FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

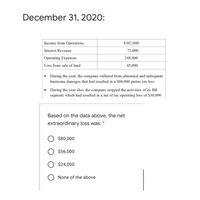

Transcribed Image Text:December 31, 2020:

Income from Operations

$302,000

Interest Revenue

72,000

Operating Expenses

248,000

Loss from sale of land

45,000

During the year, the company suffered from abnormal and infrequent

hurricane damages that had resulted in a $80,000 pretax tax loss

• During the year also, the company stopped the activities of its BB

segment which had resulted in a net of tax operating loss of $30,000

Based on the data above, the net

extraordinary loss was:

O $80,000

$56,000

O $24,000

None of the above

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Nonearrow_forwardBlack Company, organized on January 2, 20X1, had pre-tax accounting income of $500,000 and taxable income of $800,000 for the year ended December 31, 20X1. The only temporary difference is accrued product warranty costs, which are expected to be paid as follows: 20X2 20X3 20X4 20X5 $100,000 50,000 50,000 100,000 Circumstances indicate that it is highly likely that Black will have taxable income in the future. It had no temporary differences in prior years. The enacted income tax rate is 21%. Required: 1. In Black's December 31, 20X1, balance sheet, how much should the deferred tax asset be? 2. Suppose that as of December 31, 20X1, a newly enacted law called for the tax rate to change to 25%, effective January 1, 20X3. Then what would be the amount of the deferred tax asset at December 31, 20X1?arrow_forwardThe following were recognized during the current fiscal year by Kool Corporation: Loss on early extinguishment of noncurrent debt $30,000 Depreciation expense 18,000 Correction of understated expenses in the prior period 15,000 Losses related to a strike 24,000 Impairment of goodwill 3,400 What net amount of the above items should be included in income from continuing operations? A. $(72,000) $(51,400) $(90,400) D. $(75,400) B. C.arrow_forward

- vt,1arrow_forwardAltima Corporation discovered an error in its 2020 financial statements. The firm recorded $4,200,000 in depreciation expense instead of record $4,500,000. Altima has a constant tax rate of 40% and reports 3 years of comparative income statements and 2 years of comparative balance sh- in its annual report. Ignoring the income tax effect, what is the correct journal entry to record the prior-period adjustment? O Depreciation expense Accumulated Depreciation O Retained Earnings 300,000 Income Tax Payable Accumulated Depreciation Retained Earnings O Accumulated Depreciation 300,000 Retained Earnings Accumulated Depreciation 300.000 estion 22 300,000 300,000 120.000 180,000 300,000 300,000arrow_forwardA chemical company has a total income of 1.62 million per year and total expenses of 716057 not including depreciation. At the start of the first year of operation, a composite account of all depreciable assets shows a value of 1.24 with a MACRS recovery period of 7 years, and a straight-line recovery period of 9.4 years. Thirty-five percent of all profits before taxes must be paid out for income taxes. What would be the reduction in income tax charges for the first year of operation if the MACRS method were used for the depreciation accounting instead of the straight-line method?-arrow_forward

- Don't give answer in imagearrow_forward24. Horner Corporation has a deferred tax asset at December 31, 2015 of $80,000 due to the recognition of potential tax benefits of an operating loss carryforward. The enacted tax rates are as follows: 40% for 2012-2014; 35% for 2015; and 30% for 2016 and thereafter. Assuming that management expects that only 60% of the related benefits will actually be realized, a valuation account should be established in the amount of: a. $80,000 b. $32,000 c. $28,000 d. $24,000arrow_forwardGodoarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education