FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Transcribed Image Text:Assignment takeAssignmentando inoke=&take

eBook

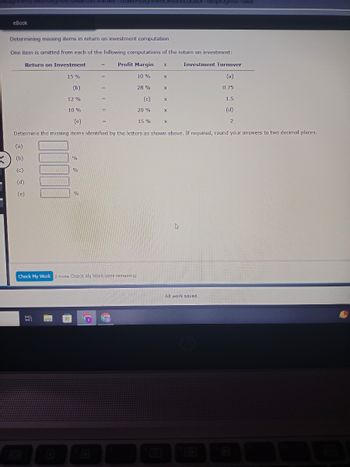

Determining missing items in return on investment computation

One item is omitted from each of the following computations of the return on investment:

Return on Investment

Profit Margin

Investment Turnover

10 %

(a)

28 %

(a)

(b)

(c)

(d)

(e)

15 %

(b)

12 %

1

10 %

%

%

=

%

Check My Work 2 more Check My Work uses remaining.

(c)

20%

X

(e)

Determine the missing items identified by the letters as shown above. If required, round your answers to two decimal places.

15%

X

X

X

X

sionLocator=aunprogress-laise

X

0.75

All work saved.

1.5

(d)

2

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Subject;arrow_forwardThe graph below charts the past five years of returns for two different assets. Percentage Return 15% 10% 5% 0% -5% -10% -15% 1 2 3 Year It can be stated that the two assets demonstrate: Select one: O a. perfectly positive correlation O b. perfectly negative correlation O c. negatively correlated O d. positively correlated 5arrow_forwardNonearrow_forward

- eBook Inventory $5,000 $4,900 65,000 29,000 230,000 froze Income Statement Pietro Frozen Foods, Inc., produces frozen pizzas. For next year, Pietro predicts that 54,100 units will be produced, with the following total costs: Direct materials Direct labor Variable overhead Fixed overhead Next year, Pietro expects to purchase $120,500 of direct materials. Projected beginning and ending inventories for direct materials and work in process are as follows: Direct materials nirxas. F en pizzes Work-in-Process Inventory $14,000 $16,000 Beginning Ending Next year, Pietro expects to produce 54,100 units and sell 53,400 units at a price of $18.00 each. Beginning inventory of finished goods is $42,500, and ending inventory of finished goods is expected to be $34,000. Total selling expense is projected at $27,000, and total administrative expense is projected at $108,000. Required: erat. Contin no Ing. 1. Prepare an income statement in good form. Round the percent to four decimal places before…arrow_forwardVery important please be correct thank you need all 11 requiredarrow_forward8arrow_forward

- ROI and Margin Arbus Company provided the following information: Turnover 1.3 Operating assets $106,000 Operating income 6,620 Required: 1. What is ROI? (Round your answer to three decimals.) 0.062 ✓ 2. What is margin? (Round your answer to two decimals.) X Feedbackarrow_forwardplease provide correct optionarrow_forwardPlease do not give solution in image format ? And Explain Proper Step by Step.arrow_forward

- Exercise 17-4 (Algo) Computing and interpreting common-size percents LO P2 Express the following comparative income statements in common-size percents. Using the common-size percents, which item is most responsible for the decline in net income? Complete this question by entering your answers in the tabs below. Income Statement Reason for Decline in Net Income Express the following comparative income statements in common-size percents. (Round your percentage answers to 1 decimal place.) Sales Cost of goods sold Gross profit Operating expenses Net income GOMEZ CORPORATION Comparative Income Statements For Years Ended December 31 Current Year $ Current Year % 780,000 $ 560,000 220,000 130,400 89,600 $ Income Statement Prior Year $ $ $ 660,000 295,400 364,600 251,600 113,000 Prior Year % Reason for Decline in Net Income >arrow_forwardDetermine the gross margin percentage and the profit margin percentage. (Round answers to 2 decimal places, e.g. 52.75%.) Gross margin percentage Profit margin percentage 35.28 % %arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education