Managerial Accounting

15th Edition

ISBN: 9781337912020

Author: Carl Warren, Ph.d. Cma William B. Tayler

Publisher: South-Western College Pub

expand_more

expand_more

format_list_bulleted

Question

Provide Solutions about this Question please solve it with Step by step

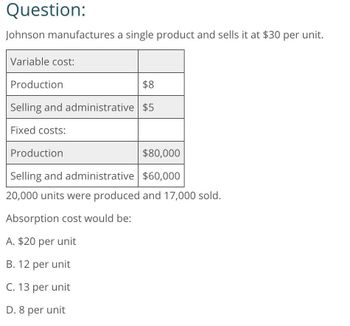

Transcribed Image Text:Question:

Johnson manufactures a single product and sells it at $30 per unit.

Variable cost:

Production

$8

Selling and administrative $5

Fixed costs:

Production

$80,000

Selling and administrative $60,000

20,000 units were produced and 17,000 sold.

Absorption cost would be:

A. $20 per unit

B. 12 per unit

C. 13 per unit

D. 8 per unit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Total costs for ABC Distributing are $250,000 when the activity level is 10,000 units. If variable costs are $5 per unit, what are their fixed costs? $240,000 $200,000 $260,000 Their fixed costs cannot be determined from the information presented.arrow_forwardStarling Co. manufactures one product with a selling price of 18 and variable cost of 12. Starlings total annual fixed costs are 38,400. If operating income last year was 28,800, what was the number of units Starling sold? a. 4,800 b. 6,400 c. 5,600 d. 11,200arrow_forwardMorris Industries manufactures and sells three products (AA, BB, and CC). The sales price and unit variable cost for the three products are as follows: Their sales mix s reflected as a ratio of 5:3:2. Annual fixed costs shared by the three products are $25,000 per year. What are total variable costs for Morris with their current product mix? Calculate the number of units of each product that will need to be sold in order for Morris to break even. What is their break-even point in sales dollars? Using an income statement format, prove that this is the break-even point.arrow_forward

- A company sells its products for $80 per unit and has per-unit variable costs of $30. What is the contribution margin per unit? A. $30 B. $50 C. $80 D. $110arrow_forwardA companys product sells for $150 and has variable costs of $60 associated with the product. What is its contribution margin per unit? A. $40 B. $60 C. $90 D. $150arrow_forwardGive me true answer the accounting questionarrow_forward

- What is the absorption cost per unit of this financial accounting question?arrow_forwardIf fixed costs are $1,200,000, the unit selling price is $240, and the unit variable costs are $110, what is the amount of sales required to realize an operating income of $200,000? Answer a. 12,000 units b. 5,833 units c. 10,769 units d. 9,231 unitsarrow_forwardPrearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College PubPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College PubPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT