FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

Transcribed Image Text:1.1

→ Show Transcribed Text

Calculate the contribution margin per unit. (Round per unit cost to 2 decimal places, eg. 15.25.)

Contribution margin $

C

per unit

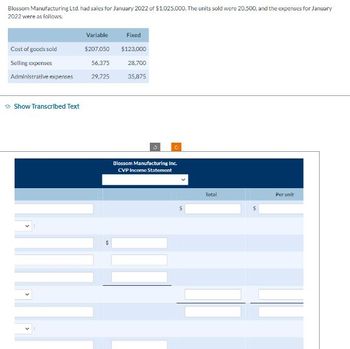

Transcribed Image Text:Blossom Manufacturing Ltd. had sales for January 2022 of $1,025,000. The units sold were 20.500, and the expenses for January

2022 were as follows:

Cost of goods sold

Selling expenses

Administrative expenses

Show Transcribed Text

Variable

$207.050

56.375

29,725

Fixed

$123,000

28,700

35,875

10

C

Blossom Manufacturing Inc.

CVP Income Statement

Total

Per unit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The most recent monthly income statement for Headphones Manufacturing Company is given below: Department A Department B (S) 600,340 Total (S) 1,006,990 (S) Sales 406,650 Variable expenses Contribution margin Traceable fixed expenses Segment margin Common fixed expenses Net operating income 256.530 420.000 180,340 676,530 150,120 330,460 100,000 50,120 200.000 (19,660) 300,000 30,460 20.870 29.130 50,000 29,250 (48,790) (19,540) Due to its poor result, consideration is being given to closing Department B. Studies show that if Department B is closed, 20% of its traceable fixed expenses will continue unchanged. The studies also show that closing Department B would result in a 5 percent decrease in sales in Department A. The company allocates common fixed expenses to the departments on the basis of sales dollars. Required: c) The company has done a detailed investigation to the production in Department A. Currently, department produces 4 products as follow: A B Selling price per unit…arrow_forwardThe actual selling expenses incurred in March 2022 by Sheffield Company are as follows. Variable Expenses Fixed Expenses Sales commissions $12,100 Sales salaries $38,500 Advertising 7,590 Depreciation 7,700 Travel 5,610 Insurance 1,100 Delivery 3,795 Variable costs and their percentage relationship to sales are sales commissions 6%, advertising 4%, travel 3%, and delivery 2%. Fixed selling expenses will consist of sales salaries $38,500, Depreciation on delivery equipment $7,700, and insurance on delivery equipment $1,100.arrow_forwardDuring Heaton Company's first two years of operations, it reported absorption costing net operating income as follows: Year 1 Sales (862 per unit) Year 2 $930,000 $1,550,000 495,000 Cost of goods sold t# $33 per unit) Gross margin 625,000 435,000 725,000 Selling and adninistrative expenses 292.000 322,000 Set operating income $ 143,000 $ 403,000 *$3 per unit variable: $247,000 fixed each year. The company's $33 unit product cost is computed as follows: Dirpet materials Diret labor Variable manufacturing overhead 3 13 Fixed manufacturing overhead (5260,000 20,000 unita) Absorption costing unit product cost Production and cost data for the first two years of operations are Year 1 Year 2 Units produced 20,000 20,000 thits sold 15,000 25,000 Required: 1. Using variable costing, what is the unit product cost for both years? 2. What is the variable costing net operating income in Year 1 and in Year 27 3. Reconcile the absorption costing and the variable costing net operating income figures…arrow_forward

- Sunland Beauty Corporation manufactures cosmetic products that are sold through a network of sales agents. The agents are paid a commission of 21% of sales. The income statement for the year ending December 31, 2022, is as follows. SUNLAND BEAUTY CORPORATIONIncome StatementFor the Year Ended December 31, 2022 Sales $71,200,000 Cost of goods sold Variable $30,616,000 Fixed 8,560,000 39,176,000 Gross profit $32,024,000 Selling and marketing expenses Commissions $14,952,000 Fixed costs 10,660,400 25,612,400 Operating income $6,411,600 The company is considering hiring its own sales staff to replace the network of agents. It will pay its salespeople a commission of 7% and incur additional fixed costs of $9,968,000. Calculate the company’s break-even point in sales dollars for the year 2022 if it hires its own sales force to replace the network of agents. Break-even…arrow_forwardTyler Company has the following information pertaining to its two product lines for last year: Variable selling and admin. expenses Direct fixed expenses Sales Direct fixed selling and admin. expenses Variable expenses Operating income Common expenses are $105,000 for the year. What is the income for Tyler Company? $102,500 $120,500 $99,000 $101,000 Product A $38,000 19,500 250,000 38,000 42,000 $112,500 " Product B $31,000 34,500 210,000 22,000 31,000 $91,500arrow_forwardWhitman Company Income Statement Sales (38,000 units $41.60 per unit) Cost of goods sold (38,000 units x $23 per unit) Gross margin Selling and administrative expenses $ 1,580,800 874,000 706,800 475,000 Net operating income $ 231,800 The company's selling and administrative expenses consist of $285,000 per year in fixed expenses and $5 per unit sold in variab expenses. The $23 unit product cost given above is computed as follows: Direct materials Direct labor Variable manufacturing overhead $ 11 4 4 Fixed manufacturing overhead ($216,000 + 54,000 units) Absorption costing unit product cost 4 $ 23 Required: 1. Redo the company's Income statement in the contribution format using variable costing. 2. Reconcile any difference between the net operating Income on your variable costing Income statement and the net operating Income on the absorption costing Income statement above. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Redo the company's…arrow_forward

- The GAAP income statement for Carla Vista Company for the year ended December 31, 2022,s shows sale $930,000, cost of good sold $555,000, and operating expenses $235,000. Assuming all costs and expenses are 70% variable and 30% fixed, prepare a CVP income statement through contribution margin.arrow_forwardThe following is the year ended data for Tiger Company: Sales Revenue $58,000 Cost of Goods Manufactured 21,000 Beginning Finished Goods Inventory 1,100 Ending Finished Goods Inventory 2,200 Selling Expenses 15,000 Administrative Expenses 3,900 What is the gross profit? A. $22,100 B. $38,100 C. $19,200 D.arrow_forwardBurger Shack, Inc. Product Line Income Statement For the Year Ended December 31, 2023 Hamburgers Hot Dogs Tacos Sales $120,000 $110,000 $90,000 Cost of Goods Sold (Variable) $56,000 $48,000 $60,000 Gross Profit $64,000 $62,000 $30,000 Selling and Administrative Expenses (Variable) $11,000 $14,000 $15,000 Income from Operations $53,000 $48,000 $15,000 Fixed Expenses* Net Incomearrow_forward

- Dineshbhaiarrow_forwardRevenue and expense data for the current calendar year for Tannenhill Company and for the electronics industry are as follows. Tannenhill’s data are expressed in dollars. The electronics industry averages are expressed in percentages. TannenhillCompany ElectronicsIndustryAverage Sales $800,000 100 % Cost of goods sold 512,000 70 Gross profit $288,000 30 % Selling expenses $176,000 17 % Administrative expenses 64,000 7 Total operating expenses $240,000 24 % Operating income $48,000 6 % Other revenue 16,000 2 $64,000 8 % Other expense 8,000 1 Income before income tax $56,000 7 % Income tax expense 24,000 5 Net income $32,000 2 % a. Prepare a common-sized income statement comparing the results of operations for Tannenhill Company with the industry average. If required, round percentages to one decimal place. Enter all amounts as positive numbers.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education