FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

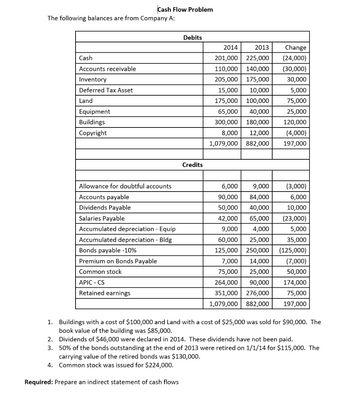

Transcribed Image Text:The following balances are from Company A:

Cash

Accounts receivable

Inventory

Deferred Tax Asset

Land

Equipment

Buildings

Copyright

Cash Flow Problem

Allowance for doubtful accounts

Accounts payable

Dividends Payable

Salaries Payable

Accumulated depreciation - Equip

Accumulated depreciation - Bldg

Bonds payable -10%

Premium on Bonds Payable

Common stock

APIC - CS

Retained earnings

Debits

Credits

2014

2013

Change

201,000 225,000

(24,000)

110,000 140,000

(30,000)

205,000 175,000

30,000

15,000 10,000

5,000

175,000 100,000

75,000

65,000

40,000

25,000

300,000 180,000

120,000

8,000 12,000 (4,000)

882,000

197,000

1,079,000

6,000

9,000

90,000 84,000

50,000 40,000

42,000

65,000

9,000

4,000

60,000

25,000

125,000 250,000

7,000 14,000

75,000 25,000

264,000 90,000

351,000

276,000

1,079,000

882,000

(3,000)

6,000

10,000

(23,000)

5,000

35,000

(125,000)

(7,000)

50,000

174,000

75,000

197,000

1.

Buildings with a cost of $100,000 and Land with a cost of $25,000 was sold for $90,000. The

book value of the building was $85,000.

2.

Dividends of $46,000 were declared in 2014. These dividends have not been paid.

3. 50% of the bonds outstanding at the end of 2013 were retired on 1/1/14 for $115,000. The

carrying value of the retired bonds was $130,000.

4. Common stock was issued for $224,000.

Required: Prepare an indirect statement of cash flows

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- 12 -ok 7 int Required Information [The following information applies to the questions displayed below.] Income statement and balance sheet data for The Athletic Attic are provided below. Net sales Cost of goods sold Gross profit Expenses: THE ATHLETIC ATTIC Income Statements For the Years Ended December 31 Operating expenses Depreciation expense Interest expense Income tax expense Total expenses Net income Assets Current assets: Cash Accounts receivable Inventory Supplies Long-term assets; Equipment Less: Accumulated depreciation Total assets Liabilities and Stockholders' Equity Current liabilities: Accounts payable Interest payable Income tax payable Long-term liabilities: Notes payable 2825 $ 10,680,000 6,980,000 3,700,000 1,620,000 200,000 42,000 424,000 2,286,000 $ 1,414,000 2024 $9,100,000 Stockholders' equity: Common stock Retained earnings Total liabilities and stockholders' equity 5,600,000 3,500,000 1,570,000 200,000 42,000 370,000 2,182,000 $1,318,000 THE ATHLETIC ATTIC…arrow_forwardPlease do not give solution in image format thankuarrow_forwardThis is all supposed to be done in excel using formulas.arrow_forward

- Please input numbers below based on data provided for the year 2017arrow_forwardThe following are the Financial Statements of Louise Company: Loulse Company Statement of Financial Position As of December 31, 2015, and 2016 2015 2016 ASSETS Current Assets Cash Accounts Receivables, net Merchandise Inventory Marketable Securities 198,000 30,000 15,000 20,000 10,000 273,000 270,000 40,000 10,000 20,000 8.000 348,000 Prepaid Expenses Total Current Assets Non-Current Assets Land Building, net Machinery, net Fumiture and Fixtures, net Long-term Investments Total Non-Current Assets 500,000 390,000 100,000 50,000 100,000 L140.000 500,000 380,000 90,000 45,000 80,000 1,095,000 TOTAL ASSETS 1413.000 1.443.000arrow_forwardtwo picture for one question thanksarrow_forward

- The balance sheet of 1680 MARKETING Corporation at August 31, 2014 contains the following items: Assets Cash Accounts receivable - net Inventories P 400, 000 700, 000 500, 000 300, 000 Land Building – net Machinery – net 2, 000, 000 600, 000 500, 000 P5. 000, 000 Goodwill Equities Accounts payable Wages payable Property taxes payable Mortgage payable Interest on mortgage payable Note payable – unsecured Interest payable – unsecured Capital stock Retained earnings (deficit) P1, 100, 000 600, 000 100, 000 1, 500, 000 150, 000 500, 000 50, 000 2, 000, 000 (1. 000, 000) P5. 000, 000 The company is in financial difficult and its stockholders and creditors have requested a statement of affairs for planning purposes. The following information is available: The company estimates that P370, 000 is the maximum amount collectible for the accounts receivable. Except for 20% of the inventory items that are damaged and worth only P20, 000, the cost of other items is expected to be recovered in full.…arrow_forwardUse the below information to answer the following questions: 20202021Sales$11,573$12,936Depreciation 1661 1736Cost of goods sold 3979 4707Other Expenses 846 924Interest Expense 776 926Cash 6067 6466Accounts Receivables 8034 9427Short-term Notes Payable 1171 1147Long-term debt 20,320 24,696Net fixed assets 50,888 54,273Accounts Payable 4384 4644Tax rate 26% 34%Inventory 14,283 15,288Payout ratio 33% 30% A. Create the Balance Sheets for 2020 & 2021.arrow_forwardVaughn Manufacturing Balance Sheet December 31, 2021 Assets Equities Cash $ 302000 Accounts payable $ 640000 Accounts receivable (net) 1942000 Income taxes payable 185000 Inventories 2451000 Miscellaneous accrued payables 230000 Plant and equipment, Bonds payable (8%, due 2023) 1850000 net of depreciation 1984000 Preferred stock ($100 par, 6% Patents 262000 cumulative nonparticipating) 752000 Other intangible assets 75200 Common stock (no par, 60,000 Total Assets $7016200 shares authorized, issued and outstanding) 1122000 Retained earnings 2466200 Treasury stock-1500 shares of preferred (229000) Total Equities $7016200 Vaughn Manufacturing Income Statement Year Ended December 31, 2021 Net…arrow_forward

- Question Content Area Use the information provided for Harding Company to answer the question that follow. Harding Company Accounts payable $33,234 Accounts receivable 67,995 Accrued liabilities 6,510 Cash 22,738 Intangible assets 35,347 Inventory 83,390 Long-term investments 101,069 Long-term liabilities 79,156 Notes payable (short-term) 27,161 Property, plant, and equipment 689,074 Prepaid expenses 2,037 Temporary investments 30,842 Based on the data for Harding Company, what is the quick ratio (rounded to one decimal place)? a.3.1 b.0.8 c.1.8 d.15.4arrow_forwardPlease do not give solution in image format ? And Fast Answering Please ? And Explain Proper Step by Step.arrow_forwardsolve yellow blanks thank you!arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education