Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

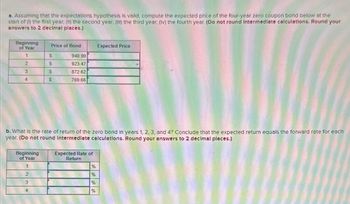

Transcribed Image Text:a. Assuming that the expectations hypothesis is valid, compute the expected price of the four-year zero coupon bond below at the

start of (1) the first year; (II) the second year; (III) the third year; (IV) the fourth year. (Do not round Intermediate calculations. Round your

answers to 2 decimal places.)

Beginning

Price of Bond

of Year

Expected Price

1

S

940.90

2

S

923.47

3

S

872.62

4

S

769.66

b. What is the rate of return of the zero bond in years 1, 2, 3, and 4? Conclude that the expected return equals the forward rate for each

year. (Do not round Intermediate calculations. Round your answers to 2 decimal places.)

Expected Rate of

Beginning

of Year

Return

1

%

2

%

3

%

4

%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Similar questions

- The function s(t) = 0.16 − 0.04 e− t/4 provides the term structure of effective annual rates of zero coupon bonds of maturity t, with t in years. Find the following: (a) The effective annual rate of a 3 year zero coupon bond. (b) The 2-year forward effective annual rate for a one year period. (c) The forward effective annual rate for a one year period, 3 years forward. (d) The 3-year forward effective annual rate for a 3 month period. (e) The forward effective annual rate for a one day period, 3 years forward (the “overnight” rate).(Use 1/365 for a one-day period.)arrow_forwardAssume the zero-coupon yields on default-free securities are as summarized in the following table: 3 years 4 years 5 years Maturity 1 year 2 years 7.00% 7.30% 6.20% 6.50% 6.70% Zero-Coupon Yields What is the maturity of a default-free security with annual coupon payments and a yield to maturity of 6.20%? Why? What is the maturity of a default-free security with annual coupon payments and a yield to maturity of 6.20%? (Select the best choice below.) O A. One year В. Тwo years C. Three years D. Four years E. Five yearsarrow_forward3. The following is a list of prices for zero-coupon bonds with different maturities and par value of $1,000. Suppose the interest rate is compounded once per year. Maturity (Years) Price ($) 970 960 910 870 1 2 3 4 Answer the following questions: (a) What is, according to the expectations theory, the one-year interest rate in the second year? (b) What is, according to the expectations theory, the one-year interest rate in the third year? (c) What is, according to the expectations theory, the one-year interest rate in the forth year?arrow_forward

- The yield curve for default-free zero-coupon bonds is currently as follows: Maturity (years) YTM 1 9.8% 2 10.8 3 11.8 Required: a. What are the implied one-year forward rates? (Do not round intermediate calculations. Round your answers to 2 decimal places.) Maturity (years) YTM Forward rate 1 9.8% 2 3 10.8% 11.8% % % b. Assume that the pure expectations hypothesis of the term structure is correct. If market expectations are accurate, what will the pure yield curve (that is, the yields to maturity on one- and two-year zero-coupon bonds) be next year? O There will be a shift upwards in next year's curve. O There will be a shift downwards in next year's curve. O There will be no change in next year's curve. c. What will be the yield to maturity on two-year zeros? (Do not round intermediate calculations. Round your answers to 2 decimal places.) YTM % d. If you purchase a two-year zero-coupon bond now, what is the expected total rate of return over the next year? (Hint: Compute the current…arrow_forwardYou find the following Treasury bond quotes. To calculate the number of years until maturity, assume that it is currently May 2022. All of the bonds have a par value of $1,000 and pay semiannual coupons. Rate ?? 5.952 6.133 Maturity Month/Year May 31 May 34 May 40 Bid Asked 103.4534 103.5262 104.4874 104.6331 ?? ?? Change Ask Yield +.3222 +.4221 +.5327 5.879 ?? 3.911 In the above table, find the Treasury bond that matures in May 2034. What is your yield to maturity if you buy this bond? Note: Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16. Yield to maturity %arrow_forwardYou find the following Treasury bond quotes. To calculate the number of years until maturity, assume that it is currently May 2022. All of the bonds have a par value of $1,000 and pay semiannual coupons. Rate ?? 6.052 6.143 Maturity Month/Year Bid Asked Change May 33 May 36 May 42 103.4560 103.5288 104.4900 104.6357 ?? ?? +.3248 Ask Yield 5.919 +.4245 +.5353 ?? 3.951 In the above table, find the Treasury bond that matures in May 2036. What is your yield to maturity if you buy this bond? Note: Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16. Yield to maturity %arrow_forward

- You find the following Treasury bond quotes. To calculate the number of years until maturity, assume that it is currently May 2022. All of the bonds have a par value of $1,000 and pay semiannual coupons. Rate ?? 6.252 6.163 Maturity Month/Year May 36 May 41 May 51 Bid 103.5462 104.4952 ?? Asked 103.6340 104.6409 ?? Change Ask Yield +.3015 2.329 +.4293 +.5405 ?? 4.031 In the above table, find the Treasury bond that matures in May 2036. What is the coupon rate for this bond? Note: Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.arrow_forwardam. 11.arrow_forwardSuppose 1-year Treasury bonds yield 4.40% while 2-year T-bonds yield 5.70%. Assuming the pure expectations theory is correct, and thus the maturity risk premium for T-bonds is zero, what is the yield on a 1-year T-bond expected to be one year from now? Do not round your intermediate calculations. Round your final answer to 2 decimal places. a. 7.02% b. 5.66% c. 5.05% Od. 4.92% e. 7.32%arrow_forward

- Manshukarrow_forwardIn calculating the current price of a bond paying semiannual coupons, one needs to O use double the number of years for the number of payments made. O use the semiannual coupon. O use the semiannual rate as the discount rate. O All of the above needs to be done.arrow_forward3. Interest rate swap. Consider a portfolio of floating-rate bonds that all mature in three years. What is the fixed coupon rate for a fairly priced fixed-for-floating interest rate swap given the following discount factors? Years 2. 0.,95 06'0 0.86arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education