FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

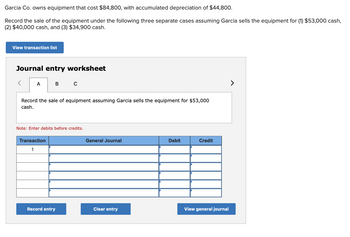

Transcribed Image Text:Garcia Co. owns equipment that cost $84,800, with accumulated depreciation of $44,800.

Record the sale of the equipment under the following three separate cases assuming Garcia sells the equipment for (1) $53,000 cash,

(2) $40,000 cash, and (3) $34,900 cash.

View transaction list

Journal entry worksheet

< A

Record the sale of equipment assuming Garcia sells the equipment for $53,000

cash.

в с

Note: Enter debits before credits.

Transaction

1

Record entry

General Journal

Clear entry

Debit

Credit

View general journal

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Caleb Company owns a machine that had cost $46,000 with accumulated depreciation of $20,200. Caleb exchanges the machine for a newer model that has a market value of $56,000. Record the exchange assuming Caleb paid $31,800 cash and the exchange has commercial substance. Record the exchange assuming Caleb paid $23,800 cash and the exchange has commercial substance.arrow_forwardRodriguez Company pays $395,380 for real estate with land, land improvements, and a building. Land is appraised at $157,040; land improvements are appraised at $58,890, and the building is appraised at $176,670. 1. Allocate the total cost among the three assets. 2. Prepare the journal entry to record the purchase. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Allocate the total cost among the three assets. Land Land improvements Building Totals Appraised Value 5 0 Percent of Total Appraised Value 0% Total Cost of Acquisition -Apportioned Cost Required 2 >arrow_forwardArlington Company sold equipment for $90,000 cash. The equipment had an original cost of $180,000 and accumulated depreiation of $70,000 as of the date of sale. Which of the following would NOT be included in the entry to record the sale?arrow_forward

- Pond Scum Creamery sold ice cream equipment for $18,000. Pond Scum originally purchased the equipment for $95,000, and depreciation through the date of sale totaled $73,500. Record the gain or loss on the sale of the equipment. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list Journal entry worksheet 1 Record the sale of the equipment. Note: Enter debits before credits. Transaction 1 General Journal Debit Credit Clear entry Record entry View general journalarrow_forwardGoodman Company exchanges an asset with The Pryce Corporation. Details of the exchange are as follows: Goodman’s Piece of equipment: Pryce’s building: Cost $800,000 Cost $960,000 Accumulated depreciation 230,000 Accumulated depreciation 350,000 Fair value 700,000 Fair value 850,000 Required- Prepare the journal entry in the books of both Goodman and Pryce, assuming both are public companies. Assume now that Goodman paid $80,000 in this transaction. Record the appropriate journal entry in Goodman books. Repeat b) assuming now that Goodman is a private company and that the fair value of Pryce’s building is the most determinable fair value.arrow_forwardThe Bronco Corporation exchanged land for equipment. The land had a book value of $136,000 and a fair value of $182,000. Bronco paid the owner of the equipment $26,000 to complete the exchange which has commercial substance. Required: 1. What is the fair value of the equipment? 2. Prepare the journal entry to record the exchange. Complete this question by entering your answers in the tabs below. Required 1 Required 2 What is the fair value of the equipment? Fair valuearrow_forward

- homework i Carver Incorporated purchased a building and the land on which the building is situated for a total cost of $846,300 cash. The land was appraised at $194,649 and the building at $778,596. Required: a. What is the accounting term for this type of acquisition? b. Determine the amount of the purchase cost to allocate to the land and the amount to allocate to the building. c. Would the company recognize a gain on the purchase? d. Record the purchase in a horizontal statements model. Complete this question by entering your answers in the tabs below. Required A Required B Required C Required D Check my work Record the purchase in a horizontal statements model. Note: Do not round intermediate calculations. Round your final answers to nearest whole dollar. In the Statement of Cash Flows column, use the initials OA to designate operating IA for investing activity, FA for financing activity, NC for net change in cash and NA for not affected. Enter any decreases to account balances and…arrow_forwardjlp.3arrow_forwardRequired information [The following information applies to the questions displayed below] Case A. Kapono Farms exchanged an old tractor for a newer model. The old tractor had a book value of $20,500 (original cost of $45,000 less accumulated depreciation of $24,500) and a fair value of $10,700. Kapono paid $37,000 cash to complete the exchange. The exchange has commercial substance. Case B. Kapono Farms exchanged 100 acres of farmland for similar land. The farmland given had a book value of $585,000 and a fair value of $870,000. Kapono paid $67,000 cash to complete the exchange. The exchange has commercial substance. Required: 1. What is the amount of gain or loss that Kapono would recognize on the exchange? What is the initial value of the new land? 2. Assume the fair value of the farmland given is $468,000 instead of $870,000. What is the amount of gain or loss that Kapono would recognize on the exchange? What is the initial value of the new land? 3. Assume the same facts as…arrow_forward

- A company purchased equipment valued at $263,000. It traded in old equipment for a $164,000 trade-in allowance and the company paid $99,000 cash with the trade-in. The old equipment cost $250,000 and had accumulated depreciation of $100,000. This transaction has commercial substance. What is the recorded value of the new equipment? Multiple Choice $249,000. $99,000. $263,000. $164,000. $150,000.arrow_forwardLowes Corporation sold its storage building for $86,000 cash. Lowes originally purchased the building for $200,000, and depreciation through the date of sale totaled $120,000. Required:Prepare the journal entry to record the sale of this building. (A separate calculation of any gain or loss is recommended.)arrow_forwardMainline Produce Corporation acquired all the outstanding common stock of Iceberg Lettuce Corporation for $30,000,000 in cash. The book values and fair values of Iceberg's assets and liabilities were as follows: Current assets Property, plant, and equipment Other assets Current liabilities Long-term liabilities Required: 1. Calculate the amount paid for goodwill. 2. Determine the financial statement effects of the acquisition. Required 1 Required 2 Complete this question by entering your answers in the tabs below. Book Value $ 11,400,000 20,200,000 3,400,000 7,800,000 13,200,000 Assets Determine the financial statement effects of the acquisition. Note: Amounts to be deducted should be indicated with a minus sign. Enter your answer in millions rounded to 1 decimal place. (i.e. 5,500,000 should be entered as 5.5). Accounts Payable Accounts Receivable Accumulated Depreciation Advertising Expense Fair Value $ 14,400,000 26,200,000 4,400,000 7,800,000 12,200,000 Balance Sheet Liabilities…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education