Derrick Iverson is a divisional manager for Holston Company. His annual pay raises are largely determined by his division’s

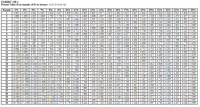

| Sales | $ 2,800,000 | |

|---|---|---|

| Variable expenses | 1,150,000 | |

| Contribution margin | 1,650,000 | |

| Fixed expenses: | ||

| Advertising, salaries, and other fixed out-of-pocket costs | $ 610,000 | |

| 640,000 | ||

| Total fixed expenses | 1,250,000 | |

| Net operating income | $ 400,000 |

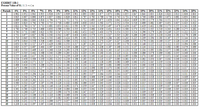

Click here to view Exhibit 12B-1 and Exhibit 12B-2, to determine the appropriate discount factor(s) using tables.

Required:

1. Compute the project's

2. Compute the project's simple

3a. Would the company want Derrick to pursue this investment opportunity?

3b. Would Derrick be inclined to pursue this investment opportunity?

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

- Firm Z has invested $4 million in marketing campaign to assess the demand for a product Manish. This product will be in the market next year and will last five years. Revenues are projected to be $50 million per year along with expenses of $20 million. The firm spends $15 million immediately and equipment that will be depreciated using MACRS depreciation 20. Additionally, it will use some fully depreciated existing equipment that has a market value of $4 million. Finally, they will have no incremental cash or inventory requirements. But receivables are expected to account for 15% of annual sales. Payables are expected to be 15% of the annual cost of goods sold between year one and four. All accounts payables and receivables will be settled at the end of your five. Based on this information andCost of debt is 2.45%, cost of equity is 11%, cost of preferred stock is 5% and WACC is 5.42%., find the NPV of the project. Identify the IRR of the project. Will you accept this project? Why?…arrow_forwardPivot, Inc. is currently valuing a new project that has the average risk of its investment projects. The project requires upfront R&D and marketing expenses of $10 million and a $30 million investment in equipment. The equipment will be obsolete in 3 years and will be depreciated using the straight-line method over that period. For each year over the next 3 years, the project offers annual sales of $100 million, has annual manufacturing costs of $30 million, and annual operating expenses of $10 million. Further, the project requires no net working capital in year 0, and $2.0 million in net working capital in each year from year 1 to year 2 and no net working capital in year 3. Beyond year 3, the project's free cash flows are expected to growth at an annual rate of 1%. Pivot currently has 20 million outstanding shares with its stock price of $30 per share, $320 million in debt, $20 million in excess cash, the cost of debt of 5%, and the cost of equity of 10%, and the corporate tax rate…arrow_forwardYour firm is contemplating the purchase of a new $540,000 computer-based order entry system. The system will be depreciated straight-line to zero over its five-year life. It will be worth $68,000 at the end of that time. You will be able to reduce working capital by $93,000 (this is a one-time reduction). The tax rate is 21 percent and the required return on the project is 9 percent. If the pretax cost savings are $150,000 per year, what is the NPV of this project? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) NPV Will you accept or reject the project? Accept Reject If the pretax cost savings are $115,000 per year, what is the NPV of this project? (A negative answer should be indicated by a minus sign. Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) NPV Will you accept or reject the project? Reject Accept At what level of pretax cost savings would you be indifferent between accepting the…arrow_forward

- Consider a project to supply Detroit with 27,000 tons of machine screws annually for automobile production. You will need an initial $6,000,000 investment in threading equipment to get the project started; the project will last for 6 years. The accounting department estimates that annual fixed costs will be $1,450,000 and that variable costs should be $275 per ton; accounting will depreciate the initial fixed asset investment straight-line to zero over the 6-year project life. It also estimates a salvage value of $825,000 after dismantling costs. The marketing department estimates that the automakers will let the contract at a selling price of $392 per ton. The engineering department estimates you will need an initial net working capital investment of $580,000. You require a return of 11 percent and face a tax rate of 22 percent on this project. a-1. What is the estimated OCF for this project? (Do not round intermediate calculations. and round your answer to the nearest whole number,…arrow_forwardConsider a project to supply Detroit with 28,000 tons of machine screws annually for automobile production. You will need an initial $5,800,000 investment in threading equipment to get the project started; the project will last for 6 years. The accounting department estimates that annual fixed costs will be $1,400,000 and that variable costs should be $265 per ton; accounting will depreciate the initial fixed asset investment straight-line to zero over the 6-year project life. It also estimates a salvage value of $775,000 after dismantling costs. The marketing department estimates that the automakers will let the contract at a selling price of $380 per ton. The engineering department estimates you will need an initial net working capital investment of $560,000. You require a return of 14 percent and face a tax rate of 25 percent on this project. a-1. What is the estimated OCF for this project? (Do not round intermediate calculations and round your answer to the nearest whole…arrow_forwardOakmont Company has an opportunity to manufacture and sell a new product for a four-year period. After careful study, Oakmont estimated the following costs and revenues for the new product: When the project concludes in four years the working capital will be released for investment elsewhere within the company. Required: Using Excel (this will save you time and effort) answer the following: Oakmont’s cost of capital is 15%, and management does not feel it should have any adjustment for risk, compute the NPV. Same situation as (a), but management does feel this project does possess a greater than average risk, so 19% should be the required rate of return. Compute the NPV. Management is concerned that Sales Revenues and Expenses could be rising due to inflationary factors. So the projection for year 1 is as shown, but that sales revenues will grow by 2% per year for years 2-4; and that variable expenses will grow by 4% per year for years 2-4, and that fixed out-of-pocket operating…arrow_forward

- Beacon Company is considering automating its production facility. The initial investment in automation would be $7.52 million, and the equipment has a useful life of 6 years with a residual value of $1,100,000. The company will use straight- line depreciation. Beacon could expect a production increase of 47,000 units per year and a reduction of 20 percent in the labor cost per unit. Production and sales volume Sales revenue Variable costs Direct materials Direct labor Variable manufacturing overhead Total variable manufacturing costs Contribution margin Fixed manufacturing costs Net operating income Required: 1-a. Complete the following table showing the totals. Current (no automation) 81,000 Proposed (automation) 128,000 units units Per Unit $94 $ 17 30 9 56 $38 Total $ ? ? 1,240,000 ? Per Unit $94 $ 17 ? 9 ? $44 Total $ ? ? 2,200,000 ?arrow_forwardMonica is a senior financial manager of Eclipse Ltd. She is conducting a capital budgeting analysis on a new product. She has already authorised an extensive market research on the marketability of the product that cost $15,000, which she paid yesterday. The new project is expected to generate yearly revenue of $390,000 for 4 years. The related variable costs are expected to be $100,000 p.a. and Monica estimates the relevant fixed costs would be another $30,000 p.a. The project will require the company to purchase new equipment at a cost of $500,000. The new equipment will be installed in a building which the company already owns but the building is currently left vacant. The company will depreciate the equipment by the straight-line method to zero salvage value over the 4 years and Monica believes that they can sell the equipment at the end of 4 years for $20,000. Eclipse Ltd’s required payback is 3 years and the required rate of return is 12% p.a. The relevant tax rate is 30% and tax…arrow_forwardCardinal Company is considering a project that would require a $2,782,000 investment in equipment with a useful life of five years. At the end of five years, the project would terminate and the equipment would be sold for its salvage value of $200,000. The company’s discount rate is 18%. The project would provide net operating income each year as follows: Sales $ 2,873,000 Variable expenses 1,019,000 Contribution margin 1,854,000 Fixed expenses: Advertising, salaries, and other fixed out-of-pocket costs $ 754,000 Depreciation 516,400 Total fixed expenses 1,270,400 Net operating income $ 583,600 Required:If the equipment’s salvage value was $400,000 instead of $200,000, what would be the project’s simple rate of return? (Round your answer to 2 decimal places.)arrow_forward

- K- Yoga, Spa, and Swim Club is planning for the coming year. Investors would like to eam a 10% rebum on the company's $39,000,000 of assets. The company primarily incurs fixed costs maintain the swimming pools, Fixed costs are projected to be $12,600,000 for the year. About 520,000 members are expected to swim each year. Variable costs are about $10 per swimmer. The club is a price-taker and won't be able to charge more than its competitors who charge $38 for a membership. What profit (loss) will it earn in terms of dollars? OA $12,600,000 OB. $1,900,000 OC. $7,919,962 OD. $(1,960,000)arrow_forwardSanders Inc. has developed a new product line that they believe will revolutionize their industry and ensure they remain an industry leader. The projected sales are as follows: Year Unit Sales 1 97,500 2 112,000 3 120,000 4 135,000 5 103,000 The project will require $750,000 in net working capital to start and additional net working capital investments each year equal to 10 percent of the projected increase in sales for the following year. Total fixed assets are $4,100,000 per year. Variable costs will be $215, and units will sell for $335 each. The company will need to purchase equipment for $15,000,000 which will be depreciated as a seven-year MACRS property. In five years, the equipment can be sold for $3,500,000. The company is in the 21 percent tax bracket and has a 14 percent required return on their projects. The company will use land that was purchased for $1,800,000 three years ago. The land could be sold today for $2,400,000 and it…arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education