Principles of Accounting Volume 1

19th Edition

ISBN: 9781947172685

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

Give true calculation

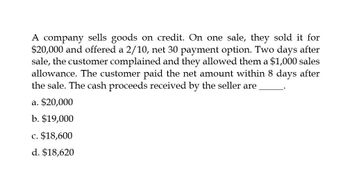

Transcribed Image Text:A company sells goods on credit. On one sale, they sold it for

$20,000 and offered a 2/10, net 30 payment option. Two days after

sale, the customer complained and they allowed them a $1,000 sales

allowance. The customer paid the net amount within 8 days after

the sale. The cash proceeds received by the seller are

a. $20,000

b. $19,000

c. $18,600

d. $18,620

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- A seller sells $800 worth of goods on credit to a customer, with a cost to the seller of $300. Shipping charges are $100. The terms of the sale are 2/10, n/30, FOB Destination. What, if any, journal entry or entries will the seller record for these transactions?arrow_forwardA customer pays on credit for $1,250 worth of merchandise, terms 4/15, n/30. If the customer pays within the discount window, how much will they remit in cash to the retailer? A. $1,250 B. $1,200 C. $50 D. $500arrow_forwardAir Compressors Inc. purchases compressor parts for its inventory from a supplier. The following transactions take place during the current year: A. On April 5, the company purchases 400 parts for $8.30 per part, on credit. Terms of the purchase are 4/ 10, n/30, invoice dated April 5. B. On May 5, Air Compressors does not pay the amount due and renegotiates with the supplier. The supplier agrees to $400 cash immediately as partial payment on note payable due, converting the debt owed into a short-term note, with a 7% annual interest rate, payable in three months from May 5. C. On August 5, Air Compressors pays its account in full. Record the journal entries to recognize the initial purchase, the conversion plus cash, and the payment.arrow_forward

- Prepare journal entries for the following sales and cash receipts transactions. (a) Merchandise is sold on account for 300 plus 3% sales tax, with 2/10, n/30 cash discount terms. (b) Part of the merchandise sold in transaction (a) for 70 plus sales tax is returned for credit. (c) The balance on account for the merchandise sold in transaction (a) is paid in cash within the discount period.arrow_forwardA customer returns $690 worth of merchandise and receives a full refund. What accounts recognize this sales return, assuming the customer has not yet remitted payment to the retailer? A. accounts receivable, sales returns and allowances B. accounts receivable, cash C. sales returns and allowances, purchases D. sales discounts, cost of goods soldarrow_forwardRecord journal entries for the following transactions of Mason Suppliers. A. Sep. 8: Purchased 50 deluxe hammers at a cost of $95 each from a manufacturer. Credit terms are 5/20, n/60, invoice date September 8. B. Sep. 12: Mason Suppliers returned 8 hammers for a full refund. C. Sep. 16: Mason Suppliers found 4 defective hammers, but kept the merchandise for an allowance of $250. D. Sep. 28: Mason Suppliers paid their account in full with cash.arrow_forward

- Consider the following transaction: On March 6, Fun Cards sells 540 card decks with a sales price of $7 per deck to Padma Singh. The cost to Fun Cards is $4 per deck. Prepare a journal entry under each of the following conditions. Assume MoneyPlus charges a 2% fee for each sales transaction using its card. A. Payment is made using a credit, in-house account. B. Payment is made using a MoneyPlus credit card.arrow_forwardA retailer pays on credit for $650 worth of inventory, terms 3/10, n/40. If the merchandiser pays within the discount window, how much will the retailer remit in cash to the manufacturer? A. $19.50 B. $630.50 C. $650 D. $195arrow_forwardWindow World extended credit to customer Nile Jenkins in the amount of $130,900 for his purchase of window treatments on April 2. Terms of the sale are 2/60, n/150. The cost of the purchase to Window World is $56,200. On September 4, Window World determined that Nile Jenkinss account was uncollectible and wrote off the debt. On December 3, Mr. Jenkins unexpectedly paid in full on his account. Record each Window World transaction with Nile Jenkins. In order to demonstrate the write-off and then subsequent collection of an account receivable, assume in this example that Window World rarely extends credit directly, so this transaction is permitted to use the direct write-off method. Remember, however, that in most cases the direct write-off method is not allowed.arrow_forward

- If a retailer made a purchase in the amount of $350 with credit terms of 2/15, n/60. What would the retailer pay in cash if they received the discount?arrow_forwardPianos Unlimited sells pianos to customers. The company contracts with a supplier who provides it with replacement piano keys. There is an agreement that Pianos Unlimited is not required to provide cash payment immediately, and instead will provide payment within thirty days of the invoice date. Additional information: Pianos Unlimited purchases 400 piano keys for $7 each on September 1, invoice date September 1, with discount terms 2/10, n/30. Pianos Unlimited returns 150 piano keys (receiving a credit amount for the total purchase price per key of $7 each) on September 8. The company purchases an additional 230 keys for $5 each on September 15, invoice date September 15, with no discount terms. The company pays 50% of the total amount due to the supplier on September 24. What amount does Pianos Unlimited still owe to the supplier on September 30? What account is used to recognize this outstanding amount?arrow_forwardBlue Barns sold 136 gallons of paint at $31 per gallon on July 6 to a customer with a cost of $19 per gallon to Blue Barns. Terms of the sale are 2/15, n/45, invoice dated July 6. The customer pays their account in full on July 24. On July 28, the customer discovers 17 gallons are the wrong color and returns the paint for a full cash refund. Blue Barns returns the gallons to their inventory at the original cost per gallon. Record the journal entries to recognize these transactions for Blue Barns.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning  College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub