FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

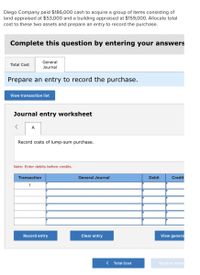

Transcribed Image Text:Diego Company paid $186,000 cash to acquire a group of items consisting of

land appraised at $53,000 and a building appraised at $159,00O. Allocate total

cost to these two assets and prepare an entry to record the purchase.

Complete this question by entering your answers

General

Total Cost

Journal

Prepare an entry to record the purchase.

View transaction list

Journal entry worksheet

A

Record costs of lump-sum purchase.

Note: Enter debits before credits.

Transaction

General Journal

Debit

Credit

1

Record entry

Clear entry

View genera

Total Cost

General Journ

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Journal Entries: Disposition of Plant Assets Prepare the entries for the transactions using a general journal. 1. Discarding an asset. a. On January 4, shelving units, which had a cost of $6,400 and had accumulated depreciation of $5,900, were discarded. b. On June 15, a hand cart, which had a cost of $1,500 and had accumulated depreciation of $1,350, was sold for $150. c. On October 1, a copy machine, which had a cost of $7,200 and had accumulated depreciation of $6,800, was sold for $450. Page: 1 DOC. POST. NO. REF. DATE ACCOUNT TITLE DEBIT CREDIT 20-- 1 Jan. 4 2 2 3 4. 4 June 15 6 6 7 7 8 9. Oct. 1 9 10 10 11 11 12 12 2. Exchange or trade-in of assets. a. On December 31, a drill press, which had a cost of $60,000 and had accumulated depreciation of $48,000, was traded in for a new drill press with a fair market value of $75,000. The old drill press and $65,000 in cash were given for the new drill press. b. On December 31, the old drill press in (a) and $60,000 in cash were given for…arrow_forwardOo.129. Subject:- Accountarrow_forwardRahularrow_forward

- Recording Asset Acquisition, Depreciation, and Disposal On January 2, 2016, Verdi Company acquired a machine for $75,000. In addition to the purchase price, Verdi spent $2,100 for shipping and installation, and $2,600 to calibrate the machine prior to use. The company estimates that the machine has a useful life of 5 years and a residual value of $11,000. Required a. Prepare journal entries to record the acquisition costs. Description Debit + → b. Calculate the annual depreciation expense using straight-line depreciation and prepare a journal entry to record depreciation expense for 2016. Description Credit Cash ◆ ◆ Accumulated depreciation c. On December 31, 2019, Verdi sold the machine to another company for $14,000. Prepare the necessary journal entry to record the sale. Credit Description Debit Credit Debit ◆ ♦arrow_forwardA machine with a cost of $141,000 and accumulated depreciation of $90,500 is sold for $61,000 cash. The amount that should be reported in the operating activities section reported under the direct method is: Multiple Choice $61,000. $10,500. $50,500.arrow_forwardi need help with this question pleasearrow_forward

- Owearrow_forwardQuestion Content Area A building with an appraisal value of $130,876 is made available at an offer price of $155,610. The purchaser acquires the property for $39,936 in cash, a 90-day note payable for $25,942, and a mortgage amounting to $59,561. The cost of the building to be reported on the balance sheet is a. $115,674 b. $125,439 c. $155,610 d. $130,876arrow_forwardOwearrow_forward

- Basket purchase allocation Dorsey Co. has expanded its operations by purchasing a parcel of land with a building on it from Bibb Co. for $255,000. The appraised value of the land is $60,000, and the appraised value of the building is $240,000.Page 215Required:a. Assuming that the building is to be used in Dorsey Co.’s business activities, what cost should be recorded for the land?b. Explain why, for income tax purposes, management of Dorsey Co. would want as little of the purchase price as possible allocated to land.c. Explain why Dorsey Co. allocated the cost of assets acquired based on appraised values at the purchase date rather than on the original cost of the land and building to Bibb Co. d. Assuming that the building is demolished at a cost of $20,000 so that the land can be used for employee parking, what cost should Dorsey Co. record for the land?arrow_forwardHauswirth Corporation sold (or exchanged) a warehouse in year O. Hauswirth bought the warehouse several years ago for $89,000, and it has claimed $24,400 of depreciation expense against the building. Note: Loss amounts should be indicated by a minus sign. Leave no answer blank. Enter zero if applicable. Round your final answers to the nearest whole dollar amount. Required: A. Assuming that Hauswirth receives $80,600 in cash for the warehouse, compute the amount and character of Hauswirth's recognized gain or loss on the sale. B. Assuming that Hauswirth exchanges the warehouse in a like-kind exchange for some land with a fair market value of $80,600, compute Hauswirth's realized gain or loss, recognized gain or loss, deferred gain or loss, and basis in the new land. C. Assuming that Hauswirth receives $35,500 in cash in year 0 and a $81,500 note receivable that is payable in year 1, compute the amount and character of Hauswirth's gain or loss in year 0 and in year 1. carrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education