FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

thumb_up100%

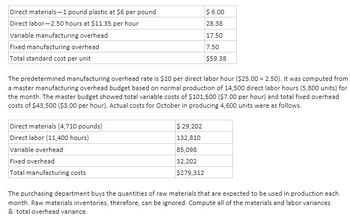

Transcribed Image Text:**Standard Cost and Manufacturing Cost Analysis**

**Standard Cost Per Unit:**

- **Direct materials—1 pound plastic at $6 per pound:** $6.00

- **Direct labor—2.50 hours at $11.35 per hour:** $28.38

- **Variable manufacturing overhead:** $17.50

- **Fixed manufacturing overhead:** $7.50

**Total standard cost per unit: $59.38**

**Manufacturing Overhead Rate Calculation:**

The predetermined manufacturing overhead rate is $10 per direct labor hour ($25.00 ÷ 2.50). It was computed from a master manufacturing overhead budget based on normal production of 14,500 direct labor hours (5,800 units) for the month. The master budget showed total variable costs of $101,500 ($7.00 per hour) and total fixed overhead costs of $43,500 ($3.00 per hour).

**Actual Costs for October (4,600 units produced):**

- **Direct materials (4,710 pounds):** $29,202

- **Direct labor (11,400 hours):** $132,810

- **Variable overhead:** $85,098

- **Fixed overhead:** $32,202

**Total manufacturing costs: $279,312**

### Additional Information:

The purchasing department buys the quantities of raw materials that are expected to be used in production each month. Raw materials inventories, therefore, can be ignored. You are required to compute all of the materials and labor variances and total overhead variance based on the provided data.

### Instructions for Students:

1. **Analyze the cost per unit:** Compare the actual costs against the standard costs to determine variances.

2. **Understand variance analysis:** Variance analysis is crucial for cost control and efficiency improvement in manufacturing processes.

3. **Use the provided data:**

- **Direct Materials Price Variance**

- **Direct Materials Usage Variance**

- **Direct Labor Rate Variance**

- **Direct Labor Efficiency Variance**

- **Variable Overhead Spending Variance**

- **Variable Overhead Efficiency Variance**

- **Fixed Overhead Spending Variance**

- **Fixed Overhead Volume Variance**

4. **Interpret the results:** Use these variances to find areas where the manufacturing process can be optimized.

This educational resource is designed to help students grasp the essential concepts of cost accounting and variance analysis in a manufacturing setup.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- For direct labor:a. Compute the actual direct labor cost per hour for the month.b. Compute the labor rate variance. Julia Company uses a standard cost system in which manufacturing overhead is applied to units of product on the basis of standard machine-hours. At standard, each unit of product requires one machine-hour to complete. The standard variable overhead is $1.75 per machine-hour and Budgeted Fixed Manufacturing Costs are $300,000 per year. The denominator level of activity is 150,000 machine-hours, or 150,000 units. Actual data for the year were as follows: Actual variable overhead cost $ 211,680 Actual fixed manufacturing overhead cost $ 315,000 Actual machine-hours 126,000 Units produced 120,000 Required: What are the predetermined variable and fixed manufacturing overhead rates for the year? Compute the variable overhead rate and efficiency variances for the year. Compute the fixed…arrow_forwardThe following information relates to Steele Manufacturing's overhead costs for the month: Static budget variable overhead Static budget fixed overhead Static budget direct labor hours Static budget number of units $35,600 $15,200 14,300 hours 5,500 units Steele allocates variable manufacturing overhead to production based on standard direct labor hours. Steele reported the following actual results for last month: actual variable overhead, $35,100; actual fixed overhead, $15,000; actual production of 5,400 units at 2.2 direct labor hours per unit. The standard direct labor time is 2.6 direct labor hours per unit. Compute the variable overhead efficiency variance. (Round the answer to the nearest dollar.) OA. $4,831 U B. $5,378 F C. $5,378 U OD. $4,831 Farrow_forwardAnthon Corporation has provided the following information regarding last month's activities. Units produced (actual) 10,920 Master production budget Direct materials. Direct labor $ 240,372 203,952 278,613 Overhead Standard costs per unit Direct materials Direct labor Variable overhead Actual costs Direct materials purchased and used Direct labor Overhead Direct materials Direct labor Variable overhead Fixed overhead $ 3.96 per liter x 5 liters per unit of output $ 33.60 per hour x 0.50 hour per unit $ 29.90 per direct labor-hour Variable overhead is applied on the basis of direct labor-hours. Required: Calculate all variable production cost price and efficiency variances and fixed production cost price and production volume variances. Note: Do not round intermediate calculations. Indicate the effect of each variance by selecting "F" for favorable, or "U" for unfavorable. If there is no effect, do not select either option. Price Variance $ 234,780 (60,200 liters) 181,260 (5,300 hours)…arrow_forward

- Tat Manufacturing Corporation uses a standard cost system with machine-hours as the activity base for overhead. The following information relates to production for last year. Variable Fixed Total budgeted overhead (at the denominator level of activity) Total applied overhead $ 432,000 $ 684,000 $ 410,400 $ 649,800 $ 456,000 $ 655,500 Total actual overhead The standard machine-hours allowed for the actual output during the year were 7,600. The actual machine-hours incurred were 7,500. 11 What was Taft's variable overhead efficiency variance? A. 2$ 21,600 Favorable B. $ 51,000 Unfavorable 6998 2$ 2$ $ 45,600 Unfavorable С. 5,400 Favorable D. E. None of the above 750 12 Hoover Corporation uses a standard cost system in which it applies manufacturing overhead to units of product on the basis of standard direct labor-hours (DLHS). Hoover's total applied factory overhead was $315,000 last year when the standard DLHS for the actual output were 30,000 hours. The standard variable factory…arrow_forwardAnthon Corporation has provided the following information regarding last month's activities. Units produced (actual) Master production budget Direct materials Direct labor Overhead Standard costs per unit Direct materials Direct labor Variable overhead Actual costs Direct materials purchased and used Direct labor Overhead 10,500 $ 237,600 201,600 267,000 $ 3.96 per liter x 5 liters per unit of output $ 33.60 per hour x 0.5 hour per unit $ 28.50 per direct labor-hour $ 207,480 (53,200 liters) 176,472 (5,160 hours) 272,000 (58% is variable) Variable overhead is applied on the basis of direct labor-hours Required: Calculate all variable production cost price and efficiency variances and fixed production cost price and production volume variance- Note: Do not round intermediate calculations. Indicate the effect of each veriance by selecting "F" for favorable, or "U" for unfavorable. If there is no effect, do not select either option.arrow_forwardThe following information was gathered for Larsen Corp. for the year ending 20xx. Budgeted direct labor hours 15,500 Actual direct labor hours 16,200 Budgeted factory overhead cost $73,625 Actual factory overhead cost $74,990 -Assume direct labor hours is the cost driver Required: What is the amount of over/underapplied overhead ? Is the variance over or under estimated ?arrow_forward

- The following data pertains to the month of October for ElmCo. when production was budgeted to be 5,000 units of P90. P90 has standard costs per unit of: 3 Ibs. of Direct Materials at a cost of $7.00 per Ib.; 0.20 hours of Direct Labor at $18.00 per hour; and Variable Overhead assigned on the basis of 0.05 machine hours at a rate of $50 per machine hour. In October the production of P90 totaled 4,600 units, using 324 machine hours costing a total of $17,066. Determine the variable overhead spending variance. (Negative numbers indicate a favorable variance.)arrow_forwardCraftmore Machining reports the following budgeted overhead cost and related data for this year. Activity Budgeted Cost Activity Cost Driver Budgeted Activity Usage Assembly $ 399,750 Direct labor hours (DLH) 13,000 Product design 61,500 Engineering hours (EH) 1,230 Electricity 20,500 Machine hours (MH) 10,000 Setup 51,250 Setups 410 Total $ 533,000 Required:1. Compute a single plantwide overhead rate assuming the company allocates overhead cost based on 13,000 direct labor hours.2. Job 31 used 240 direct labor hours and Job 42 used 520 direct labor hours. Allocate overhead cost to each job using the single plantwide overhead rate from part 1.3. Compute an activity rate for each activity using activity-based costing.4. Allocate overhead costs to Job 31 and Job 42 using activity-based costing. Activity Cost Driver Activity Usage Job 31 Job 42 Direct labor hours (DLH) 240 520 Engineering hours (EH) 27 33 Machine hours (MH) 60 60 Setups 5 7arrow_forwardBelinda Company has the following budgeted variable costs per unit produced: Direct materials $ 7.50 Direct labour 2.24 Variable overhead: Supplies 0.33 Maintenance 0.17 Power 0.18 Budgeted fixed overhead costs per month include supervision of $68,000, depreciation of $71,000, and other overhead of $205,000. Required: 1. Prepare a flexible budget for all costs of production for the following levels of production: 120,000 units, 130,000 units, and 145,000 units. 2. What is the per-unit total product cost for each of the production levels from Requirement 1? (Round each unit cost to the nearest cent.)arrow_forward

- Acme Company's production budget for August is 18,000 units and includes the following component unit costs: direct materials, $8.00; direct labor, $10.50; variable overhead, $6.40. Budgeted fixed overhead is $37,000. Actual production in August was 19,950 units. Actual unit component costs incurred during August include direct materials, $8.70; direct labor, $9.90; variable overhead, $7.30. Actual fixed overhead was $39,000. Required: Prepare a performance report, including each cost component. Note: Indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (i.e., zero variance). Cost Component Direct materials Direct labor Variable overhead Fixed overhead Total budgeted cost Original Budget (18,000 units) $ Flexed Budget (19,950 units) 0 $ Actual Cost (19,950 units) 0 $ 0 Budget Variancearrow_forwardMiguez Corporation makes a product with the following standard costs: Standard Quantity or Hours Standard Price or Rate Standard Cost Per Unit Direct materials 2.3 liters $ 7.00 per liter $ 16.10 Direct labor 0.7 hours $ 22.00 per hour $ 15.40 Variable overhead 0.7 hours $ 2.00 per hour $ 1.40 The company budgeted for production of 2,600 units in September, but actual production was 2,500 units. The company used 5,440 liters of direct material and 1,680 direct labor-hours to produce this output. The company purchased 5,800 liters of the direct material at $7.20 per liter. The actual direct labor rate was $24.10 per hour and the actual variable overhead rate was $1.90 per hour. The company applies variable overhead on the basis of direct labor-hours. The direct materials purchases variance is computed when the materials are purchased. The labor rate variance for September is: Multiple Choice $3,675 F $3,528 U $3,528 F $3,675 Uarrow_forwardStafford Company prepared a static budget for a production and sales volume of 11,200 units. Per unit Static standards Budget Number of units 11,200 Sales revenue $77.00 $862,400 Variable manufacturing costs: Materials $18.00 201,600 Labor $14.00 156,800 Overhead $ 5.40 60,480 Variable general, selling, and administrative costs Contribution margin $18.00 201,600 $241,920 Fixed costs Manufacturing overhead 112,800 General, selling, and administrative costs 57,000 Net income $ 72,120 What is the net income if 10,200 units are sold? Multiple Choice $71,995 $72,478 $64,268 $50,520arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education