FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

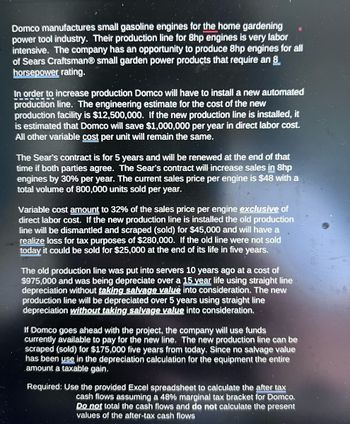

Transcribed Image Text:Domco manufactures small gasoline engines for the home gardening

power tool industry. Their production line for 8hp engines is very labor

intensive. The company has an opportunity to produce 8hp engines for all

of Sears CraftsmanⓇ small garden power products that require an 8

horsepower rating.

In order to increase production Domco will have to install a new automated

production line. The engineering estimate for the cost of the new

production facility is $12,500,000. If the new production line is installed, it

is estimated that Domco will save $1,000,000 per year in direct labor cost.

All other variable cost per unit will remain the same.

The Sear's contract is for 5 years and will be renewed at the end of that

time if both parties agree. The Sear's contract will increase sales in 8hp

engines by 30% per year. The current sales price per engine is $48 with a

total volume of 800,000 units sold per year.

Variable cost amount to 32% of the sales price per engine exclusive of

direct labor cost. If the new production line is installed the old production

line will be dismantled and scraped (sold) for $45,000 and will have a

realize loss for tax purposes of $280,000. If the old line were not sold

today it could be sold for $25,000 at the end of its life in five years.

The old production line was put into servers 10 years ago at a cost of

$975,000 and was being depreciate over a 15 year life using straight line

depreciation without taking salvage value into consideration. The new

production line will be depreciated over 5 years using straight line

depreciation without taking salvage value into consideration.

If Domco goes ahead with the project, the company will use funds

currently available to pay for the new line. The new production line can be

scraped (sold) for $175,000 five years from today. Since no salvage value

has been use in the depreciation calculation for the equipment the entire

amount a taxable gain,

Required: Use the provided Excel spreadsheet to calculate the after tax

cash flows assuming a 48% marginal tax bracket for Domco.

Do not total the cash flows and do not calculate the present

values of the after-tax cash flows

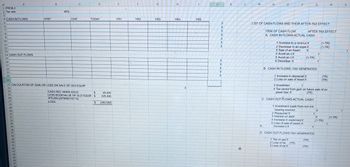

Transcribed Image Text:A

B

C

D

E

F

G

H

1 PROB.2

2

Tax rate

48%

3

4 CASH IN FLOWS

CFBT

CFAT

TODAY

YR1

YR2

YR3

YR4

YR5

5

3

6

7

8

3

9

10

11

3

3

12

13

14 CASH OUT FLOWS

15

16

17

18

19

21

3

$

45,000

22 CALCULATION OF GAIN OR LOSS ON SALE OF OLD EQUIP

CASH REC WHEN SOLD:

LESS BOOKVALUE OF OLD EQUIP. S 325,000

975,000-((975000/15)*10)

23

24

25

26

27

28

29

30

31

32

33

34

35

36

37

38

40

41

42

43

45

47

48

LOSS

$

(280,000)

3

3

3

3

K

M

N

+

R

S

LIST OF CASH FLOWS AND THEIR AFTER-TAX EFFECT

ITEM OF CASH FLOW

AFTER TAX EFFECT

A. CASH IN FLOWS-ACTUAL CASH:

1 Increase to a revenueX

(1-TR)

2 Decrease to an experX

(1-TR)

3 Sale of an Asset:

X

4 Avoid an cX

1

5 Avoid an cx

(1-TR)

6 Decrease X

1

B. CASH IN FLOWS-TAX GENERATED:

1 Increase in depreciat X

(TR)

2 Loss on sale of Assel X

(TR)

3 Investmen

1

4 Tax saved from gain on future sale of an

asset that X

(TR)

C. CASH OUT FLOWS-ACTUAL CASH:

1 Investment (cash from non intr

bearing source):

X

1

2 Repaymer X

1

3 Interest on debt:

X

(1-TR)

4 Increase in expenses X

(1-TR)

5 Loss of sale of asset: X

6,

Increase ir X

D. CASH OUT FLOWS-TAX GENERATED:

1 Tax on gai X

(TR)

2 Loss of de (TR)

3 Loss of de X

(TR)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- The Knot manufactures men’s neckwear at its Spartanburg plant. The Knot is considering implementing a JIT production system. The following are the estimated costs and benefits of JIT production: a. Annual additional tooling costs $250,000 annually. b. Average inventory would decline by 80% from the current level of $1,000,000. c. Insurance, space, materials-handling, and setup costs, which currently total $400,000 annually, would decline by 20%. d. The emphasis on quality inherent in JIT production would reduce rework costs by 25%. The Knot currently incurs $160,000 in annual rework costs. e. Improved product quality under JIT production would enable The Knot to raise the price of its product by $2 per unit. The Knot sells 100,000 units each year. The Knot’s required rate of return on inventory investment is 15% per year. Q. Suppose The Knot implements JIT production at its Spartanburg plant. Give examples of performance measures The Knot could use to evaluate and control JIT…arrow_forwardBirkenstock is considering adding a new Big Buckle sandal to its current product offerings. Birkenstock expects to price the shoes at $125 per pair. The variable costs to produce one pair are estimated to be: $20 per pair direct materials; $25 per pair direct labor; $5 per pair shipping costs and $5 per pair miscellaneous overhead. The fixed costs for this line of shoes are: $50,000 advertising/promotion; $125,000 manufacturing plant manager salary; $350,000 depreciation expense on manufacturing equipment; and $50,000 other miscellaneous fixed costs. • Birkenstock's best guess is that they will sell 12,000 pairs of Big Buckle sandals in 2021. What is Birkenstock's expected 2021 profit on this product? Type your answer in the first blank below.arrow_forwardMiddle Industries produces a sensor for use in manufacturing. It produces the sensor in a plant with an annual practical capacity of 75,000 units. The variable cost of the sensor is $185.00 per unit, and the fixed costs of the plant are $12,375,000 annually. Current annual demand is 55,000 sensors. Middle Industries bought the plant because it was close to its other manufacturing facilities and was available for sale when they were searching for a location. Required: What cost per sensor should the cost system report to facilitate management decision making? What is the cost of excess capacity? What cost per sensor would the cost system report if the smallest manufacturing plant that could be built was able to produce 75,000 sensors? What would be the cost of excess capacity?arrow_forward

- Mighty Safe Fire Alarm is currently buying 57,000 motherboards from MotherBoard, Inc., at a price of $63 per board. Mighty Safe is considering making its own boards. The costs to make the board are as follows: direct materials, $33 per unit; direct labor, $12 per unit; and variable factory overhead, $15 per unit. Fixed costs for the plant would increase by $90,000. Which option should be selected and why? Oa. a. buy, $90,000 increase in profits Ob. make, $80,940 increase in profits c. make, $171,000 increase in profits Od. buy, $80,940 increase in profitsarrow_forwardNeptune Company produces toys and other items for use in beach and resort areas. A small, inflatable toy has come onto the market that the company is anxious to produce and sell. The new toy will sell for $2.70 per unit. Enough capacity exists in the company's plant to produce 30,400 units of the toy each month. Variable expenses to manufacture and sell one unit would be $1.72, and fixed expenses associated with the toy would total $44,188 per month. The company's Marketing Department predicts that demand for the new toy will exceed the 30,400 units that the company is able to produce. Additional manufacturing space can be rented from another company at a fixed expense of $2,209 per month. Variable expenses in the rented facility would total $1.89 per unit, due to somewhat less efficient operations than in the main plant. Required: 1. What is the monthly break-even point for the new toy in unit sales and dollar sales. 2. How many units must be sold each month to attain a target profit…arrow_forwardVoltaic Electronics uses a standard part in the manufacture of different types of radios. The total cost of producing 36,000 parts is $ 100,000, which includes fixed costs of $ 40,000 and variable costs of $ 60,000. The company can buy the part from an outside supplier for $2 per unit and avoid 20% of the fixed costs. Assume that the company can use the freed manufacturing space to make another product that can earn a profit of $ 15,000. If Voltaic outsources, what will be the effect on operating income?A. decrease of $11,000B. increase of $ 11,000C. increase of $ 15,000D . decrease of $ 8,000arrow_forward

- Elroy Racers makes bicycles. It has always purchased its bicycle tires from the M. Wilson Tires at $25 each but is currently considering making the tires in its own factory. The estimated costs per unit of making the tires are as follows: Direct materials $8 Direct labor $5 Variable manufacturing overhead $7 The company’s fixed expenses would increase by $60,000 per year if managers decided to make the tire.(b)What qualitative factors should Elroy Racers consider in making this decision?arrow_forwardUrmilabenarrow_forwardFAE Technologies is deciding whether it should begin production of a new toy robot. It has manufactured children’s toys before but nothing as advanced as its latest robot so historical data is at a minimum. The company believes that they can secure the materials for manufacture for between $65-85 per unit and labor costs would be between $15-25 per unit. Management’s expectations are that materials will cost $70 per unit and labor $25 per unit and that 800 units will be sold monthly. Should FAE decide to manufacture the robots in-house, maintenance of the factory machine would cost $15,000 per month. However, management has found that another alternative is for the company to outsource the labor for a flat rate of $35 per unit. The company expects to sell between 750-1000 units per month initially at a price of $149. Provide recommendations for FAE technologies that will maximize profit. Also include base, worst, and best case scenario calculations and provide a scenario summary. Be…arrow_forward

- Jupiter Game Company manufactures pocket electronic games. Last year Jupiter sold 25,000 games at $25 each. Total costs amounted to $525,000, of which $150,000 were considered fixed. In an attempt to improve its product, the company is considering replacing a component part that has a cost of $2.50 with a new and better part costing $4.50 per unit in the coming year. A new machine also would be needed to increase plant capacity. The machine would cost $18,000 with a useful life of six years and no salvage value. The company uses straight-line depreciation on all plant assets. (Ignore income taxes.) Jupiter Game Company manufactures pocket electronic games. Last year Jupiter sold 25,000 games at $25 each. Total costs amounted to $525,000, of which $150,000 were considered fixed. In an attempt to improve its product, the company is considering replacing a component part that has a cost of $2.50 with a new and better part costing $4.50 per unit in the coming year. A new machine also would…arrow_forwardZycon has produced 10,000 units of partially finished Product A. These units cost $15,000 to produce, and they can be sold to another manufacturer for $20,000. Instead, Zycon can process the units further and produce finished Products X, Y, and Z. Processing further will cost an additional $22,000 and will yield total revenues of $35,000. Place an X in the appropriate column to identify whether the item is relevant or irrelevant to the sell or process further decision.arrow_forwardA firm that manufactures paper is considering a project to set up a logging operation. Wood pulp generated by the project - normally an unwanted by-product of a logging operation - is an input to the paper manufacturing process. This will save the company $340,000 in wood pulp purchases, but it will cost $50,000 more to transport the wood pulp to the paper factory than it would cost to dump it as waste. How would you describe this situation in terms of the NPV analysis for the logging operation? Question 2Answer a. There is a positive externality equal to $290,000 which should be included in the NPV analysis. b. There is a positive externality equal to $340,000 which should be included in the NPV analysis. c. There is a negative externality equal to $290,000 which should be included in the NPV analysis. d. There is a negative externality equal to $340,000 which should be included in the NPV analysis.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education