FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

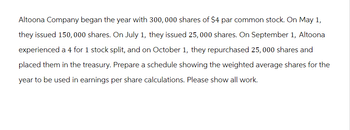

Transcribed Image Text:Altoona Company began the year with 300, 000 shares of $4 par common stock. On May 1,

they issued 150,000 shares. On July 1, they issued 25, 000 shares. On September 1, Altoona

experienced a 4 for 1 stock split, and on October 1, they repurchased 25,000 shares and

placed them in the treasury. Prepare a schedule showing the weighted average shares for the

year to be used in earnings per share calculations. Please show all work.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- Junkyard Arts, Inc., had earnings of $174,300 for the year. The company had 24,000 shares of common stock outstanding during the year and issued 3,900 shares of $100 par value preferred stock. The preferred stock has a dividend of $9 per share. There were no transactions in either common or preferred stock during the year. Determine the basic earnings per share for Junkyard Arts for the year. Round answer to two decimal places.$fill in the blank 1per sharearrow_forwardOn January 1, the company had 150,000 common shares outstanding. During the year, the following events occurred: March 1: Two-for-one stock split June 1: Issued 45,000 additional shares September 1: 20% stock dividend What was the weighted-average number of shares outstanding for the year?arrow_forwardMcVie Corporation's stock has a par value of $2. The company has the following transactions during the year: Feb. 28 Issued 310,000 shares at $5 per share. Jun. 7 Issued 95,000 shares in exchange for equipment with a clearly determined value of $212,000. Sep. 19 Purchased 2,400 shares of treasury stock at $8 per share. Prepare the journal entries to record the transactions. If an amount box does not require an entry, leave it blank. Feb. 28 Jun. 7 Sep. 19arrow_forward

- In a recent annual report, Rosh Corporation disclosed that 60,800,000 shares of common stock have been authorized. At the beginning of the fiscal year, a total of 36,436,357 shares had been issued and the number of shares in treasury stock was 7,251,269. During the year, 562,765 additional shares were issued, and the number of treasury shares increased by 3,074,188. Determine the number of shares outstanding at the end of the year. Note: Amounts to be deducted should be indicated by a minus sign. Computation of Shares Outstanding Issued shares Treasury stock Shares outstandingarrow_forwardBastion Corporation earned net income of $200,000 this year. The company began the year with 10,000 shares of common stock and issued 5,000 more on April 1. They issued $7,500 in preferred dividends for the year. What is the EPS for the year for Bastion?arrow_forwardDuring its first year of operations, Bramble Corporation had the following transactions pertaining to its common stock. Jan. 10 Issued 81,500 shares for cash at $6 per share. Mar. 1 Issued 5,000 shares to attorneys in payment of a bill for $36,200 for services rendered in helping the company to incorporate. July 1 Issued 33,300 shares for cash at $8 per share. Sept. 1 Issued 62,400 shares for cash at $10 per share. (a) Prepare the journal entries for these transactions, assuming that the common stock has a par value of $5 per share. (List all debit entries before credit entries. Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. Record entries in the order displayed in the problem statement.)arrow_forward

- Milo Co. had 795,000 shares of common stock outstanding as of January 1. On May 1, they issued 145,000 shares of common stock. On September 1, Milo Co. purchased 61,000 shares of treasury stock. On November 1, they issued 59,000 shares of common stock. Calculate the weighted average shares outstanding for the year.arrow_forwardMarcy Company had 30,000 shares of common stock at the beginning of the year. On July 1, it issued 3,000 shares; on November 2, it issued another 3,000 shares; and on December 1, it reacquired 1,000 shares of treasury stock. What is its weighted average number of shares for the year?arrow_forwardHickory Inc. experienced the following stockholders' equity transactions (listed in chronological order) during it's first year of operations. Based on these transactions, calculate the balances that would appear in the stockholders' equity accounts listed below. Formatting: Please round to the nearest dollar and do not use dollar signs (i.e. enter '1,000' rather than '$1,000'). All numbers should be positive. Common Stock, 100,000 shares of $1 par value common stock authorized Preferred Stock, 50,000 shares of $10 par value preferred stock authorized 1 Issued 5,000 common shares at $30 per share 2 Exchanged 4,000 preferred shares for a piece of equipment with a fair value of $49,000. 3 Issued 2,500 common shares at $25 per share 4 Purchased 500 of own common shares on the open market at $24 per share 5 Declared a 30% common stock dividend. Common stock was trading at $23 per share on the date of declaration.…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education