FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

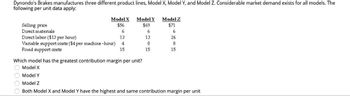

Transcribed Image Text:Dynondo's Brakes manufactures three different product lines, Model X, Model Y, and Model Z. Considerable market demand exists for all models. The

following per unit data apply:

Model X Model Y

$56

$69

6

6

13

4

15

00

Selling price

Direct materials

Direct labor ($13 per hour)

Variable support costs ($4 per machine-hour)

Fixed support costs

13

8

15

Model Z

$71

6

26

8

15

Which model has the greatest contribution margin per unit?

Model X

Model Y

Model Z

Both Model X and Model Y have the highest and same contribution margin per unit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Salvador Manufacturing builds and sells snowboards, skis and poles. The sales price and variable cost for each are shown: Salvador Manufacturing data Product Selling price per unit Variable cost per unit Snowboards $301 $175 Skis 455 204 Poles 79 44 Their sales mix is reflected in the ratio 8:2:8. If annual fixed costs shared by the three products are $136,431, how many composite units will need to be sold in order for Salvador to break even?arrow_forward3C AND 3Darrow_forwardSalvador Manufacturing builds and sells snowboards, skis and poles. The sales price and variable cost for each follows: Product Selling Priceper Unit Variable Costper Unit Snowboards $340 $150 Skis $380 $200 Poles $60 $30 Their sales mix is reflected in the ratio 7:3:2. If annual fixed costs shared by the three products are $250,900. Determine the break-even point in sales dollars. Break-even point $fill in the blank 1arrow_forward

- Cordova manufactures three types of stained glass window, cleverly named Products A, B, and C. Information about these products follows: Sales price Variable costs per unit Fixed costs per unit Required number of labor hours Product A Product B Product C Cordova currently is limited to 50,000 labor hours per month. Required: Assuming an infinite demand for each of Cordova's products, determine contribution margin per direct labor hour. (Round your answers to 2 decimal places.) Contribution Margin Product B Ⓒ Product C O Product A Product A Product B Product C $46.00 $56.00 $86.00 22.00 12.25 38.00 8.00 8.00 2.50 4.00 $ $ $ 8.00 1.50 14.67 CM per DL hour 13.12 CM per DL hour 15.25 CM per DL hour Which product would be Cordova's first choice to produce?arrow_forwardSubject: acountingarrow_forwardEstela Company produces skateboards and scooters. Their per unit selling prices and variable costs follow. Skateboards require 2 machine hours per unit. Scooters require 3 machine hours per unit. Selling price per unit Skateboards $ 200 Scooters) $ 400 120 310 Variable costs per unit (a) Compute the contribution margin per unit (b) Compute the contribution margin per machine hour (a) Contribution margin pet und Contion margm per machine hour Skateboards Scootersarrow_forward

- 3. JJ Manufacturing builds and sells switch harnesses for glove boxes. The sales price and variable cost for each follows: Product Selling price per unit Variable cost per unit Trunk switch $60.00 $28.00 Gas door switch $75.00 $33.00 Glove box light $40.00 $22.00 Their sales mix is reflected in the ratio 4:4:1. What is the overall Composite Unit Contribution Margin for JJ Manufacturing with their current product mix? If annual fixed costs shared by the three products are $18,840, how many units of each product are to be sold in order for JJ Manufacturing to break even? Trunk Switch? Gas Door Switch? Glove Box Light? Determine their break-even point in sales dollars. Trunk Switch? Gas Door Switch? Glove Box Light?arrow_forwardDragon Sports Inc. manufactures and sells two products, baseball bats and baseball gloves. The fixed costs are $251,600, and the sales mix is 40% bats and 60% gloves The unit selling price and the unit variable cost for each product are as follows: Products Unit Selling Price Unit Variable Cost Bats $50 $40 Gloves 130 80 a. Compute the break-even sales (units) for the overall enterprise product, E. units b. How many units of each product, baseball bats and baseball gloves, would be sold at the break-even point? Baseball bats units Baseball gloves unitsarrow_forwardManatoah Manufacturing produces 3 models of window air conditioners: model 101, model 201, and model 301. The sales price and variable costs for these three models are as follows: Sales Price Variable Cost per Unit Product per Unit $275 350 395 Model 101 Model 201 Model 301 The current product mix is 4:3:2. The three models share total fixed costs of $657,000. $180 215 240 A. Calculate the sales price per composite unit. Sales price $ B. What is the contribution margin per composite unit? Contribution margin $ per composite unit Break-even point in dollars $ Break-even point in units per composite unit. C. Calculate Manatoah's break-even point in both dollars and units. unitsarrow_forward

- Portsmouth Company makes upholstered furniture. Its only variable cost is direct materials. The demand for the company's products far exceeds its manufacturing capacity. The bottleneck (or constraint) in the production process is upholstery labor-hours. Information concerning three of Portsmouth's products appears below: Selling price per unit Variable cost per unit Upholstery labor-hours per unit Required: Recliner Sofa Love Seat $ 1,254 $ 750 $ 2,065 $ 1,250 $ 1,350 $ 900 9 hours 13 hours 5 hours 1. Portsmouth is considering paying its upholstery laborers hourly compensation, in addition to their usual salaries, to work overtime. Assuming that this extra time would be used to produce sofas, up to how much of an overtime rate per hour should the company be willing to pay to keep the upholstery shop open after normal working hours? 2. A small nearby upholstering company has offered to upholster furniture for Portsmouth at a price of $50 per hour. The management of Portsmouth is…arrow_forwardRST Company produces a product that has a variable cost of $6 per unit. The company's fixed costs are $30,000. The product sells for $10 per unit. RST desires to earn a profit of $20,000. The sales level in units to achieve the desire profit is Show Transcribed Text n A company that sells multiple types of products has a selling price per composite unit of $150, variable cost per composite unit of $50 and total fixed costs of $25,000. The contribution margin per composite unit is Sarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education