FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

thumb_up100%

Transcribed Image Text:Our

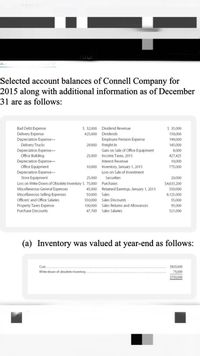

Selected account balances of Connell Company for

2015 along with additional information as of December

31 are as follows:

LEI

Bad Debt Expense

$ 32,000

DIvidend Revenue

$ 35,000

Delivery Expense

425,000

Dividends

150,000

Depreciation Expense-

Employee Pension Expense

190,000

Delivery Trucks

Depreciation Expense--

Office Building

Depreciation Expense-

Office Equipment

Depreciation Expense-

Store Equipment

Loss on Write-Down of Obsolete Inventory $ 75,000

Miscellaneous General Expenses

Miscellaneous Selling Expenses

Officers' and Office Salaries

29,000 Freight-In

145,000

Gain on Sale of Office Equipment

8,000

25,000 Income Taxes, 2015

427,425

Interest Revenue

10,000

10,000 Inventory, January 1, 2015

Loss on Sale of Investment

775,000

25,000

Securities

20,000

Purchases

$4,633,200

45,000

Retained Earnings, January 1, 2015

550,000

50,000

Sales

8,125,000

55,000

95,000

550,000 Sales Discounts

Property Taxes Expense

Purchase Discounts

100,000 Sales Returns and Allowances

47,700 Sales Salaries

521,000

(a) Inventory was valued at year-end as follows:

Cost...

$825,000

Write-down of obsolete inventory.

75,000

$750,000

Transcribed Image Text:78%

145,000

Gain on Sale of Office Equipment

8,000

427,425

Lense

Office Building

Depreciation Expense-

Office Equipment

Depreciation Expense-

Store Equipment

Loss on Write-Down of Obsolete Inventory $ 75,000 Purchases

Miscellaneous General Expenses

Miscellaneous Selling Expenses

Officers' and Office Salaries

25,000 Income Taxes, 2015

Interest Revenue

10,000

10,000 Inventory, January 1, 2015

775,000

Loss on Sale of Investment

25,000

Securities

20,000

$4,633,200

45,000 Retained Earnings, January 1, 2015

550,000

50,000

Sales

8,125,000

550,000 Sales Discounts

55,000

Property Taxes Expense

Purchase Discounts

100,000 Sales Returns and Allowances

95,000

47,700 Sales Salaries

521,000

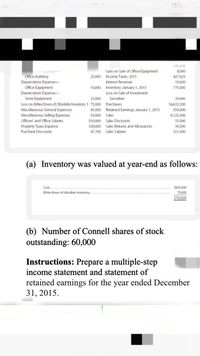

(a) Inventory was valued at year-end as follows:

Cost....

$825,000

Write-down of obsolete inventory.

75,000

$750,000

(b) Number of Connell shares of stock

outstanding: 60,000

Instructions: Prepare a multiple-step

income statement and statement of

retained earnings for the year ended December

31, 2015.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Loss Carryforward The Bookbinder Company had $680,000 cumulative operating losses prior to the beginning of last year. It had $140,000 in pre-tax earnings last year before using the past operating losses and has $420,000 in the current year before using any past operating losses. It projects $470,000 pre-tax earnings next year. Enter your answers as positive values. If an amount is zero, enter "0". Round your answers to the nearest dollar. a. How much taxable income was there last year? $ How much, if any, cumulative losses remained at the end of the last year? $ b. What is the taxable income in the current year? $ How much, if any, cumulative losses remain at the end of the current year? $ c. What is the projected taxable income for next year? $ How much, if any, cumulative losses are projected to remain at the end of next year? $arrow_forwardSelling and administrative expense $40,000 Depreciation expense 70,000 350,000 30,000 110,000 17,500 Sales Interest expense Cost of goods sold Taxes What is the EBITDA for Ball Corp? Select one: None of the answers $70,000 $200,000 $130,000arrow_forwardFinancial update as of June 15 • Your existing business generates $135,000 in EBIT. • The corporate tax rate applicable to your business is 25%. • The depreciation expense reported in the financial statements is $25,714. • You don’t need to spend any money for new equipment in your existing cafés; however, you do need $20,250 of additional cash. • You also need to purchase $10,800 in additional supplies—such as tableclothes and napkins, and more formal tableware—on credit. • It is also estimated that your accruals, including taxes and wages payable, will increase by $6,750. Based on your evaluation you have______in free cash flow.arrow_forward

- I want to answer this questionarrow_forward= Listen Industrial Incorporated has the following account balances: COGS = 4,800; Depreciation = 600; Interest = 300; rent = 1,200; Salaries= 3,600; Sales = 12,000, Taxes = 420. Industrial Incorporated's Operating Cash Flow is_ $1,980 $1,450 $1,800 $1,680 O $1,080arrow_forwardElgin Battery Manufacturers had sales of $840,000 in 2021 and their cost of goods sold is 562,800 Selling and administrative expenses were 75,600 Depreciation expense was $19,000 and interest expense for the year was $12,000. The firm's tax rate is 35 percent. What is the dollar amount of taxes paid in 2021? Multiple Choice $172.974 $59.710 $198,400 $63,910arrow_forward

- 27,500 Prepaid rent 4, 000 Inventory 42, 500 Equipment 90, 000 Accumulated depreciation $ 27,000 Accounts payable 30,000 Salaries payable 0 Common stock 100,000 Retained earnings 25,000 Sales revenue 433,000 Cost of goods sold 259, 800 Salaries expense 86, 600 Rent expense 24,000 Depreciation expense 0 Utilities expense 17, 320 Advertising expense 5,770 Totals $ 615,000 $ 615,000 The following year - end adjusting entries are required: Depreciation expense for the year on the equipment is $9,000. Salaries at year - end should be accrued in the amount of $5,600. Required: 1. Prepare and complete a worksheet.Required: Prepare and complete a worksheet. WOLKSTEIN DRUG COMPANY Worksheet December 31, 2024arrow_forwardPart B: Financial Planning - Pro Forma Statements 1. Using the financial statements for 2009 as your 'base', assume that Luxio's sales are 20% higher for 2010. Use this projection to prepare the pro forma statements following the requirements listed below. Assume the change in sales is permanent. 2. For the Income Statement: • Cost of Goods Sold rate is expected to remain constant; o 'Depreciation' and 'Interest paid' expenses are expected not to change; o The Tax rate is expected to decrease to 32%; and • Management is expected to increase the amount of dividends paid by 5% (therefore, the Dividend payout rate will increase by 5%). 3. For the Balance Sheet: o 'Current assets' change in direct proportion to sales; • 'Fixed assets' are being operated at 100% of capacity; • 'Accounts payable' changes in direct proportion to sales; o 'Notes payable' and 'Other' current liabilities do not change; • 'Common stock' remains unchanged; and • Use 'Long-term debt' as the plug variable. 4.…arrow_forwardBest Feeds, Inc. has the following information on their income statement: Sales $2,000,000 Cash Costs 1,200,000 Depreciation 100,000 EBIT 700,000 Interest Expense 200,000 EBT 500,000 Taxes (25%) 125,000 Net Income $ 375,000 What is their NOPAT? Group of answer choices $427,620 $450,120 $375,000 $498,750 $525,000arrow_forward

- 2017 2016 Cash 5300 3700 Account Receivable 21200 23400 Inventory 9000 7000 Land 20000 26000 Building 70000 70000 Accumated depreciation-building -15000 -10000 Accounts payable 10370 31100 Common stocks 75000 69000 Retained earnings 25130 20000 XYZ Company 2017 Income statement included net sales of Php 120,000, cost of good sold of Php 70,000 and net income of Php 14,000. Compute the ratios for 2017 in terms of accounts receivable turnover. Choose... + Compute the ratios for 2017 in terms of inventory turn over. Choose... + Compute the ratios for 2017 in terms of acid-test ratio. Choose... + Compute the ratios for 2017 in terms of current ratio. Choose.. + Activate V Go to Settincarrow_forward($n millions) Net soles Cost of goods sold Depreciation Earnings before interest and taxes Interest paidl Taxable incone 7,010 470 $1,320 165 $1,214 425 Taxes Net. incone $789 windswept, Inc. 2016 and 2017 Balance sheets, ($ in nillions) 2016 2017 2016 2017 Cash Accounts re. Inventory Total Net fixed 33sets Accounts payable Long-tera debt, Conmon stock Retained earnings $240 S 270 $1,410 $1,410 1,110 1,318 1,820 920 1,848 1,710 3,368 3,280 658 3,430 4,008 Total assets $6,530 S6,9 Total 11ab. & equity $6,530$6.988arrow_forward4arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education