FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Please help me to compute turnover for the year was....show calculation

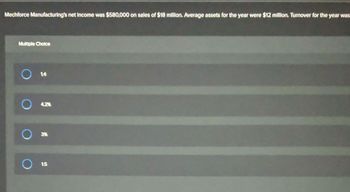

Transcribed Image Text:Mechforce Manufacturing's net Income was $580,000 on sales of $18 million. Average assets for the year were $12 million. Turnover for the year was

Multiple Choice

O 14

4.2%

3%

1.5

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Compute Altoona Company's (a) inventory turnover ratio and (b) number of days' sales in inventory ratio, using the following information. Use 365 days year. Round your intermediate calculations to 2 decimal places and final answers to 1 decimal place. Cost of Goods Sold $727,000 Beginning Inventory 60,000 Ending Inventory 73,000 (a) Inventory Turnover Ratio (b) Number of Days' Sales in Inventory Ratioarrow_forwardThe Income Statement columns of the August 31 (year-end) work sheet for Ralley Company are shown here. To save time and space, the expenses have been grouped together into two categories. INCOME STATEMENT ACCOUNT NAME DEBIT CREDIT Income Summary 31,100.00 31,130.00 Sales 324,360.00 Sales Returns and Allowances 13,970.00 Sales Discounts 7,620.00 Purchases 126,210.00 Purchases Returns and Allowances 1,020.00 Purchases Discounts 1,110.00 Freight In 8,460.00 Selling Expenses 61,470.00 General Expenses 51,751.00 300,581.00 357,620.00 Net Income 57,039.00 357,620.00 357,620.00 From the information given, prepare an income statement for the company. Ralley CompanyIncome StatementFor Year Ended August 31, 20-- (See images)arrow_forward1. Inventory turnover is calculated as __________ divided by __________. cost of goods sold; inventory cost of goods sold; average inventory cost of goods sold; total assets average inventory; cost of goods sold 2. The number of days’ sales in inventory is calculated as __________ divided by __________. average inventory; average daily cost of goods sold ending inventory; cost of goods sold net income; sales cost of goods sold; average inventoryarrow_forward

- To answer the following questions, use the following information. Round to 1 decimal place for percentages. 2018 2017 2016 Cost of merchandise sold 20,441 19,038 17,405 Inventories 5,261 5,055 4,838 Required: A. Calculate the inventory turnover for the Years 2017 and 2018. B. Calculate the days' sales in inventory for the Years 2017 and 2018. C. Is the change in both the inventory turnover and the days' sales in inventory from 2017 to 2018 favorable or is it unfavorable? Explain your answer.arrow_forwardPlease help mearrow_forwardCurrent Attempt in Progress Blue Spruce Warehouse distributes hardback books to retail stores and extends credit to all of its customers. During the month of June, the following merchandising transactions occurred. Purchased books on åccount for $ 2.265 from Catlin Publishers. June 1 Sold books on account to Garfunkel Bookstore for $ 1,000. The cost of the merchandise sold was $ 800. 6. Received $ 65 credit for books returned to Catlin Publishers. 9. Paid Catlin Publishers in full. 15 Received payment in full from Garfunkel Bookstore. 17 Sold books on account to Bell Tower for $ 1,000. The cost of the merchandise sold was $ 850. 20 Purchased books on account for $ 800 from Priceless Book Publishers. 24 Received payment in full from Bell Tower. Paid Priceless Book Publishers in full. 26 28 Sold books on account to General Bookstore for $ 2,950. The cost of the merchandise sold was $ 830, 30 Granted General Bookstore $ 120 credit for books returned costing $ 60.arrow_forward

- Based on the following data for the current year, what is the inventory turnover (rounded to one decimal place)? Sales on account during year $469,274 Cost of merchandise sold during year 179,305 Accounts receivable, beginning of year 42,159 Accounts receivable, end of year 52,598 Merchandise inventory, beginning of year 32,886 Merchandise inventory, end of year 40,548 Oa. 17.7 Ob. 12.8 Oc. 3.9 Od. 4.9arrow_forwardA company reports the following: Cost of goods sold $3,960,250 Average inventory 255,500 Round your answers to one decimal place. a. Determine the inventory turnover. Assume a 365-day year.fill in the blank 1 b. Determine the number of days' sales in inventory. Assume a 365-day year.fill in the blank 2arrow_forwardIn chronological order, the inventory, purchases, and sales of a single product for a recent month are as follows (see attached). 1.Using the periodic inventory system, compute the cost of ending inventory, cost of goods sold, and gross margin. Use the average-cost, FIFO, and LIFO inventory costing methods. (Round unit costs to cents and totals to dollar.) 2.Explain the differences in gross margin produced by the three methods.arrow_forward

- Given the following information Compute: (A) age of inventory; and (B) operating cycle. (check the attached picture) Choose the bullet with the correct answer (A) 18.5 days and (B) 25.5 days (A) 28.5 days and (B) 35.5 days (A) 28.5 days and (B) 55.5 days (A) 38.5 days and (B) 75.5 days (A) 38.5 days and (B) 95.5 daysarrow_forwardBased on the following information compute (a) inventory turnover, (b) average daily cost of merchandise sold, and (c) days' sales in inventory for the current year. Use a 365-day year. Item Prior Year Current Year Cost of merchandise sold $172,900 $215,000 Inventory 18,000 12,000 If required, round your answers to two decimal places. (a) Inventory turnover times (b) Average daily cost of merchandise sold $ (c) Days' sales in inventory days (d) If an inventory turnover of 12 is average for the industry, how is this company doing?arrow_forwardhow do i calculate the gross prfoit rate under each tab ( LIFO,FIFO AVERAGE-COST) base off the attachment?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education