FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

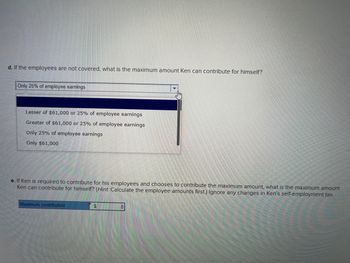

Transcribed Image Text:d. If the employees are not covered, what is the maximum amount Ken can contribute for himself?

Only 25% of employee earnings

Lesser of $61,000 or 25% of employee earnings

Greater of $61,000 or 25% of employee earnings

Only 25% of employee earnings

Only $61,000

e. If Ken is required to contribute for his employees and chooses to contribute the maximum amount, what is the maximum amount

Ken can contribute for himself? (Hint: Calculate the employee amounts first.) Ignore any changes in Ken's self-employment tax.

Maximum contribution

$

0

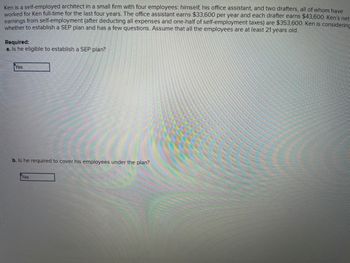

Transcribed Image Text:Ken is a self-employed architect in a small firm with four employees: himself, his office assistant, and two drafters, all of whom have

worked for Ken full-time for the last four years. The office assistant earns $33,600 per year and each drafter earns $43,600. Ken's net

earnings from self-employment (after deducting all expenses and one-half of self-employment taxes) are $353,600. Ken is considering

whether to establish a SEP plan and has a few questions. Assume that all the employees are at least 21 years old.

Required:

a. Is he eligible to establish a SEP plan?

Yes

b. Is he required to cover his employees under the plan?

Yes

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- 1arrow_forwardBill Mason is considering two job offers. Job 1 pays a salary of $41,900 with $4,875 of nontaxable employee benefits. Job 2 pays a salary of $40,000 and $6,530 of nontaxable benefits. Use a 28 percent tax rate. a. Calculate the monetary value of each job. b. Which position would have the higher monetary value? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Calculate the monetary value of each job. Note: Round your final answers to the nearest whole number. Monetary Value Job 1 Job 2arrow_forwardkeAssignmentMain.do?invoker=&takeAssignmentSessionLocator=&inprogress3false еВook Problem 9-35 (LO. 6) Amber's employer, Lavender, Inc., has a 5 401(k) plan that permits salary deferral elections by its employees. Amber's salary is $99,000, and her marginal tax rate is 24% and she is 42 years old. a. What is the maximum amount Amber can elect for salary deferral treatment for 2020? b. If Amber elects salary deferral treatment for the above amount, how much can she save in taxes? Her tax liability for 2020 would be reduced by $ C. What is the recommended amount that Amber should elect as salary deferral treatment for 2020? Previous Next Check My Workarrow_forward

- Required: b-1. Suppose Ekiya receives a competing job offer of $140,000 in wages and nontaxable (excluded) benefits worth $9,000. What is the amount of Ekiya's after-tax compensation for the competing offer? b-2. Which job should she take if taxes are the only concern? Complete this question by entering your answers in the tabs below. Required B1 Required B2 Suppose Ekiya receives a competing job offer of $140,000 in wages and nontaxable (excluded) benefits worth $9,000. What is the amount of Ekiya's after-tax compensation for the competing offer? Note: Round your intermediate calculations and final answers to the nearest whole dollar amount. Required B2 (1) Gross income (2) For AGI deductions (3) Adjusted gross income (4) Standard deduction (5) Taxable income (6) Income tax liability After-tax compensationarrow_forwardq1 Steve worked as a tech supervisor for a computer company. In September of this year, he was laid off. He was paid unemployment compensation for the rest of the year totaling S7,000. Which of the following is true? a. Steve will have to report all S7,000 of the unemployment compensation as income. b. Unemployment compensation is never taxable. c.Steve will have to report $4,600 of the unemployment compensation as income. d. As long as the unemployment compensation payments are less than the taxpayer's previous salary, they are not taxable. e. None of these choices are true.arrow_forwardThe plant union is negotiating with the Eacty Company, which is on the verge of bankruptcy. Eagle has offered to pay for the employees' hospitalization insurance in exchange for a wage reduction. Each employee currently pays premiums of $4,000 a year for their insurance. Which of the following is correct: a.If an employee's wages are reduced by $5,000 and the employee is in the 24% marginal tax bracket, the employee would benefit from the offer. b.If an employee's wages are reduced by $6,000 and the employee is in the 35% marginal tax bracket, the employee would benefit from the offer. c.If an employee's wages are reduced by $4,000 and the employee is in the 12% marginal tax bracket, the employee would benefit from the offer. d."If an employee's wages are reduced by $5,000 and the employee is in the 24% marginal tax bracket, the employee would benefit from the offer", "If an employee's wages are reduced by $4,000 and the employee is in the 12% marginal tax bracket, the employee would…arrow_forward

- PROBLEM 3. Glenda is trying to decide whether to accept a bonus of 25% of net income after salaries and bonus or a salary of P97,500 plus bonus of 10% of net income after salaries and bonus as a means of allocating profit among the partners. Salaries traceable to the other partners are estimated to be P450,000. What amount of income would be necessary so that Glenda would consider the choices to be equal? P1,100,000 P1,197,000 a. b. с. P650,000 d. P1.262.500arrow_forwardAn excel spreadsheet must be use to complete the following activity: You work for a small business. The company offers employees a 401k plan. The company matches employee contributions to the plan up to 3 percent of the employee's gross pay. 1. Find each employee's contribution to a 401(k) account by multiplying the employee's gross pay by the contribution percentage. Find the employer's matching contribution and the total contribution amount for each employee. The employees are listed by employee number. 2. Find the employer's total contribution for all employees.arrow_forward2arrow_forward

- If an employee takes a customer to lunch and discusses business, can the employee deduct the cost of a meal? Explain. C O A. Employees can no longer deduct any portion of the cost of meals and entertainment. O B. Employees can deduct 50% of the entire cost. O C. Employees can deduct 50% of their own meals and entertainment that are business related but none of the cost of the customer's meal. O D. Employees can deduct 50% of their own meals and entertainment that are business related as well as 100% of the cost of the customer's meal.arrow_forwardWhat is the Health Savings Arrangement (HSA) catch-up contribution limit for an employee who is 58 years old and married? O $3,600 O $1,000 O $7,200 O $1,050arrow_forward02.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education