Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

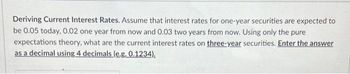

Transcribed Image Text:Deriving Current Interest Rates. Assume that interest rates for one-year securities are expected to

be 0.05 today, 0.02 one year from now and 0.03 two years from now. Using only the pure

expectations theory, what are the current interest rates on three-year securities. Enter the answer

as a decimal using 4 decimals (e.g. 0.1234).

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Suppose the following table shows yields to maturity of U.S. Treasury securities as of January 1, 2000. Based on the data in the table, calculate the implied forward one-year and two-year rates at January 1, 2002. y1=3.0% y2=3.5% y3=4.0% y4=4.5%arrow_forwardSuppose we observe the following rates: 1R1 = 4.1%, 1R2 = 4.9%, and E(21) = 4.1%. If the liquidity premium theory of the term structur of interest rates holds, what is the liquidity premium for year 2? (Round your intermediate calculations to 5 decimal places and fina percentage answer to 2 decimal places. (e.g., 32.16)) Liquidity premium for year 2 %arrow_forward8. Demonstrate your understanding on Chapter 6: Expectations Theory/ Cross-Product a. One-year Treasury securities yield 3.95%. The market anticipates that 1 year from now, 1-year Treasury securities will yield 4.4%. If the pure expectations theory is correct, what is the yield today for 2-year Treasury securities? Calculate the yield using a geometric average. Do not round intermediate calculations. Round your answer to two decimal places. b. An analyst is evaluating securities in a developing nation where the inflation rate is very high. As a result, the analyst has been warned not to ignore the cross-product between the real rate and inflation. A 6-year security with no maturity, default, or liquidity risk has a yield of 17.60%. If the real risk-free rate is 5%, what average rate of inflation is expected in this country over the next 6 years? (Hint: Refer to "The Links Between Expected Inflation and Interest Rates: A Closer Look".) Do not round intermediate calculations. Round your…arrow_forward

- 1. Term structure of interest rates and swap valuation Suppose the current term structure of interest rates, assuming annual compounding, is as follows: s1 82 83 84 S5 86 7.0% 7.3% 7.7% 8.1% 8.4% 8.8% What is the discount rate d(0, 4)? (Recall that interest rates are always quoted on an annual basis unless stated otherwise.) Please submit your answer rounded to three decimal places. For example, if your answer is 0.4567 then you should submit an answer of 0.457. Enter answer herearrow_forwardThe following is a list of prices for zero-coupon bonds of various maturities. a. Calculate the yield to maturity for a bond with a maturity of (i) one year; (ii) two years; (iii) three years; (iv) four years. Assume annual coupon payments. (Do not round intermediate calculations. Round your answers to 2 decimal places.) Maturity (Years) 1 2 3 4 Maturity (years) 1 2 3 4 Maturity (Years) 2 3 4 $ $ $ $ b. Calculate the forward rate for (i) the second year; (ii) the third year; (iii) the fourth year. Assume annual coupon payments. (Do not round intermediate calculations. Round your answers to 2 decimal places.) $ $ $ Price of Bond 983.40 918.47 867.62 774.16 Price of Bond $983.40 918.47 867.62 774.16 Price of Bond YTM 918.47 867.62 774.16 % % % % Forward Rate % % % #arrow_forwardHello sir! I need ur helparrow_forward

- Interest rates on 4-year Treasury securities are currently 5.6%, while 6-year Treasury securities yield 7.85%. If the pure expectations theory is correct, what does the market believe that 2-year securities will be yielding 4 years from now? Calculate the yield using a geometric average. Do not round intermediate calculations. Round your answer to two decimal places. %arrow_forwardi need the answer quicklyarrow_forwardAssume the zero-coupon yields on default-free securities are as summarized in the following table: (Click on the following icon in order to copy its contents into a spreadsheet.) Maturity (years) Zero-coupon YTM 1 6.30% 2 6.90% 3 7.30% 4 7.70% 5 8.00% What is the price of a three-year, default-free security with a face value of $1,000 and an annual coupon rate of 8%? What is the yield to maturity for this bond? What is the price of a three-year, default-free security with a face value of $1,000 and an annual coupon rate of 8%? The price is $1894.57. (Round to the nearest cent.)arrow_forward

- Assume the zero-coupon yields on default-free securities are as summarized in the following table: (Click on the following icon in order to copy its contents into a spreadsheet.) Maturity (years) Zero-coupon YTM 1 6.70% 2 7.10% 3 7.30% 4 7.70% 5 8.00% What is the price of a three-year, default-free security with a face value of $1,000 and an annual coupon rate of 5%? What is the yield to maturity for this bond? What is the price of a three-year, default-free security with a face value of $1,000 and an annual coupon rate of 5%? The price is $ (Round to the nearest cent.)arrow_forwardIf the YTM on a bond is 17.5 %, what will be the periodic rate assuming the bond is paying coupons semi-annually? (Write this number as a decimal and not as a percentage, e.g. 0.11 not 11%. Round your answer to three decimal places. For example 1.23450 or 1.23463 will be rounded to 1.235 while 1.23448 will be rounded to 1.234).arrow_forwardCalculate the durations and volatilities of securities A, B, and C. Their cash flows are shown below. The interest rate is 6%. Note: Do not round intermediate calculations. Round "Duration" to 4 decimal places and "Volatility" to 2 decimal places. ABO А Period 1 135 115 105 Period 2 135 115 105 Period 3 230 310 300 Duration years years years Volatilityarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education