FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

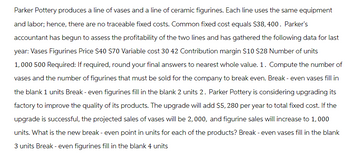

Transcribed Image Text:Parker Pottery produces a line of vases and a line of ceramic figurines. Each line uses the same equipment

and labor; hence, there are no traceable fixed costs. Common fixed cost equals $38, 400. Parker's

accountant has begun to assess the profitability of the two lines and has gathered the following data for last

year: Vases Figurines Price $40 $70 Variable cost 30 42 Contribution margin $10 $28 Number of units

1,000 500 Required: If required, round your final answers to nearest whole value. 1. Compute the number of

vases and the number of figurines that must be sold for the company to break even. Break - even vases fill in

the blank 1 units Break - even figurines fill in the blank 2 units 2. Parker Pottery is considering upgrading its

factory to improve the quality of its products. The upgrade will add $5, 280 per year to total fixed cost. If the

upgrade is successful, the projected sales of vases will be 2,000, and figurine sales will increase to 1,000

units. What is the new break - even point in units for each of the products? Break - even vases fill in the blank

3 units Break - even figurines fill in the blank 4 units

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- I could use a hand with thisarrow_forwardCordova manufactures three types of stained glass window, cleverly named Products A, B, and C. Information about these products follows: Sales price Variable costs per unit Fixed costs per unit Required number of labor hours Product A Product B Product C Cordova currently is limited to 50,000 labor hours per month. Required: Assuming an infinite demand for each of Cordova's products, determine contribution margin per direct labor hour. (Round your answers to 2 decimal places.) Contribution Margin Product B Ⓒ Product C O Product A Product A Product B Product C $46.00 $56.00 $86.00 22.00 12.25 38.00 8.00 8.00 2.50 4.00 $ $ $ 8.00 1.50 14.67 CM per DL hour 13.12 CM per DL hour 15.25 CM per DL hour Which product would be Cordova's first choice to produce?arrow_forwardFeather Friends, Incorporated, distributes a high-quality wooden birdhouse that sells for $40 per unit. Variable expenses are $20.00 per unit, and fixed expenses total $200,000 per year. Its operating results for last year were as follows: Sales Variable expenses Contribution margin Fixed expenses Net operating income Required: Answer each question independently based on the original data: 1. What is the product's CM ratio? 2. Use the CM ratio to determine the break-even point in dollar sales. 3. Assume this year's unit sales and total sales increase by 59,000 units and $2,360,000, respectively. If the fixed expenses do not change, how much will net operating income increase? $ 1,000,000 500,000 500,000 200,000 $ 300,000 4-a. What is the degree of operating leverage based on last year's sales? 4-b. Assume the president expects this year's unit sales to increase by 19%. Using the degree of operating leverage from last year, what percentage increase in net operating income will the…arrow_forward

- Parker Pottery produces a line of vases and a line of ceramic figurines. Each line uses the same equipment and labor; hence, there are no traceable fixed costs. Common fixed cost equals $40,000. Parker's accountant has begun to assess the profitability of the two lines and has gathered the following data for last year: VasesFigurinesPrice$40$70Variable cost3042Contribution margin$10$28Number of units1,000500 Required: If required, round your final answers to nearest whole value. 1. Compute the number of vases and the number of figurines that must be sold for the company to break even. Break-even vasesfill in the blank 1 unitsBreak-even figurinesfill in the blank 2 units 2. Parker Pottery is considering upgrading its factory to improve the quality of its products. The upgrade will add $5,260 per year to total fixed cost. If the upgrade is successful, the projected sales of vases will be 1,500, and figurine sales will increase to 1,000 units. What is the new break-even point in…arrow_forwardNorthwood Company manufactures basketballs. The company has a ball that sells for $25. At present, the ball is manufactured in a small plant that relies heavily on direct labor workers. Thus, varlable expenses are high, totaling $15.00 per ball, of which 60% Is direct labor cost Last year, the company sold 62.000 of these balls, with the following results: Sales (62,809 balls) Variable expenses Contribution margin Fixed expenses $ 1,558, 000 930,e00 620, e00 426, e00 Net operating income $ 194,e00 Required: 1. Compute (a) last year's CM ratio and the break-even polnt In balls, and (b) the degree of operating leverage at last year's sales level. 2 Due to an Increase In labor rates, the company estimates that next year's varlable expenses will Increase by $3.00 per ball. If this change takes place and the selling price per ball remalns constant at $25.00, what will be next year's CM ratio and the break-even polnt in balls? 3. Refer to the data in (2) above. If the expected change In…arrow_forwardLaser Cast Inc. manufactures color laser printers. Model J20 presently sells for $325 and has a product cost of $260, as follows: Line Item Description Amount Direct materials $190 Direct labor 50 Factory overhead 20 Total $260 It is estimated that the competitive selling price for color laser printers of this type will drop to $310 next year. Laser Cast has established a target cost to maintain its historical markup percentage on product cost. Engineers have provided the following cost-reduction ideas: 1. Purchase a plastic printer cover with snap-on assembly, rather than with screws. This will reduce the amount of direct labor by 9 minutes per unit.2. Add an inspection step that will add six minutes per unit of direct labor but reduce the materials cost by $7 per unit.3. Decrease the cycle time of the injection molding machine from four minutes to three minutes per part. Thirty percent of the direct labor and 45% of the factory overhead are related to running injection…arrow_forward

- Vandenberg, Inc., produces and sells two products: a ceiling fan and a table fan. Vandenbergplans to sell 30,000 ceiling fans and 70,000 table fans in the coming year. Product price and costinformation includes: Ceiling Fan Table FanPrice $60 $15Unit variable cost $12 $7Direct fixed cost $23,600 $45,000Common fixed selling and administrative expenses total $85,000.Required:1. What is the sales mix estimated for next year (calculated to the lowest whole number foreach product)?2. Using the sales mix from Requirement 1, form a package of ceiling fans and table fans.How many ceiling fans and table fans are sold at break-even?3. Prepare a contribution-margin-based income statement for Vandenberg, Inc., based on theunit sales calculated in Requirement 2.4. What if Vandenberg, Inc., wanted to earn operating income equal to $14,400? Calculate thenumber of ceiling fans and table…arrow_forwardIvanhoe's Water World is distributing replacement water coolers in the Montreal area for $160 per cooler. Ivanhoe's fixed costs are equal to $65,875 per month, and the Ivanhoe's accounting staff has calculated the monthly break-even in units to be 775. (a) Your answer is incorrect. Given this information, compute the variable cost per unit and the contribution margin per unit. Variable cost $ Contribution margin $ +A per unit per unit SUPPORTarrow_forwardCrane Company manufactures dog food for distribution in Washington, Oregon, and California. A dog food distributor from Florida has approached Crane and offered to purchase 264000 pounds of dog food for $1.40 per pound. Crane can produce 2048000 pounds of dog food per year, and its results for last year are as follows: Sales (1844000 at $1.65) Variable costs Contribution margin Fixed costs Operating income $3042600 O $1392800 O $1336400 O $2084400 O $1270400 1106400 1936200 814000 $1122200 If Crane accepts the offer, it will only be able to sell 1784000 pounds of dog food at the regular price due to its capacity constraints. What will Crane's total operating income be next year if it accepts the offer?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education