FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

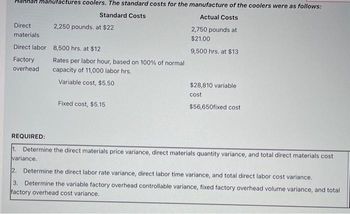

Transcribed Image Text:manufactures coolers. The standard costs for the manufacture of the coolers were as follows:

Standard Costs

Actual Costs

Direct

materials

2,250 pounds. at $22

Direct labor 8,500 hrs. at $12

Factory

overhead

Rates per labor hour, based on 100% of normal

capacity of 11,000 labor hrs.

Variable cost, $5.50

Fixed cost, $5.15

2,750 pounds at

$21.00

9,500 hrs. at $13

$28,810 variable

cost

$56,650fixed cost

REQUIRED:

1. Determine the direct materials price variance, direct materials quantity variance, and total direct materials cost

variance.

2. Determine the direct labor rate variance, direct labor time variance, and total direct labor cost variance.

3. Determine the variable factory overhead controllable variance, fixed factory overhead volume variance, and total

factory overhead cost variance.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Single plantwide factory overhead rate Bach Instruments Inc. makes three musical instruments: flutes, clarinets, and oboes. The budgeted factory overhead cost is $105,000. Overhead is allocated to the three products on the basis of direct labor hours. The products have the following budgeted production volume and direct labor hours per unit: Budgeted Production Volume Direct Labor Hours Per Unit Flutes 2,300 units 0.6 Clarinets 700 1.6 Oboes 1,000 1.0 If required, round all per unit answers to the nearest cent. a. Determine the single plantwide overhead rate.$fill in the blank 1 per direct labor hour b. Use the overhead rate in (a) to determine the amount of total and per-unit overhead allocated to each of the three products. TotalFactory Overhead Cost Per UnitFactory Overhead Cost Flutes $fill in the blank 2 $fill in the blank 3 Clarinets fill in the blank 4 fill in the blank 5 Oboes fill in the blank 6 fill in the blank 7 Total…arrow_forwardAnswer question Darrow_forwardTest and Pack Department 120,000 Total $306,000 The direct labor information for the production of 7,500 units of each product is as follows: Assembly Department Test and Pack Department Blender 750 dlh 2,250 dlh Toaster oven 2,250 750 Total 3,000 dlh 3,000 dlh Four Finger Appliance used direct labor hours to allocate production department factory overhead to products. If required, round all per unit answers to the nearest cent. a. Determine the two production department factory overhead rates. Assembly Department per direct labor hour Test and Pack Department per direct labor hour b. Determine the total factory overhead and the factory overhead per unit allocated to each product. Product Total Factory Overhead Factory Overhead Per Unit Blender Toaster ovenarrow_forward

- Standards: 3 yards of cloth per unit at $1.15 per yard 2 direct labor hours per unit at $10.75 per hour Overhead allocated at $5.00 per direct labor hour Actual: 2,300 yards of cloth were purchased at $1.20 per yard Employees worked 1,700 hours and were paid $10.25 per hour Actual variable overhead was $1,600 Actual fixed overhead was $6,700 Direct materials cost variance $115 U Direct materials efficiency variance 805 F Direct labor cost variance 850 F Direct labor efficiency variance 3,225 F Variable overhead cost variance 1,600 U Variable overhead efficiency variance 1,600 F Fixed overhead cost variance 700 U Fixed overhead volume variance 2,400 F Begin by journalizing the purchase of direct materials on account, including the related variance. (Prepare a single compound journal entry.) Date Accounts and Explanation Debit Creditarrow_forwardPlease do not give solution in image format thankuarrow_forwardSingle plantwide factory overhead rate Platzer Instruments Inc. makes three musical instruments: flutes, clarinets, and oboes. The budgeted factory overhead cost is $104,040. Overhead is allocated to the three products on the basis of direct labor hours. The products have the following budgeted production volume and direct labor hours per unit: Instruments BudgetedProductionVolume Direct LaborHours Per Unit Flutes 2,300 units 0.5 Clarinets 400 1.6 Oboes 1,000 1.1 If required, round all per unit answers to the nearest cent. a. Determine the single plantwide overhead rate.fill in the blank 1 of 1$ per direct labor hour b. Use the overhead rate in (a) to determine the amount of total and per-unit overhead allocated to each of the three products, Instruments TotalFactory Overhead Cost Per UnitFactory Overhead Cost Flutes fill in the blank 1 of 7$ fill in the blank 2 of 7$ Clarinets fill in the blank 3 of 7 fill in the blank 4 of 7 Oboes fill in the blank 5…arrow_forward

- 2arrow_forwardssment Tool iFrame A manufactured product has the following information for June. Direct materials Direct labor Overhead Units manufactured Standard Quantity and Cost 7 pounds @ $8 per pound 3 DLH @ $15 per DLH 3 DLH @ $12 per DLH Actual Results 59,200 pounds @ $8.10 per pound 24,900 hours @ $15.50 per hour $ 308,700 8,400 units Exercise 23-8 (Algo) Standard cost per unit, total budgeted and actual costs, and total cost variance LO P2 (1) Prepare the standard cost card showing standard cost per unit. (2) Compute total budgeted cost for June production. (3) Compute total actual cost for June production. (4) Compute total cost variance for June. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 Prepare the standard cost card showing standard cost per unit. Direct materials Direct labor Overhead Total $ 0arrow_forwardI need c and d partarrow_forward

- Max Company has developed the following standards for one of its products: Direct materials 15 pounds ´ £16 per poundDirect labour 4 hours ´ £24 per hourVariable overhead 4 hours ´ £14 per hour The following activities occurred during the month of October: Materials purchased 10,000 pounds costing £170,000Materials used 7,200 poundsUnits produced 500 unitsDirect labour 2,300 hours at £23.60 per hourActual variable overhead £30,000 The company records materials price variances at the time of purchase. Refer to Figure 17-1. Max's variable standard cost per unit would bearrow_forwardGail Cleaners produces a commercial cleaning compound known as Carpex. The direct materials and direct labour standards for one unit of Carpex follow: Direct materials Direct labour Variable overhead Standard Quantity or Hours 4.10 kilograms 0.40 hour 0.40 hour Standard Price or Rate $ 2.20 per kilogram $10.00 per hour $ 1.30 per hour Standard Cost $9.02 4.00 0.52 The budgeted fixed overhead cost is $14,614 per month. The denominator activity level of the allocation base is 800 direct labour- hours. Materials price variance Materials quantity variance During the most recent month, the following activity was recorded: a. 9,900 kilograms of material were purchased at a cost of $2.22 per kilogram. b. A total of 850 hours of direct labour time was recorded at a total labour cost of $9,110. c. The variable overhead cost was $1,580, and the fixed overhead cost was $14,704. Assume that the company produced 1,600 units during the month, using 6,600 kilograms of material in the production…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education