Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

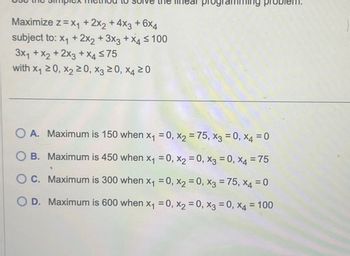

Transcribed Image Text:Maximize z=x₁ + 2x2 + 4x3 + 6x4

subject to: x1 + 2x2 + 3x3 + x4 ≤ 100

3x1 + x2 + 2x3 + x4 ≤75

with x₁ ≥0, X2 ≥0, X3 ≥0, x4 20

pro

OA.

A. Maximum is 150 when x₁ =0, x2 = 75, x3 = 0, x4 = 0

OB. Maximum is 450 when x₁ = 0, x2 = 0, x3 = 0, x4 = 75

O C. Maximum is 300 when x₁ =0, x2 =0, x3 = 75, x4 = 0

OD. Maximum is 600 when x₁ = 0, x2 = 0, x3 = 0, x4 = 100

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- Consider the radiation with the following wavelengths: 1. 600 nm II. 200 nm III. 1200 nm Arrange by: LOWEST energy LOWEST frequency HIGHEST energy_ ergy_||| A. I, I, III B. II, II, I C. III, III, I D. III, II, II E. II, II, III 20arrow_forwardBefore After 5 Treated A B Untreated C D Imagine that we have a difference-in-differences regression: Y BO+B1xTreated + B2xAfter + B3x(TreatedxAfter) What is the value of B2? OD OD-C OB OB-Darrow_forwardIn cell E16, enter the appropriate formula to calculate the probability of either rolling a 7 or 11.arrow_forward

- No chatgpt used i will give 5 upvotes typing please i need both answersarrow_forwardListen Which of the following graphs shows f(x)=3x+4 and its inverse? Four Graphs Graph A Graph B 6 2 6 2 -2 0 2 6 8 10 4 -2 0 2 4 6 8 -2 -2 Graph C -2 0 2 4 6 8 4 A Graph A B Graph B C Graph C D Graph D y 8 6 12 Graph D 4 -2 0 2 4 6 8 -2arrow_forwardCan you show me the calculations to get these numbers: 40/80, 40/80, 20/80, 60/80arrow_forward

- How do you know when to use the formula FV=PV(1+i)n vs. FV=PV(1+r/m)mtarrow_forwardCalculate the relative frequency P(E) using the given information. N = 400, fr(E) = 300 P(E) =arrow_forwardFind the optimal solution for the following problem. Note: Round your answers to 3 decimal places. Maximize C = 13x + 9y subject to and 6x + 11y ≤ 18 16x + 21y ≤ 41 x ≥ 0, y ≥ 0. a. What is the optimal value of x? X b. What is the optimal value of y? c. What is the maximum value of the objective function?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education