FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

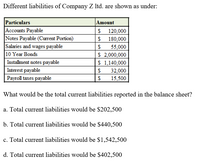

Transcribed Image Text:Different liabilities of Company Z Itd. are shown as under:

Particulars

Accounts Payable

Notes Payable (Current Portion)

Salaries and wages payable

10 Year Bonds

Installment notes payable

Amount

120,000

180,000

55,000

$ 2,000,000

$ 1,140,000

Interest payable

32,000

Payroll taxes payable

15,500

What would be the total current liabilities reported in the balance sheet?

a. Total current liabilities would be $202,500

b. Total current liabilities would be $440,500

c. Total current liabilities would be $1,542,500

d. Total current liabilities would be $402,500

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Discussionarrow_forwardBased on the following information as of December 31,2020, compute the company’s debt-equity ratio. Assume current liabilities are all interest-bearing. Round to nearest two decimal places. Current assets: 15 Non-current assets: 12 Current Liabilities: 22 Non-current Liabilities: 4 Debt to Equity Ratio = ?arrow_forwardCalculate the dividend payout ratio.arrow_forward

- 21. Kinsella Corporation's statement of financial position showed the following amounts: current liabilities, $75,000; total liabilities, $100,000; total assets, $200,000. What is the total long-term debt to total equity ratio? a.0.375 b.0.125 c.0.75 d.0.25arrow_forwardThe comparative accounts payable and long-term debt balances for a company follow. Current Year Previous YearAccounts payable $114,240 $102,000Long-term debt 127,200 120,000 Based on this information, what is the amount and percentage of increase or decrease that wouldbe shown on a balance sheet with horizontal analysis?arrow_forwardWhat is the overall assement of the company's credit risk (explain)? Is there any difference between the two years?arrow_forward

- Calculate debt to equity, long-term debt to equity and specify as a percent to 2 decimal placesarrow_forwardCalculate the 2020 current ratio using the following information: Balance Sheet Cash and Cash Equivalents Marketable Securities Accounts Receivable Total Current Assets Total Assets Current Liabilities Long Term Debt Shareholders Equity Income Statement Interest Expense Net Income Before Income Taxes 1.17 0.60 1.40 0.80 2020 5,000 15,000 10,000 40,000 70,000 50,000 10,000 10,000 7,500 45,000arrow_forwardUsing a BalanceSheetMOON CORPORATIONBALANCE SHEETJULY 31, 2011Assets Liabilities & Owners’ EquityCash . . . . . . . . . . . . . . . . $ 18,000 Liabilities:Accounts Receivable . . . 26,000 Notes PayableLand . . . . . . . . . . . . . . . . 37,200 (due in 60 days) . . . . . . . . . . . . . $ 12,400Building. . . . . . . . . . . . . . 38,000 Accounts Payable . . . . . . . . . . . . . 9,600Office Equipment . . . . . . 1,200 Total liabilities . . . . . . . . . . . . . . $ 22,000Stockholders’ equity:Capital Stock . . . . . . . . . $60,000Retained Earnings. . . . . 38,400 98,400Total . . . . . . . . . . . . . . . . $120,400 Total . . . . . . . . . . . . . . . . . . . . . . . . . $120,400STAR CORPORATIONBALANCE SHEETJULY 31, 2011Assets Liabilities & Owners’ EquityCash . . . . . . . . . . . . . . . . $ 4,800 Liabilities:Accounts Receivable . . . 9,600 Notes PayableLand . . . . . . . . . . . . . . . . 96,000 (due in 60 days) . . . . . . . . . . . . . $ 22,400Building. . . . . . . . . . . .…arrow_forward

- Please input numbers in boxes below based on data provided for year 2018. Current assets - current liabilities = net working capitalarrow_forwardRATIO ANALYSIS. Debt Ratio Activity 6 · Understand the information provided by the debt ratio. · Identify the expected range and whether an increasing or decreasing trend is preferred. Purpose: The debt ratio compares total liabilities to total assets. This ratio measures the proportion of assets financed by debt. It is a measure of long-term solvency. Total liabilities DEBT RATI0 = Total assets JOHNSON & CITIGROUP 12/31/99 HEWLETT- PACKARD 10/3 1/99 JOHNSON 1/03/99 WAL-MART 1/31/99 ($ in 000s) Assets $716,937,000 $35,297,000 $26,211,000 $49,996,000 Liabilities 667,251,000 17,002,000 12,621.000 28,884,000 Stockholders' Equity $ 49,686,000 $18,295,000 $13,590,000 $21,112,000 Source: Disclosure, Inc, Compact D/SEC, 2000. 1. For each-company listed above, compute the debt ratio. Record your results below. Debt ratio: 0.93 2. The debt ratios computed above are primarily in the ranġe (less than 0,40 / 0.40 through 0.70 / over 0.70): 3. % of Wal-Mart's assets are financed by debt. 4.…arrow_forwardMake comments on this tablearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education