Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

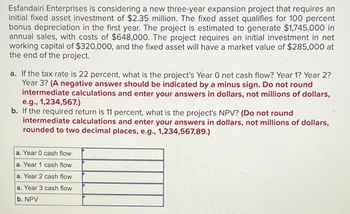

Transcribed Image Text:Esfandairi Enterprises is considering a new three-year expansion project that requires an

initial fixed asset investment of $2.35 million. The fixed asset qualifies for 100 percent

bonus depreciation in the first year. The project is estimated to generate $1,745,000 in

annual sales, with costs of $648,000. The project requires an initial investment in net

working capital of $320,000, and the fixed asset will have a market value of $285,000 at

the end of the project.

a. If the tax rate is 22 percent, what is the project's Year O net cash flow? Year 1? Year 2?

Year 3? (A negative answer should be indicated by a minus sign. Do not round

intermediate calculations and enter your answers in dollars, not millions of dollars,

e.g., 1,234,567.)

b. If the required return is 11 percent, what is the project's NPV? (Do not round

intermediate calculations and enter your answers in dollars, not millions of dollars,

rounded to two decimal places, e.g., 1,234,567.89.)

a. Year 0 cash flow

a. Year 1 cash flow

a. Year 2 cash flow

a. Year 3 cash flow

b. NPV

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- A firm is considering a new seven-year expansion project with an initial fixed asset investment of $3.9 million. The fixed asset will be depreciated straight-line to zero over its seven-year tax life, after which time it will be worthless. No bonus depreciation will be taken. The project is estimated to generate $2,479,000 in annual sales, with costs of $791,000. The tax rate is 20 percent and the required return is 7.2 percent. What is the net present value of this project? Instruction: Enter your response rounded to two decimal places.arrow_forwardEsfandairi Enterprises is considering a new three-year expansion project that requires an initial fixed asset investment of $2.18 million. The fixed asset will be depreciated straight- line to zero over its three-year tax life, after which time it will be worthless. The project is estimated to generate $1.645 million in annual sales, with costs of $610,000. The project requires an initial investment in net working capital of $250,000, and the fixed asset will have a market value of $180,000 at the end of the project. The tax rate is 21 percent. a. What is the project's Year O net cash flow? Year 1? Year 2? Year 3? (A negative answer should be indicated by a minus sign. Do not round intermediate calculations and enter your answers in dollars, not millions of dollars, e.g., 1,234,567.) b. If the required return is 12 percent, what is the project's NPV? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) a. Year 0 cash flow a. Year 1 cash flow…arrow_forwardHubrey Home Inc. is considering a new three-year expansion project that requires an initial fixed asset investment of $3.7 million. The fixed asset falls into Class 10 for tax purposes (CCA rate of 30% per year), and at the end of the three years can be sold for a salvage value equal to its UCC. The project is estimated to generate $2,630,000 in annual sales, with costs of $832,000. If the tax rate is 35%, what is the OCF for each year of this project? (Enter the answers in dollars. Do not round your intermediate calculations. Round the final answers to 2 decimal places. Omit $ sign in your response.) OCF1 $ OCF2 $ OCF3 $arrow_forward

- please fix and given me the accurate answerarrow_forwardBhadibenarrow_forwardAmalgamated Industries is considering a 4- year project. The project is expected to generate operating cash flows of $11 million, $14 million, $16 million, and $9 million over the four years, respectively. It will require initial capital expenditures of $41 million dollars and an intitial investment in NWC of $24 million. The firm expects to generate a $11 million after tax salvage value from the sale of equipment when the project ends, and it expects to recover 100% of its nwc investments. Assuming the firm requires a return of 10% for projects of this risk level, what is the project's IRR? Question 3 options: 9.59% 9.22% 8.95% 9.41% 9.69%arrow_forward

- Amalgamated Industries is considering a 4- year project. The project is expected to generate operating cash flows of $3 million, $16 million, $18 million, and $14 million over the four years, respectively. It will require initial capital expenditures of $35 million dollars and an initial investment in NWC of $6 million. The firm expects to generate a $6 million after tax salvage value from the sale of equipment when the project ends, and it expects to recover 100% of its nw investments. Assuming the firm requires a return of 15% for projects of this risk level, what is the project's IRR? A. 16.16% B. 16.47% C. 15.39% D. 16.00% E. 15.70%arrow_forwardEsfandairi Enterprises is considering a new 3-year expansion project that requires an initial fixed asset investment of $2.37 million. The fixed asset qualifies for 100 percent bonus depreciation. The project is estimated to generate $1,765,000 in annual sales, with costs of $664,000. The project requires an initial investment in net working capital of $360,000, and the fixed asset will have a market value of $345,000 at the end of the project. a. If the tax rate is 21 percent, what is the project’s Year 0 net cash flow? Year 1? Year 2? Year 3? (A negative answer should be indicated by a minus sign. Do not round intermediate calculations and enter your answers in dollars, not millions of dollars, e.g., 1,234,567.) b. If the required return is 11 percent, what is the project's NPV? (Do not round intermediate calculations and enter your answer in dollars, not millions of dollars, rounded to two decimal places, e.g., 1,234,567.89.)arrow_forwardEsfandairi Enterprises is considering a new three-year expansion project that requires an initial fixed asset investment of $2,300,000. The fixed asset will be depreciated straight-line to zero over its three-year tax life, after which time it will be worthless. The project is estimated to generate $2,890,000 in annual sales, with costs of $1,910,000. Assume the tax rate is 21 percent and the required return on the project is 12 percent. What is the project's NPV? Note: A negative answer should be indicated by a minus sign. Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16. Net present valuearrow_forward

- Summer Tyme, Inc., is considering a new 3-year expansion project that requires an initial fixed asset investment of $662,691. The fixed asset will be depreciated straight-line to 61,885 over its 3-year tax life, after which time it will have a market value of $112,268. The project requires an initial investment in net working capital of $78,031. The project is estimated to generate $223,911 in annual sales, with costs of $101,913. The tax rate is 0.29 and the required return on the project is 0.12. What is the total cash flow in year 0? (Make sure you enter the number with the appropriate +/- sign)arrow_forwardEsfandairi Enterprises is considering a new three-year expansion project that requires an initial fixed asset investment of $2.18 million. The fixed asset will be depreciated straight-line to zero over its three-year tax life, after which time it will be worthless. The project is estimated to generate $1730000 million in annual sales, with costs of $640,000. The tax rate is 24 percent. If the required return is 13 percent, what is the project's NPV? please answer fast i give upvotearrow_forwardH. Cochran, Inc., is considering a new three-year expansion project that requires an initial fixed asset investment of $2.15 million. The fixed asset will be depreciated straight- line to zero over its three-year tax life, after which time it will be worthless. The project is estimated to generate $2.23 million in annual sales, with costs of $1.25 million. Assume the tax rate is 23 percent and the required return on the project is 14 percent. What is the project's NPV? (A negative answer should be indicated by a minus sign. Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) Net present valuearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education