FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

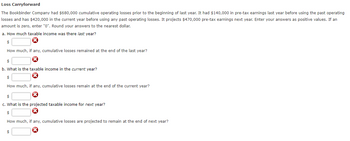

Transcribed Image Text:Loss

Carryforward

The Bookbinder Company had $680,000 cumulative operating losses prior to the beginning of last year. It had $140,000 in pre-tax earnings last year before using the past operating

losses and has $420,000 in the current year before using any past operating losses. It projects $470,000 pre-tax earnings next year. Enter your answers as positive values. If an

amount is zero, enter "0". Round your answers to the nearest dollar.

a. How much taxable income was there last year?

$

How much, if any, cumulative losses remained at the end of the last year?

$

b. What is the taxable income in the current year?

$

How much, if any, cumulative losses remain at the end of the current year?

$

c. What is the projected taxable income for next year?

$

How much, if any, cumulative losses are projected to remain at the end of next year?

$

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- You invested in RYURX and RYIHX which each had a loss on the year. RYURX had a year-to-date loss of 5% while RYIHX had a year-to-date loss of 7%. If you invested a total of $15,500 and had a total year-to-date loss of $915, how much did you invest in each company?arrow_forwardBonobo's activities for the year ended December 31, 2018 included the following: • Income tax expense for the year was $30,000. • Sales for the year were $650,000. • Accounts payable decreased $10,000 in 2018. • Selling and administration expenses for the year totaled $200,000. • Accounts receivable increased $20,000 in 2018. • The Company's cost of goods sold in 2018 was $325,000. • The Company's inventory decreased $15,000 during the year. What is the cash receipts from customers under the direct method? O $110,000 $630,000 $320,000 $670,000arrow_forwardRJS generated $65,000 net income this year. The firm's financial statements also show that its interest expense was $80,000, its marginal tax rate was 35 percent, and its invested capital was $1,200,000. If its average cost of funds is 14 percent, what was RJS's economic value added (EVA) this year? Round your answer to the nearest dollar. Use a minus sign to enter a negative value, if any.arrow_forward

- Andrews Medical reported a net loss–AOCI in last year’s balance sheet. This year, the company revised its estimate of future salary levels causing its PBO estimate to decline by $4 million. Also, the $8 million actual return on plan assets fell short of the $9 million expected return. How does this gain and loss affect Andrews’ income statement, statement of comprehensive income, and balance sheet?arrow_forwardDuring August, 2020, Sheffield’s Supply Store generated net sales of $60100. The company’s expenses were as follows: cost of goods sold of $35000 and operating expenses of $4500. The company also had rent revenue of $1000 and a loss on the sale of a delivery truck of $1700. Sheffield’s operating income for the month of August 2020 is $20600.$21600.$19900.$25100.arrow_forwardSmashed Pumpkins Company paid $208 in dividends and $631 in interest over the past year. The company increased retained earnings by $528 and had accounts payable of $702. Sales for the year were $16,580 and depreciation was $756. The tax rate was 40 percent. What was the company's EBIT? Multiple Choice $6,632 $1,511 $1,227 $1,858 $2,129arrow_forward

- The reported net incomes for the fırst 2 years of Pina Products, Inc., were as follows: 2021, $133,000; 2022, $184,000. Early in 2023, the following errors were discovered. 1. Depreciation of equipment for 2021 was overstated $18,000. 2. Depreciation of equipment for 2022 was understated $32,500. 3. December 31, 2021, inventory was understated $55,000. 4. December 31, 2022, inventory was overstated $14,200. Prepare the correcting entry necessary when these errors are discovered. Assume that the books for 2022 are closed. (Ignore income tax considerations.) (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) Account Titles and Explanation Debit Creditarrow_forwardHow much net income did H&M’s tool, incorporated, generate during 2021? What was the net profit margin? Is the company financed primarily by liabilities or stock holders equity? What is its current ratio?arrow_forwardRJS generated $78,000 net income this year. The firm's financial statements also show that its interest expense was $40,000, its marginal tax rate was 35 percent, and its invested capital was $1,000,000. If its average cost of funds is 11 percent, what was RJS's economic value added (EVA) this year? Round your answer to the nearest dollar. Use a minus sign to enter a negative value, if any. $ _______arrow_forward

- Need help with this Questionarrow_forwardYour company received a $7 million order on the last day of the year. You filled the order with $3 million worth of inventory. The customer picks up the order the same day and pays $2 million up front in cash; you also issue a bill for the customer to pay the remaining balance of $5 million within 40 days. Suppose your firm’s tax rate is 0% (ignore taxes). Based on this information, complete the table below: Account Account Increase/Decrease/ No effect Value of effect ($) Revenues Earnings Receivables Inventory Casharrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education