Concept explainers

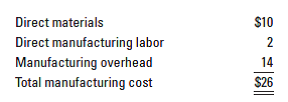

Opportunity costs. (H. Schaefer, adapted) The Wild Orchid Corporation is working at full production

capacity producing 13,000 units of a unique product, Everlast.

Manufacturing

- What is the opportunity cost to Wild Orchid of producing the 3,500 units of Stronglast? (Assume that no overtime is worked.)

- The Chesapeake Corporation has offered to produce 3,500 units of Everlast for Wild Orchid so that Wild Orchid may accept the Apex offer. That is, if Wild Orchid accepts the Chesapeake offer, Wild Orchid would manufacture 9,500 units of Everlast and 3,500 units of Stronglast and purchase 3,500 units of Everlast from Chesapeake. Chesapeake would charge Wild Orchid $36 per unit to manufacture Everlast. On the basis of financial considerations alone, should Wild Orchid accept the Chesapeake offer? Show your calculations.

- Suppose Wild Orchid had been working at less than full capacity, producing 9,500 units of Everlast, at the time the Apex offer was made. Calculate the minimum price Wild Orchid should accept for Stronglast under these conditions. (Ignore the previous $40 selling price.)

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 3 images

- Cordova manufactures three types of stained glass window, cleverly named Products A, B, and C. Information about these products follows: Sales price Variable costs per unit Fixed costs per unit Required number of labor hours Product A Product B Product C Cordova currently is limited to 50,000 labor hours per month. Required: Assuming an infinite demand for each of Cordova's products, determine contribution margin per direct labor hour. (Round your answers to 2 decimal places.) Contribution Margin Product B Ⓒ Product C O Product A Product A Product B Product C $46.00 $56.00 $86.00 22.00 12.25 38.00 8.00 8.00 2.50 4.00 $ $ $ 8.00 1.50 14.67 CM per DL hour 13.12 CM per DL hour 15.25 CM per DL hour Which product would be Cordova's first choice to produce?arrow_forwardRitchie Manufacturing Company makes a product that it sells for $180 per unit. The company incurs variable manufacturing costs of $100 per unit. Variable selling expenses are $17 per unit, annual fixed manufacturing costs are $460,000, and fixed selling and administrative costs are $195,200 per year. Required Determine the break-even point in units and dollars using each of the following approaches: a. Use the equation method. b. Use the contribution margin per unit approach. c. Use the contribution margin ratio approach. d. Prepare a contribution margin income statement for the break-even sales volume. Complete this question by entering your answers in the tabs below. Req A to C Req D Determine the break-even point in units and dollars using the equation method, the contribution margin per unit approach and the contribution margin ratio approach. a. Break-even point in units a. Break-even point in dollars b. Contribution margin per unit b. Break-even point in units b. Break-even point…arrow_forwardDragon Sports Inc. manufactures and sells two products, baseball bats and baseball gloves. The fixed costs are $554,200, and the sales mix is 40% bats and 60% gloves. The unit selling price and the unit variable cost for each product are as follows: Products Unit Selling Price Unit Variable Cost Bats 50 40 Gloves 130 80 a. Compute the break-even sales (units) for the overall enterprise product, E. units b. How many units of each product, baseball bats and baseball gloves, would be sold at the break-even point? Baseball bats units Baseball gloves unitsarrow_forward

- Jaybird Company operates in a highly competitive market where the market price for its product is $145 per unit. Jaybird desires a 30% profit per unit. Jaybird expects to sell 5,000 units. Additional information is as follows: Variable Costs per Unit Fixed Costs (total) Direct materials S 24 Overhead $ 45,000 Direct labor 25 General and administrative 18,000 Overhead 23 General and administrative 29 To achieve the target cost per unit, Jaybird must reduce total expenses by how much? Multiple Choice $ 62,000 $51,000 $70, 500 $67,500 $60, 500arrow_forwardYard Tools manufactures lawnmowers, weed-trimmers, and chainsaws. Its sales mix and unit contribution margin are as follows. Unit Contribution Sales Mix Margin Lawnmowers 20 % $30 Weed-trimmers 50 % $20 Chainsaws 30 % $40 Yard Tools has fixed costs of $4,200,000. Compute the number of units of each product that Yard Tools must sell in order to break even under this product mix. (Use Weighted-Average Contribution Margin Ratio rounded to 2 decimal places e.g. 0.25 and round final answers to 0 decimal places, e.g. 2,510.) Lawnmowers units Weed-trimmers units Chainsaws unitsarrow_forwardDragon Sports Inc. manufactures and sells two products, baseball bats and baseball gloves. The fixed costs are $251,600, and the sales mix is 40% bats and 60% gloves The unit selling price and the unit variable cost for each product are as follows: Products Unit Selling Price Unit Variable Cost Bats $50 $40 Gloves 130 80 a. Compute the break-even sales (units) for the overall enterprise product, E. units b. How many units of each product, baseball bats and baseball gloves, would be sold at the break-even point? Baseball bats units Baseball gloves unitsarrow_forward

- 4.)arrow_forwardFresh Co. is a company that produces fruit juices. Variable Manufacturing Costs of one package of juice = $0.6, Variable Marketing and Administrative Cost = $0.4, Fixed Costs = $12,000, Sales Price per unit is $4. Which of the following is Fresh Co.’s Target Volume (in Sales dollars)? a) $12,000 b) $13,320 c)$16,000 d) $14,120arrow_forwardNEED ANSWERarrow_forward

- Olsen Company produces two products. Product A has a contribution margin of $30 and requires 10 machine hours. Product B has a contribution margin of $24 and requires 4 machine hours. Determine the more profitable product assuming the machine hours are the constraint. Unit contribution margin per bottleneck hour:Product A $_____Product B $_____ Product ____ is most profitable.arrow_forwardParker Pottery produces a line of vases and a line of ceramic figurines. Each line uses the same equipment and labor; hence, there are no traceable fixed costs. Common fixed cost equals $38, 400. Parker's accountant has begun to assess the profitability of the two lines and has gathered the following data for last year: Vases Figurines Price $40 $70 Variable cost 30 42 Contribution margin $10 $28 Number of units 1,000 500 Required: If required, round your final answers to nearest whole value. 1. Compute the number of vases and the number of figurines that must be sold for the company to break even. Break - even vases fill in the blank 1 units Break - even figurines fill in the blank 2 units 2. Parker Pottery is considering upgrading its factory to improve the quality of its products. The upgrade will add $5, 280 per year to total fixed cost. If the upgrade is successful, the projected sales of vases will be 2,000, and figurine sales will increase to 1,000 units. What is the new break -…arrow_forwardSagararrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education