FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

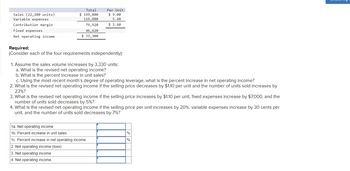

Transcribed Image Text:Sales (22,200 units)

Variable expenses

Contribution margin

Fixed expenses

Net operating income

Total

$ 199,800

119,880

79,920

46, 620

$ 33,300

Per Unit

$9.00

5.40

$ 3.60

Required:

(Consider each of the four requirements independently):

1. Assume the sales volume increases by 3,330 units:

a. What is the revised net operating income?

b. What is the percent increase in unit sales?

c. Using the most recent month's degree of operating leverage, what is the percent increase in net operating income?

2. What is the revised net operating income if the selling price decreases by $1.10 per unit and the number of units sold increases by

23%?

3. What is the revised net operating income if the selling price increases by $1.10 per unit, fixed expenses increase by $7,000, and the

number of units sold decreases by 5%?

4. What is the revised net operating income if the selling price per unit increases by 20%, variable expenses increase by 30 cents per

unit, and the number of units sold decreases by 7%?

1a. Net operating income

1b. Percent increase in unit sales

1c. Percent increase in net operating income

2. Net operating income (loss)

3. Net operating income

4. Net operating income

%

%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 6 steps

Knowledge Booster

Similar questions

- In the cost-volume- profit graph (above), what is represented by the point marked "A"? Question 1 options: Breakeven point Fixed expenses Operating income area Operating loss areaarrow_forwardBlue Spruce Inc. manufactures basketballs for professional basketball associations. For the first six months of 2022, the company reported the following operating results while operating at 90% of plant capacity: Sales Cost of goods sold Selling and administrative expenses Net income Amount $5,049,000 3,465.000 445,500 $1.138,500 Per Unit $51.00 35.00 4.50 $11.50 Fixed costs for the period were cost of goods sold of $990,000, and selling and administrative expenses of $178.200. In July, normally a slack manufacturing month, Blue Spruce receives a special order for 9.900 basketballs at $32,00 each from the Italian Basketball Association. Accepting the order would increase variable selling and administrative expenses by $0.75 per unit because of shipping costs, but it would not increase fixed costs and expenses.arrow_forwardDetermine the missing amounts Unit Selling Price$250 $500 (e)Unit Variable Costs$180 (c) (f)Unit Contribution Margin(a) $200 $330Contribution Margin Ratio(b) (d) 30%arrow_forward

- Break-Even Units and Sales Revenue: Margin of Safety Dupli-Pro Copy Shop provides photocopying service. Next year, Dupli-Pro estimates it will copy 2,890,000 pages at a price of $0.06 each in the coming year. Product costs include: Direct materials Direct labor Variable overhead Total fixed overhead $0.009 $0.003 $0.001 $84,320 There is no variable selling expense; fixed selling and administrative expenses total $36,000.arrow_forwardIn the cost-volume- profit graph (above), what is represented by the point marked "D"? Question 3 options: Operating loss area Operating income area Breakeven point Fixed expensesarrow_forwardAssume the following information: Amount Per Unit Sales $ 600,000 $ 40 Contribution margin $ 360,000 $ 24 Net operating income $ 240,000 If the selling price per unit increases by 8% and unit sales drop by 6%, then the best of estimate of the new net operating income is: Multiple Choice $263,520. $243,520. $253,520. $233,520.arrow_forward

- Assume the following information: Selling price Variable expense ratio Fixed expenses Unit sales Multiple Choice O O How many units need to be sold to achieve a target profit of $16,900? 4,150 units 1,019 units 2,817 units Amount 6,220 units $30 80% $ 8,000 per month 3,400 per montharrow_forwardMunabhaiarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education