FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

Par Value of $5

Do not give answer in image

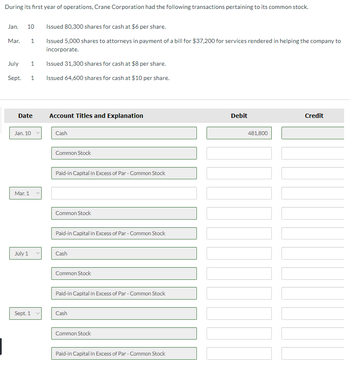

Transcribed Image Text:During its first year of operations, Crane Corporation had the following transactions pertaining to its common stock.

Jan. 10

Mar.

July 1

Sept. 1

Date

1

Jan. 10

Mar. 1

July 1

Sept. 1

Issued 80,300 shares for cash at $6 per share.

Issued 5,000 shares to attorneys in payment of a bill for $37,200 for services rendered in helping the company to

incorporate.

Issued 31,300 shares for cash at $8 per share.

Issued 64,600 shares for cash at $10 per share.

Account Titles and Explanation

Cash

Common Stock

Paid-in Capital in Excess of Par - Common Stock

Common Stock

Paid-in Capital in Excess of Par-Common Stock

Cash

Common Stock

Paid-in Capital in Excess of Par - Common Stock

Cash

Common Stock

Paid-in Capital in Excess of Par - Common Stock

Debit

481,800

Credit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Its npv vs discount rate graph please help with conceptarrow_forwardThe lowest rate of return possible is:a. 0%b. -∞c. -100%d. the company’s MARRarrow_forwardAssume X = $100 and So = $95. With T on the X-axis and $ on the Y-axis, plot the time value (price minus intrinsic value) implied for each of the following long call prices. Pa(So,T1,X) = $6.00; Pa(So,T2,X) = $7.00; Pa(So,T3,X) = $8.20; Pa(So,T4,X) = $12.50arrow_forward

- d. If the employees are not covered, what is the maximum amount Ken can contribute for himself? Only 25% of employee earnings Lesser of $61,000 or 25% of employee earnings Greater of $61,000 or 25% of employee earnings Only 25% of employee earnings Only $61,000 e. If Ken is required to contribute for his employees and chooses to contribute the maximum amount, what is the maximum amount Ken can contribute for himself? (Hint: Calculate the employee amounts first.) Ignore any changes in Ken's self-employment tax. Maximum contribution $ 0arrow_forwardNo chatgpt used i will give 5 upvotes typing please both answers plsarrow_forwardion Given r and t greater than zero: I. Present value interest factors are less than one. II. Future value interest factors are less than one. III. Present value interest factors are greater than future value interest factors. IV. Present value interest factors grow as t grows, provided r is held constant. Select one: O a. II and Ill only Ob. II and IV only O c. I and III only O d. I only Oe. I and IV onlyarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education