Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

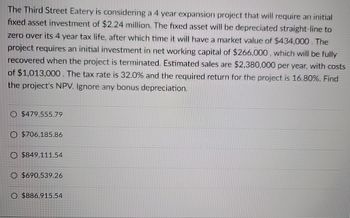

Transcribed Image Text:The Third Street Eatery is considering a 4 year expansion project that will require an initial

fixed asset investment of $2.24 million. The fixed asset will be depreciated straight-line to

zero over its 4 year tax life, after which time it will have a market value of $434,000. The

project requires an initial investment in net working capital of $266,000, which will be fully

recovered when the project is terminated. Estimated sales are $2,380,000 per year, with costs

of $1,013,000. The tax rate is 32.0% and the required return for the project is 16.80%. Find

the project's NPV. Ignore any bonus depreciation.

$479,555.79

O $706,185.86

O $849,111.54

O $690,539.26

O $886,915.54

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Similar questions

- Hubrey Home Inc. is considering a new three-year expansion project that requires an initial fixed asset investment of $3.3 million. The fixed asset falls into Class 10 for tax purposes (CCA rate of 30% per year), and at the end of the three years can be sold for a salvage value equal to its UCC. The project is estimated to generate $2,590,000 in annual sales, with costs of $820,000. If the tax rate is 35%, what is the OCF for each year of this project? (Enter the answers in dollars. Do not round your intermediate calculations. Round the final answers to 2 decimal places. Omit $ sign in your response.) OCF1 OCF2 OCF3 ta ta ta $ $ $arrow_forwardA company is considering a new 3-year expansion project that requires an initial fixed asset investment of $2.18 million. The fixed asset will be depreciated straight-line to zero over its 3-year tax life. The project is estimated to generate $1,730,000 in annual sales, costing $640,000. The project requires an initial investment in net working capital of $290,000, and the fixed asset will have a market value of $240,000 at the end of the project. a. If the tax rate is 24 percent, what is the project’s Year 0 net cash flow? Year 1? Year 2? Year 3? (Do not round intermediate calculations) b. If the required return is 12 percent, what is the project's NPV? Please use excel and show the equations used. Thanksarrow_forwardEsfandairi Enterprises is considering a new three-year expansion project that requires an initial fixed asset investment of $2.29 million. The fixed asset will be depreciated straight-line to zero over its three-year tax life. The project is estimated to generate $1,790,000 in annual sales, with costs of $700,000. The project requires an initial investment in net working capital of $410,000, and the fixed asset will have a market value of $420,000 at the end of the project. a. If the tax rate is 21 percent, what is the project's Year O net cash flow? Year 1? Year 2? Year 3? (A negative answer should be indicated by a minus sign. Do not round intermediate calculations and enter your answers in dollars, not millions of dollars, e.g., 1,234,567.) b. If the required return is 12 percent, what is the project's NPV? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) a. Year 0 cash flow a. Year 1 cash flow a. Year 2 cash flow a. Year 3 cash flow…arrow_forward

- Esfandairi Enterprises is considering a new three-year expansion project that requires an initial fixed asset investment of $2.18 million. The fixed asset will be depreciated straight- line to zero over its three-year tax life, after which time it will be worthless. The project is estimated to generate $1.645 million in annual sales, with costs of $610,000. The project requires an initial investment in net working capital of $250,000, and the fixed asset will have a market value of $180,000 at the end of the project. The tax rate is 21 percent. a. What is the project's Year O net cash flow? Year 1? Year 2? Year 3? (A negative answer should be indicated by a minus sign. Do not round intermediate calculations and enter your answers in dollars, not millions of dollars, e.g., 1,234,567.) b. If the required return is 12 percent, what is the project's NPV? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) a. Year 0 cash flow a. Year 1 cash flow…arrow_forwardEsfandairi Enterprises is considering a new three-year expansion project that requires an initial fixed asset investment of $2.35 million. The fixed asset qualifies for 100 percent bonus depreciation in the first year. The project is estimated to generate $1,745,000 in annual sales, with costs of $648,000. The project requires an initial investment in net working capital of $320,000, and the fixed asset will have a market value of $285,000 at the end of the project. a. If the tax rate is 22 percent, what is the project's Year O net cash flow? Year 1? Year 2? Year 3? (A negative answer should be indicated by a minus sign. Do not round intermediate calculations and enter your answers in dollars, not millions of dollars, e.g., 1,234,567.) b. If the required return is 11 percent, what is the project's NPV? (Do not round intermediate calculations and enter your answers in dollars, not millions of dollars, rounded to two decimal places, e.g., 1,234,567.89.) a. Year 0 cash flow a. Year 1 cash…arrow_forwardEsfandiri Enterprises is considering a new three year expansion project that requires an initial fixed asset investment of $2.18 million. The fixed asset will be depreciated straight-line to zero over its three year tax life, after which time it will be worthless. The Project is estimated to generate $1.645 million in annual sales with costs of $610,000. If the tax rate is 27.00% what is the OCF per year (OCF will be the same for the three years) for this project? Group of answer choices $650,058.06 $715,063.86 $786,570.25 $865,227.27 $951,750.00arrow_forward

- Summer Tyme, Inc., is considering a new 3-year expansion project that requires an initial fixed asset investment of $662,691. The fixed asset will be depreciated straight-line to 61,885 over its 3-year tax life, after which time it will have a market value of $112,268. The project requires an initial investment in net working capital of $78,031. The project is estimated to generate $223,911 in annual sales, with costs of $101,913. The tax rate is 0.29 and the required return on the project is 0.12. What is the total cash flow in year 0? (Make sure you enter the number with the appropriate +/- sign)arrow_forwardEsfandairi Enterprises is considering a new three-year expansion project that requires an initial fixed asset investment of $2.18 million. The fixed asset will be depreciated straight-line to zero over its three-year tax life, after which time it will be worthless. The project is estimated to generate $1730000 million in annual sales, with costs of $640,000. The tax rate is 24 percent. If the required return is 13 percent, what is the project's NPV? please answer fast i give upvotearrow_forwardH. Cochran, Inc., is considering a new three-year expansion project that requires an initial fixed asset investment of $2.15 million. The fixed asset will be depreciated straight- line to zero over its three-year tax life, after which time it will be worthless. The project is estimated to generate $2.23 million in annual sales, with costs of $1.25 million. Assume the tax rate is 23 percent and the required return on the project is 14 percent. What is the project's NPV? (A negative answer should be indicated by a minus sign. Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) Net present valuearrow_forward

- DUB company is considering a new 3-year expansion project that requires an initial fixed asset investment of $2.29 million. The fixed asset falls into the 3-year MACRS class. The project is estimated to generate $1,810,000 in annual sales, with costs of $700,000. The project requires an initial investment in net working capital of $450,000, and the fixed asset will have a market value of $480,000 at the end of the project. a. If the tax rate is 25 percent, what is the project’s Year 0 net cash flow? Year 1? Year 2? Year 3? (Do not round intermediate calculations) b. If the required return is 12%, what is the projects NPV? Please use excel and show equations.arrow_forwardSummer Tyme, Inc., is considering a new 3-year expansion project that requires an initial fixed asset investment of $2,098,350. The fixed asset will be depreciated straight-line to zero over its 3-year tax life, after which time it will be worthless. The project is estimated to generate $1,814,883 in annual sales, with costs of $1,675,390. If the tax rate is 0.33 , what is the OCF for this project?arrow_forwardQuad Enterprises is considering a new 3-year expansion project that requires an initial fixed asset investment of $2.1 million. The fixed asset falls into the 3-year MACRS class (MACRS Table) and will have a market value of $159,600 after 3 years. The project requires an initial investment in net working capital of $228,000. The project is estimated to generate $1,824,000 in annual sales, with costs of $729,600. The tax rate is 25 percent and the required return on the project is 11 percent. Calculate the project net cash flow from year 0 to year 3.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education