FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:W

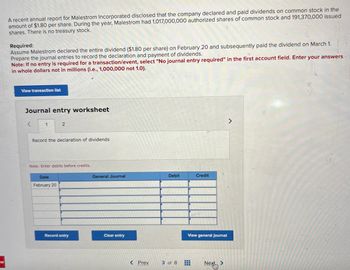

A recent annual report for Malestrom Incorporated disclosed that the company declared and paid dividends on common stock in the

amount of $1.80 per share. During the year, Malestrom had 1,017,000,000 authorized shares of common stock and 191,370,000 issued

shares. There is no treasury stock.

Required:

Assume Malestrom declared the entire dividend ($1.80 per share) on February 20 and subsequently paid the dividend on March 1.

Prepare the journal entries to record the declaration and payment of dividends.

Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your answers

in whole dollars not in millions (i.e., 1,000,000 not 1.0).

View transaction list

Journal entry worksheet

<

1

2

Record the declaration of dividends

Note: Enter debits before credits.

Date

February 20

Record entry

General Journal

Clear entry

< Prev

Debit

3 of 8

Credit

View general journal

#

Next

>

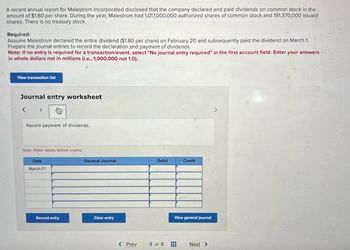

Transcribed Image Text:A recent annual report for Malestrom Incorporated disclosed that the company declared and paid dividends on common stock in the

amount of $1.80 per share. During the year, Malestrom had 1,017,000,000 authorized shares of common stock and 191,370,000 issued

shares. There is no treasury stock.

Required:

Assume Malestrom declared the entire dividend ($1.80 per share) on February 20 and subsequently paid the dividend on March 1.

Prepare the journal entries to record the declaration and payment of dividends.

Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your answers

in whole dollars not in millions (i.e., 1,000,000 not 1.0).

View transaction list

Journal entry worksheet

<

1

Record payment of dividends.

Note: Enter debits before credits.

Date

March 01

Record entry

General Journal

Clear entry

< Prev

Debit

3 of 8

Credit

View general journal

Next >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Similar questions

- On January 1, Larkspur Corporation had 99000 shares of $10 par value common stock outstanding. On May 7, the company declared a 10% stock dividend to stockholders of record on May 21. The market value of the stock was $13 on May 7. The entry to record the transaction of May 7 would include a O credit to Cash for $128700. O credit to Common Stock Dividends Distributable for $128700. ○ credit to Common Stock Dividends Distributable for $29700. O debit to Stock Dividends for $128700.arrow_forwardWeaver Corporation had the following stock issued and outstanding at January 1, Year 2: 1. 109,000 shares of $10 par common stock. 2.6,500 shares of $80 par, 4 percent, noncumulative preferred stock. On June 10, Weaver Corporation declared the annual cash dividend on its 6,500 shares of preferred stock and a $5 per share dividend for the common shareholders. The dividend will be paid on July 1 to the shareholders of record on June 20. Required Determine the total amount of dividend to be paid to the preferred shareholders and common shareholders. Preferred stock Common stock Total dividendarrow_forwardThe board of directors of Capstone Inc. declared a $0.60 per share cash dividend on its $1 par common stock. On the date of declaration, there were 50,000 shares authorized, 20,000 shares issued, and 5,000 shares held as treasury stock. What is the entry for the dividend declaration?arrow_forward

- Clair, Inc. reports net income of $700,000. It declares and pays dividends of $100,000 for the year, one-half of which relate to the preferred shares. The weighted average number of ordinary shares outstanding during the year is 200,000 shares, and the weighted average number of preferred shares outstanding during the year is 10,000 shares. Rounded to the nearest cent, earnings per share for Clair, Inc. is O $2.95. O $3.00. O $3.25. O $3.18.arrow_forwardMcVie Corporation’s stock has a par value of $2. The company has the following transactions during the year: Feb. 28 Issued 340,000 shares at $4 share. Jun. 7 Issued 95,000 shares in exchange for equipment with a clearly determined value of $206,000. Sep. 19 Purchased 2,100 shares of treasury stock at $6 per share. Prepare the journal entries to record the transactions. If an amount box does not require an entry, leave it blank. Feb. 28 Jun. 7 Sept. 19arrow_forwardWeaver Corporation had the following stock issued and outstanding at January 1, Year 2: 1.147,000 shares of $4 par common stock. 2. 7,500 shares of $50 par, 5 percent, noncumulative preferred stock. On June 10, Weaver Corporation declared the annual cash dividend on its 7,500 shares of preferred stock and a $3 per share dividend for the common shareholders. The dividend will be paid on July 1 to the shareholders of record on June 20. 券 Required Determine the total amount of dividend to be paid to the preferred shareholders and common shareholders, 彩 Preferred stock Common stock Total dividend Mc Graw Hill Prey 15 of 20 Next >arrow_forward

- The Ivanhoe Corporation has 94,600 $2.00 noncumulative preferred shares that have been issued. It declares a quarterly cash dividend on May 15 to shareholders of record on June 10. The dividend is paid on June 30. Prepare the entries on the appropriate dates to record the cash dividend. (List all debit entries before credit entries. Record journal entries in the order presented in the problem. Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) Date Account Titles Debit Creditarrow_forwardDuring its first year of operations, Vader Corp. issued 15,000 shares of its $1 par common stock for $65,000. In June, Vader issued an additional 5,000 shares of the same $1 par common stock for $8.25 each. During September, Vader repurchased 2,500 shares for $25,000; this left Vader with 17,500 shares outstanding. What is the balance in the Common Stock account as of December 31st? $81.250 O $106,250 O $17,500 O $20,000 O None of the above.arrow_forwardThe annual report for Sneer Corporation disclosed that the company declared and paid preferred dividends in the amount of $170,000 in the current year. It also declared and paid dividends on common stock in the amount of $2.70 per share. During the current year, Sneer had 1 million common shares authorized; 370,000 shares had been issued; and 163,000 shares were in treasury stock. The opening balance in Retained Earnings was $870,000 and Net Income for the current year was $370,000. Required: 1. Prepare journal entries to record the declaration, and payment, of dividends on (a) preferred and (b) common stock. 2. Using the information given above, prepare a statement of retained earnings for the year ended December 31. 3. Prepare a journal entry to close the dividends account.arrow_forward

- During the year ended December 31, 20--, Choi Company completed the following transactions: Apr. 15 Declared a semiannual dividend of $1.50 per share on preferred stock and $0.40 per share on common stock to shareholders of record on May 5, payable on May 10. Currently, 6,000 shares of $50 par preferred stock and 80,000 shares of $1 par common stock are outstanding. May 10 Paid the cash dividends. Oct. 15 Declared semiannual dividend of $1.50 per share on preferred stock and $0.40 per share on common stock to shareholders of record on November 5, payable on November 20. Nov. 20 Paid the cash dividends. 22 Declared a 10% stock dividend to common shareholders of record on December 8, distributable on December 16. Market value of the common stock was estimated at $7 per share. Dec. 16 Issued certificates for common stock dividend. 20 Board of directors declared a two-for-one common stock split. Required: Prepare journal entries for the transactionsarrow_forwardWhen Crossett Corporation was organized in January Year 1, it immediately issued 5,500 shares of $51 par, 8 percent, cumulative preferred stock and 9,500 shares of $11 par common stock. Its earnings history is as follows: Year 1, net loss of $13,100; Year 2, net income of $58,900; Year 3, net income of $94,00. The corporation did not pay a dividend in Year 1. a. How much is the dividend arrearage as of January 1, Year 2? b. Assume that the board of directors declares a $64,880 cash dividend at the end of Year 2 (remember that the Year 1 and Year 2 preferred dividends are due). How will the dividend be divided between the preferred and common stockholders?arrow_forwardMonty Inc. has 5,400,000 shares of common stock issued and outstanding. On April 1, the board of directors voted a 70 cents per share cash dividend to stockholders of record as of April 14, payable April 21. Prepare the journal entry for each of the dates above assuming the dividend represents a distribution of earnings. How would the entry differ if the dividend were a liquidating dividend?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education