FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

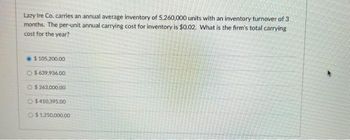

Transcribed Image Text:Lazy Ire Co. carries an annual average inventory of 5,260,000 units with an inventory turnover of 3

months. The per-unit annual carrying cost for inventory is $0.02. What is the firm's total carrying

cost for the year?

$ 105,200.00

$639.936.00

O$263,000.00

$410,395.00

$1,250,000.0

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- JC Penney has sales of $897,400, costs of goods sold of $628,300, inventory of $208,400, and accounts receivable of $74,100. How many days, on average, does it take the firm to sell its inventory assuming that all sales are on credit? 84.76 days 121.07 days 74.19 days 151.21 days 138.46 daysarrow_forwardAverage inventory=1,080,000 Debtors=690,000 Gross Profit ratio=10% Credit sales to total sales=20% Inventory turnover ratio=6 times 1 year is taken as 360 days. With the information given above, find the average collection period.arrow_forwardDabble, Inc. has sales of $984,000 and cost of goods sold of $644,000. The firm had a beginning inventory of $38,000 and an ending inventory of $48,000.What is the length of the days’ sales in inventory?arrow_forward

- Sisyphus Inc. records total sales of $657,500 in the current period, with a cost of goods sold of $389,000 . Sisyphus expects 4% of sales to be returned. How much in net sales will Sisyphus recognize for the current period? Group of answer choices $373,400 $268,500 $631,200 $657,500 $257,760 The Sisyphus Inc’s (SSY) Company’s annual statement of cash flows reported the following (in millions): Net cash from financing activities $63,864 Net cash from investing activities -62,512 Cash at the beginning of the year 13,152 Cash at the end of the year 18,948 What did SSY report for “Net cash from operating activities” during the year? Group of answer choices $71,220 million cash inflow None of the above $4,444 million cash outflow $4,444 million cash inflow $71,220 million cash outflowarrow_forwardOn average, your firm sells $32,300 of items on credit each day. The average inventory period is 27 days and your operating cycle is 47 days. What is the average accounts receivable balance? $872,100 $1.292.000 $904,400 $646,000 $1,518,100arrow_forwardTefft Industires has an average inventory of $170,000, sells on term of 2/10, net 30, and its cost of sales is $540,000. What is Tefft's inventory conversion period? *show work* A) 85 days B) 115 days C) 105 days D) cannot be determined from the data givenarrow_forward

- "On average, a firm sells $2,500,000 in merchandise a month. Its cost of goods sold equals 80 percent of sales, and it keeps inventory equal to one-half of its monthly cost of goods on hand at all times. If the firm analyzes its accounts using a 360-day year, what is the firm's inventory conversion period?" Group of answer choices a. 360 days b. 180 days c. 30 days d. 15 days e. 10 daysarrow_forwardLandis Company is preparing its financial statements. Gross margin is normally 40% of sales. Information taken from the company's records revealed sales of $95,000; beginning inventory of $9,500 and purchases of $66,500. What is the estimated amount of ending inventory at the end of the period? Multiple Choice ο ο ο ο $30,400 $57,000 $38,000 $19,000arrow_forwardSow Tire, Inc. has sales of $1,448,000 and cost of goods sold of $978,000. The firm had an average inventory of $96,800 and an ending inventory of $81,000. What is the length of the days’ sales in inventory? (Use 365 days a year. Round your answer to 2 decimal places.)arrow_forward

- Please Do both questions Delphino’s has sales for the year of $127,300 and cost of goods sold of $86,700. The firm carries an average inventory of $14,300 and has an average accounts payable balance of $13,600. What is the inventory period? 81.36 days 60.20 days 58.68 days 89.02 days The Lumber Yard has projected sales for April through July of $152,400, $161,800, $189,700, and $196,400, respectively. The firm collects 52 percent of its sales in the month of sale, 46 percent in the month following the month of sale, and the remainder in the second month following the month of sale. What is the amount of the July collections? $181,508 $122,852 $189,819 $192,626arrow_forwardDabble, Inc. has sales of $970,000 and cost of goods sold of $461,000. The firm had an average inventory of $41,000. What is the length of the days' sales in inventory? (Use 365 days a year. Round your answer to 2 decimal places.) Days' sales in inventory daysarrow_forwardAnthony Corporation reported the following amounts for the year: Net sales 296,000 Cost of goods sold 138,000 Average inventory 50,000 Anthony's gross profit ratio is: 53.4%. 51.9%. 50.3%. 46.6%. Anthony's average days in inventory is: 70 days. 114 days. 132 days. 151 days. A company's sales equal $60,000 and cost of goods sold equals $20,000. Its beginning inventory was $1,600 and its ending inventory is $2,400. The company's inventory turnover ratio equals: 5 times. 10 times. 20 times. 30 times. [Last question is in the picture attached]arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education