuring January, its first month of operations, Sheridan Company accumulated the following manufacturing costs: raw materials purchased $5,200 on account, factory labor incurred $6,600, and factory utilities payable $2,400. Prepare separate journal entries for each type of manufacturing cost. (List all debit entries before credit entries. Credit account titles are automatically indented when amount is entered. Do not indent manually.) Date Account Titles and Explanation Jan. 31 31 31 I (To record purchase of raw materials on account) (To record factory labor costs) (To record entry for utilities payable) eTextbook and Media Debit Creditarrow_forwardDuring the month, Barrera Manufacturing incurred (not paid) $49,000 in direct labor costs in Department 1, $24,000 in direct labor costs in Department 2, and $3,500 of indirect laber costs. Which of the following is NOT part of the summary journal entry to record these transactions? Process costing is used. OA. debit to Work-in-Process Inventory Department 1 for $40,000 OB. credit to Wages Payable for $76,500 OC. debit to Work-in-Process Inventory for $76,500 OD. debit to Manufacturing Overhead for $3,500 CHICarrow_forward

- Wildhorse Company purchases $61,000 of raw materials on account, and it incurs $73,200 of factory labor costs. Supporting records show that (a) the Assembly Department used $29,280 of direct materials and $42,700 of direct labor, and (b) the Finishing Department used the remainder. Manufacturing overhead is assigned to departments on the basis of 160% of labor costs. Journalize the assignment of overhead to the Assembly and Finishing Departments. (List all debit entries before credit entries. Credit account titles are automatically indented when amount is entered. Do not indent manually.) Date Account Titles Mar. 31 Work in Process - Assembly Work in Process - Finishing Raw Materials Inventory Debit 29280 31720 6100 Credit 61000arrow_forward2arrow_forwardDuring May, Bergan Company incurred factory overhead costs as follows: indirect materials, $39,000; indirect labor, $89,200; utilities cost, $18,400; and factory depreciation, $50,800. Journalize the entry on May 30 to record the factory overhead incurred during May. Refer to the Chart of Accounts for exact wording of account titles. CHART OF ACCOUNTS Bergan Company General Ledger ASSETS 110 Cash 121 Accounts Receivable 125 Notes Receivable 126 Interest Receivable 131 Materials 132 Work in Process 133 Factory Overhead 134 Finished Goods 141 Supplies 142 Prepaid Insurance 143 Prepaid Expenses 181 Land 191 Factory 192 Accumulated Depreciation-Factory LIABILITIES 210 Accounts Payable 221 Utilities Payable 231 Notes Payable 236 Interest Payable 241 Lease Payable 251 Wages Payable 252 Consultant Fees Payable EQUITY 311 Common Stock 340 Retained Earnings 351 Dividends 390 Income Summary…arrow_forward

- Warner Company purchases $52,500 of raw materials on account, and it incurs $62,200 of the factory labor costs. Supporting records show that (a) the Assembly Department used $32,700 of raw materials and $42,200 of the factory labor, and (b) the Finishing Department used the remainder.Journalize the assignment of the costs to the processing departments on March 31. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) Date Account Titles and Explanation Debit Credit Mar. 31 (To record materials used) 31 (To assign factory labor to production)arrow_forwardDuring January, its first month of operations, Ivanhoe Company accumulated the following manufacturing costs: raw materials purchased $5,400 on account, factory labor incurred $7,300, and factory utilities payable $2,600.Prepare separate journal entries for each type of manufacturing cost. (List all debit entries before credit entries. Credit account titles are automatically indented when amount is entered. Do not indent manually.)arrow_forwardConcord Company purchases $54,600 of raw materials on account, and it incurs $63,000 of the factory labor costs. Supporting records show that (a) the Assembly Department used $30,100 of raw materials and $40,100 of the factory labor, and (b) the Finishin Department used the remainder. Journalize the assignment of the costs to the processing departments on March 31. (Credit account titles are automatically indented wh amount is entered. Do not indent manually.) Date Account Titles and Explanation Mar. 31 31 (To record materials used) Debit Creditarrow_forward

- Epolito Corporation incurred $87,000 of actual Manufacturing Overhead costs during September. During the same period, the Manufacturing Overhead applied to Work in Process was $89,000. The journal entry to record the incurrence of the actual Manufacturing Overhead costs would include a: A. debit to Work in Process of $89,000. B. credit to Manufacturing Overhead of $87,000. C. debit to Manufacturing Overhead of $87,000. D. credit to Work in Process of $89,000.arrow_forwardIvanhoe Company purchases $54,000 of raw materials on account, and it incurs $64,800 of factory labor costs. Supporting records show that (a) the Assembly Department used $25,920 of direct materials and $37,800 of direct labor, and (b) the Finishing Department used the remainder. Journalize the assignment of the costs to the processing departments on March 31. (List all debit entries before credit entries. Credit account titles are automatically indented when amount is entered. Do not indent manually.) Date Account Titles and Explanation Mar. 31 31 (To record materials used) (To assign factory labor to production) Debit Creditarrow_forwardAlpesharrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education