FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

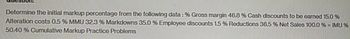

Transcribed Image Text:Determine the initial markup percentage from the following data : % Gross margin 46.8 % Cash discounts to be earned 15.0 %

Alteration costs 0.5 % MMU 32.3 % Markdowns 35.0 % Employee discounts 1.5 % Reductions 36.5 % Net Sales 100.0 % = IMU %

50.40 % Cumulative Markup Practice Problems

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- Contribution Margin, Break-Even Sales, Cost-Volume-Profit Chart, Margin of Safety, and Operating Leverage Belmain Co. expects to maintain the same inventories at the end of 20Y7 as at the beginning of the year. The total of all production costs for the year is therefore assumed to be equal to the cost of goods sold. With this in mind, the various department heads were asked to submit estimates of the costs for their departments during the year. A summary report of these estimates is as follows: EstimatedFixed Cost Estimated Variable Cost(per unit sold) Production costs: Direct materials $13 Direct labor 9 Factory overhead $212,900 6 Selling expenses: Sales salaries and commissions 44,200 3 Advertising 15,000 Travel 3,300 Miscellaneous selling expense 3,700 3 Administrative expenses: Office and officers' salaries 43,200 Supplies 5,300 1…arrow_forwardBlue Spruce Inc. manufactures basketballs for professional basketball associations. For the first six months of 2022, the company reported the following operating results while operating at 90% of plant capacity: Sales Cost of goods sold Selling and administrative expenses Net income Amount $5,049,000 3,465.000 445,500 $1.138,500 Per Unit $51.00 35.00 4.50 $11.50 Fixed costs for the period were cost of goods sold of $990,000, and selling and administrative expenses of $178.200. In July, normally a slack manufacturing month, Blue Spruce receives a special order for 9.900 basketballs at $32,00 each from the Italian Basketball Association. Accepting the order would increase variable selling and administrative expenses by $0.75 per unit because of shipping costs, but it would not increase fixed costs and expenses.arrow_forwardSubject: acountingarrow_forward

- Break-Even Units and Sales Revenue: Margin of Safety Dupli-Pro Copy Shop provides photocopying service. Next year, Dupli-Pro estimates it will copy 2,890,000 pages at a price of $0.06 each in the coming year. Product costs include: Direct materials Direct labor Variable overhead Total fixed overhead $0.009 $0.003 $0.001 $84,320 There is no variable selling expense; fixed selling and administrative expenses total $36,000.arrow_forwardContribution Margin, Break-Even Sales, Cost-Volume-Profit Chart, Margin of Safety, and Operating Leverage Belmain Co. expects to maintain the same inventories at the end of 20Y7 as at the beginning of the year. The total of all production costs for the year is therefore assumed to be equal to the cost of goods sold. With this in mind, the various department heads were asked to submit estimates of the costs for their departments during the year. A summary report of these estimates is as follows: EstimatedFixedCost EstimatedVariableCost(perunitsold) Production costs: Direct materials $22 Direct labor 14 Factory overhead $514,300 11 Selling expenses: Sales salaries and commissions 106,900 5 Advertising 36,200 Travel 8,000 Miscellaneous selling expense 8,800 4 Administrative expenses: Office and officers' salaries 104,500 Supplies 12,900 2…arrow_forwardComplete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 Required 5 Required 6 Required 7 Compute the company's margin, turnover, and return on investment (ROI) for the period. Note: Round your intermediate calculations and final answer to 2 decimal places. Margin % Turnover ROI %arrow_forward

- Subject: accountingarrow_forwardUsing the following data, estimate the new Return on Investment if there is a 9% decrease in the average operating assets - with the new average operating assets as the base. Sales $2,217,038 Contribution margin Controllable foxxed costs Average operating assets 34% 283,398 $4,189,521 Round to two decimal places. Be sure to enter the answer as a percentage but do not include the % sign.arrow_forwardSales Revenue Approach, Variable Cost Ratio, Contribution MarginRatioArberg Company’s controller prepared the following budgeted income statement for thecoming year: Required:1. What is Arberg’s variable cost ratio? What is its contribution margin ratio?2. Suppose Arberg’s actual revenues are $30,000 more than budgeted. By how much willoperating income increase? Give the answer without preparing a new income statement.3. How much sales revenue must Arberg earn to break even? Prepare a contribution marginincome statement to verify the accuracy of your answer.4. What is Arberg’s expected margin of safety?5. What is Arberg’s margin of safety if sales revenue is $380,000?arrow_forward

- If variable cost of goods sold totaled $101,100 for the year (16,850 units at $6 each) and the planned variable cost of goods sold totaled $109,680 (13,710 units at $8 each), the effect of the unit cost factor on the change in contribution margin is: a.$18,840 decrease b.$33,700 increase c.$33,700 decrease d.$18,840 increasearrow_forwardv.com/ilrn/takeAssignment/takeAssignmentMain.do?invoker=&takeAssignmentSession Lo... Break-Even Sales and Sales to Realize a Target Profit For the current year ending October 31, Papadakis Company expects fixed costs of $422,400, a unit variable cost of $46, and a unit selling price of $68. a. Compute the anticipated break-even sales (units). units. b. Compute the sales (units) required to realize a target profit of $96,800. units Check My Work Previous 6 Next Oct 26 6:18arrow_forwardThe South Division of Wiig Company reported the following data for the current year. Sales Variable costs Controllable fixed costs Average operating assets 1. 2. 3. Top management is unhappy with the investment center's return on investment (ROI). It asks the manager of the South Division to submit plans to improve ROI in the next year. The manager believes it is feasible to consider the following independent courses of action. Return on Investment $2,950,000 1,947,000 Increase sales by $300,000 with no change in the contribution margin percentage. Reduce variable costs by $155,000. Reduce average operating assets by 4%. Action 1 595,000 (a) Compute the return on investment (ROI) for the current year. (Round ROI to 2 decimal places, e.g. 1.57%.) Action 2 5,000,000 Action 3 (b) Using the ROI formula, compute the ROI under each of the proposed courses of action. (Round ROI to 2 decimal places, e.g. 1.57%.) Return on investment do % % % %arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education