FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

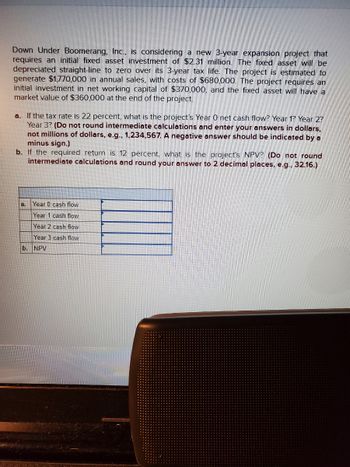

Transcribed Image Text:Down Under Boomerang, Inc., is considering a new 3-year expansion project that

requires an initial fixed asset investment of $2.31 million. The fixed asset will be

depreciated straight-line to zero over its 3-year tax life. The project is estimated to

generate $1,770,000 in annual sales, with costs of $680,000. The project requires an

initial investment in net working capital of $370,000, and the fixed asset will have a

market value of $360,000 at the end of the project.

a. If the tax rate is 22 percent, what is the project's Year O net cash flow? Year 1? Year 2?

Year 3? (Do not round intermediate calculations and enter your answers in dollars,

not millions of dollars, e.g., 1,234,567. A negative answer should be indicated by a

minus sign.)

b. If the required return is 12 percent, what is the project's NPV? (Do not round

intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.)

a.

Year 0 cash flow

Year 1 cash flow

Year 2 cash flow

Year 3 cash flow

b. NPV

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Esfandairi Enterprises is considering a new three-year expansion project that requires an initial fixed asset investment of $2.29 million. The fixed asset will be depreciated straight-line to zero over its three-year tax life. The project is estimated to generate $1,790,000 in annual sales, with costs of $700,000. The project requires an initial investment in net working capital of $410,000, and the fixed asset will have a market value of $420,000 at the end of the project. a. If the tax rate is 21 percent, what is the project's Year O net cash flow? Year 1? Year 2? Year 3? (A negative answer should be indicated by a minus sign. Do not round intermediate calculations and enter your answers in dollars, not millions of dollars, e.g., 1,234,567.) b. If the required return is 12 percent, what is the project's NPV? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) a. Year 0 cash flow a. Year 1 cash flow a. Year 2 cash flow a. Year 3 cash flow…arrow_forwarded Esfandairi Enterprises is considering a new three-year expansion project that requires an initial fixed asset investment of $2,310,000. The fixed asset falls into the three-year MACRS class (MACRS schedule). The project is estimated to generate $1,770,000 in annual sales, with costs of $668,000. The project requires an initial investment in net working capital of $370,000, and the fixed asset will have a market value of $360,000 at the end of the project. a. If the tax rate is 22 percent, what is the project's Year 0 net cash flow? Year 1? Year 2? Year 3? Note: A negative answer should be indicated by a minus sign. Do not round intermediate calculations and round your answers to two decimal places, e.g., 32.16. b. If the required return is 12 percent, what is the project's NPV? Note: Do not round intermediate calculations and round your answer to two decimal places, e.g., 32.16. 2,310,000.00 X a. Year 0 cash flow $ Year 1 cash flow $ 1,028,943 06 Year 2 cash flow $ 1,085,454.90 Year…arrow_forwardEsfandairi Enterprises is considering a new three-year expansion project that requires an initial fixed asset investment of $2.18 million. The fixed asset will be depreciated straight- line to zero over its three-year tax life, after which time it will be worthless. The project is estimated to generate $1.645 million in annual sales, with costs of $610,000. The project requires an initial investment in net working capital of $250,000, and the fixed asset will have a market value of $180,000 at the end of the project. The tax rate is 21 percent. a. What is the project's Year O net cash flow? Year 1? Year 2? Year 3? (A negative answer should be indicated by a minus sign. Do not round intermediate calculations and enter your answers in dollars, not millions of dollars, e.g., 1,234,567.) b. If the required return is 12 percent, what is the project's NPV? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) a. Year 0 cash flow a. Year 1 cash flow…arrow_forward

- Hubrey Home Inc. is considering a new three-year expansion project that requires an initial fixed asset investment of $3.7 million. The fixed asset falls into Class 10 for tax purposes (CCA rate of 30% per year), and at the end of the three years can be sold for a salvage value equal to its UCC. The project is estimated to generate $2,630,000 in annual sales, with costs of $832,000. If the tax rate is 35%, what is the OCF for each year of this project? (Enter the answers in dollars. Do not round your intermediate calculations. Round the final answers to 2 decimal places. Omit $ sign in your response.) OCF1 $ OCF2 $ OCF3 $arrow_forwardAmalgamated Industries is considering a 4- year project. The project is expected to generate operating cash flows of $11 million, $14 million, $16 million, and $9 million over the four years, respectively. It will require initial capital expenditures of $41 million dollars and an intitial investment in NWC of $24 million. The firm expects to generate a $11 million after tax salvage value from the sale of equipment when the project ends, and it expects to recover 100% of its nwc investments. Assuming the firm requires a return of 10% for projects of this risk level, what is the project's IRR? Question 3 options: 9.59% 9.22% 8.95% 9.41% 9.69%arrow_forwardEsfandairi Enterprises is considering a new three-year expansion project that requires an initial fixed asset investment of $2.35 million. The fixed asset qualifies for 100 percent bonus depreciation in the first year. The project is estimated to generate $1,745,000 in annual sales, with costs of $648,000. The project requires an initial investment in net working capital of $320,000, and the fixed asset will have a market value of $285,000 at the end of the project. a. If the tax rate is 22 percent, what is the project's Year O net cash flow? Year 1? Year 2? Year 3? (A negative answer should be indicated by a minus sign. Do not round intermediate calculations and enter your answers in dollars, not millions of dollars, e.g., 1,234,567.) b. If the required return is 11 percent, what is the project's NPV? (Do not round intermediate calculations and enter your answers in dollars, not millions of dollars, rounded to two decimal places, e.g., 1,234,567.89.) a. Year 0 cash flow a. Year 1 cash…arrow_forward

- Summer Tyme, Inc., is considering a new 3-year expansion project that requires an initial fixed asset investment of $662,691. The fixed asset will be depreciated straight-line to 61,885 over its 3-year tax life, after which time it will have a market value of $112,268. The project requires an initial investment in net working capital of $78,031. The project is estimated to generate $223,911 in annual sales, with costs of $101,913. The tax rate is 0.29 and the required return on the project is 0.12. What is the total cash flow in year 0? (Make sure you enter the number with the appropriate +/- sign)arrow_forwardEsfandairi Enterprises is considering a new three-year expansion project that requires an initial fixed asset investment of $2.18 million. The fixed asset will be depreciated straight-line to zero over its three-year tax life, after which time it will be worthless. The project is estimated to generate $1730000 million in annual sales, with costs of $640,000. The tax rate is 24 percent. If the required return is 13 percent, what is the project's NPV? please answer fast i give upvotearrow_forwardDUB company is considering a new 3-year expansion project that requires an initial fixed asset investment of $2.29 million. The fixed asset falls into the 3-year MACRS class. The project is estimated to generate $1,810,000 in annual sales, with costs of $700,000. The project requires an initial investment in net working capital of $450,000, and the fixed asset will have a market value of $480,000 at the end of the project. a. If the tax rate is 25 percent, what is the project’s Year 0 net cash flow? Year 1? Year 2? Year 3? (Do not round intermediate calculations) b. If the required return is 12%, what is the projects NPV? Please use excel and show equations.arrow_forward

- Quad Enterprises is considering a new 3-year expansion project that requires an initial fixed asset investment of $2.1 million. The fixed asset falls into the 3-year MACRS class (MACRS Table) and will have a market value of $159,600 after 3 years. The project requires an initial investment in net working capital of $228,000. The project is estimated to generate $1,824,000 in annual sales, with costs of $729,600. The tax rate is 25 percent and the required return on the project is 11 percent. Calculate the project net cash flow from year 0 to year 3.arrow_forwardDMV, Inc., is considering a new three-year expansion project that requires an initial fixed asset investment of $1.2 million. The fixed asset will be depreciated straight-line to zero over its three-year tax life, after which it will be worthless. The project is estimated to generate $1,40,000 in annual sales, with costs of $500,000. The tax rate is 37 percent and the required return is 12 percent. What is the project's NPV?arrow_forwardSummer Tyme, Inc., is considering a new 3-year expansion project that requires an initial fixed asset investment of $2,380,090. The fixed asset will be depreciated straight-line to zero over its 3-year tax life, after which time it will be worthless. The project is estimated to generate $1,966,851 in annual sales, with costs of $1,680,260. If the tax rate is 0.35 , what is the OCF for this project?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education