Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

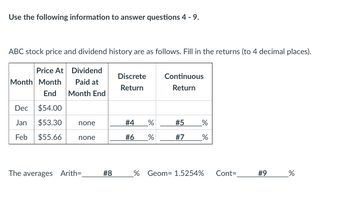

Transcribed Image Text:Use the following information to answer questions 4 - 9.

ABC stock price and dividend history are as follows. Fill in the returns (to 4 decimal places).

Price At Dividend

Paid at

Month End

Month Month

End

Dec $54.00

Jan $53.30 none

Feb $55.66 none

The averages Arith=_ #8

Discrete

Return

#4

%

#6 %

Continuous

Return

#5

#7

%

%

% Geom= 1.5254%

Cont=

#9

%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 6 steps

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

Number 4 is a decrete return. Number 5 is a Continuous return.

Discreet return (#4) =P1P0−1 =53.3054.00−1=−1.2963%=P1P0-1 =53.3054.00-1=-1.2963%

Discreet return (#5) =P2P1−1 =55.6653.30−1=4.4278%

Here is what is listed.

Was this supposed to be #4 & #6?

Solution

by Bartleby Expert

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

Number 4 is a decrete return. Number 5 is a Continuous return.

Discreet return (#4) =P1P0−1 =53.3054.00−1=−1.2963%=P1P0-1 =53.3054.00-1=-1.2963%

Discreet return (#5) =P2P1−1 =55.6653.30−1=4.4278%

Here is what is listed.

Was this supposed to be #4 & #6?

Solution

by Bartleby Expert

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Using the data from the following table,calculate the return for investing in this stock from January 1 to December 31. Prices are after the dividend has been paid. Stock Price Dividend Jan 1 $50.18 Mar 31 $51.11 $0.58 Jun 30 $49.56 $0.58 Sep 30 $51.93 $0.75 Dec 31 $52.53 $0.75 The return from January 1 to March 31 is enter your response here. (Round to five decimal places.) Part 2 The return from March 31 to June 30 is enter your response here. (Round to five decimal places.) Part 3 The return from June 30 to September 30 is enter your response here. (Round to five decimal places.) Part 4 The return from September 30 to December 31 is enter your response here. (Round to five decimal places.) Part 5 enter your response here%. (Round to two decimal places.)arrow_forwardSuppose a stock had an initial price of $86 per share, paid a dividend of $1.80 per share during the year, and had an ending share price of $74. Compute the percentage total return, dividend yield, and capital gains yield. (A negative answer should be indicated by a minus sign. Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.)arrow_forwardA stock has had the following year-end prices and dividends: Year 1234 in 10 5 6 Price $64.68 71.55 77.35 63.62 73.81 83.25 Dividend Arithmetic average return. Geometric average return $.67 .72 .78 .87 .94 What are the arithmetic and geometric returns for the stock? Note: Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g.. 32.16. % %arrow_forward

- You have found the following stock quote for RJW Enterprises, Incorporated, in the financialpages of today's newspaper. YTD % Change Stock SYM YLD PE Last Net Change -1.1 RJWEnterprises RWJ 2.5 15 108.00-.42 a. What is the annual dividend? (Do not roundintermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) b. Whatwas the closing price for this stock that appeared in yesterday's paper c. If the companycurrently has 30 million shares of stock outstanding, what was net income for the most recentfour quarters? (Do not round intermediate calculations and enter your answer in dollars, notmtermediate calculations and round your answer to 2 decimalarrow_forwardConsider the following information on two stocks: P(State) Stock A Stock B Boom 20% 30% 20% Normal 50% 12% -5% Slow 15% 4% 8% Recession 15% -10% 10% Calculate the covariance(A,B). (Enter percentages as decimals and round to 4 decimals)arrow_forwardReturn for the entire period is (Round to two decimal places.)arrow_forward

- Please help me with all answers I will give upvotearrow_forwardPlease stepwise all partsarrow_forwardSuppose a stock had an initial price of $103 per share, paid a dividend of $2.55 per share during the year, and had an ending share price of $115. Compute the percentage total return. (Do not round intermediate calculations. Round the final answer to 2 decimal places.) Percentage of total return %arrow_forward

- Nonearrow_forwardYou have found the following stock quote for RJW Enterprises, Incorporated, in the financial pages of today's newspaper. YTD Net %Change Stock -1.1 RJW Enterprises SYM RWJ YLD PE Last Change 2.5 15 84.00 -.36 a. What is the annual dividend? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) b. What was the closing price for this stock that appeared in yesterday's paper? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) c. If the company currently has 24 million shares of stock outstanding, what was net income for the most recent four quarters? (Do not round intermediate calculations and enter your answer in dollars, not millions of dollars, rounded to 2 decimal places, e.g., 1,234,567.89.) a. Annual dividend b. Yesterday's closing price c. Net incomearrow_forwardSuppose a stock had an initial price of $50 per share, paid a dividend of $1.05 per share during the year, and had an ending share price of $37. Compute the percentage total return. Enter the answer in 4 decimals e.g. 0.1234.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education