FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

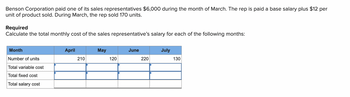

Transcribed Image Text:Benson Corporation paid one of its sales representatives $6,000 during the month of March. The rep is paid a base salary plus $12 per

unit of product sold. During March, the rep sold 170 units.

Required

Calculate the total monthly cost of the sales representative's salary for each of the following months:

Month

Number of units

Total variable cost

Total fixed cost

Total salary cost

April

May

June

July

210

120

220

130

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Norwood Company has the following information for July: Sales $440,000 Variable cost of goods sold 198,000 Fixed manufacturing costs 70,400 Variable selling and administrative expenses 44,000 Fixed selling and administrative expenses 26,400 Determine the following for Norwood Company for the month of July: a. Manufacturing margin $fill in the blank 1 b. Contribution margin $fill in the blank 2 c. Operating income $fill in the blank 3arrow_forward4. Case made 24,500 units during June, using 32,000 direct labor hours. They expected to use 31,450 hours per the standard cost card. Their employees were paid $15.75 per hour for the month of June. The standard cost card uses $15.50 as the standard hourly rate. NOTE: All dollar amounts are rounded to whole dollars and shown with "$" and commas as needed (i.e. $12,345). For the variance conditions, your answer is either "F” (for Favorable) or "U” (for Unfavorable) - capital letter and no quotes. Complete the following table of variances and their conditions: Variance Variance Amount Favorable (F) or Unfavorable (U) Labor Rate ? ? Labor Time ? ? Total DL Cost Variance ? ?arrow_forwardJavon Company set standards of 2 hours of direct labor per unit at a rate of $15.10 per hour. During October, the company actually uses 11,000 hours of direct labor at a $168,300 total cost to produce 5,700 units. In November, the company uses 15,000 hours of direct labor at a $230,250 total cost to produce 6,100 units of product.AH = Actual HoursSH = Standard HoursAR = Actual RateSR = Standard Rate(1) Compute the direct labor rate variance, the direct labor efficiency variance, and the total direct labor variance for each of these two months.(2) Javon investigates variances of more than 5% of actual direct labor cost. Which direct labor variances will the company investigate further?arrow_forward

- Denton Company manufactures and sells a single product. Cost data for the product are given: Variable costs per unit: Direct materials Direct labor Variable manufacturing overhead Variable selling and administrative Total variable cost per unit Fixed costs per month: Fixed manufacturing overhead Fixed selling and administrative Total fixed cost per month July August The product sells for $48 per unit. Production and sales data for July and August, the first two months of operations, follow: Units Produced 27,000 27,000 Sales Cost of goods sold Gross margin Selling and administrative expenses Net operating income $ 108,000 172,000 $ 280,000 Required: 1. Determine the unit product cost under: a. Absorption costing. b. Variable costing. $ 5 11 3 2 $ 21 Units Sold 23,000 31,000 The company's Accounting Department has prepared the following absorption costing income statements for July and August: July August $ 1,104,000 $ 1,488,000 529,000 575,000 218,000 $ 357,000 713,000 775,000 234,000…arrow_forwardZachary Corporation paid one of its sales representatives $8,500 during the month of March. The rep is paid a base salary plus $11 per unit of product sold. During March, the rep sold 170 units. Required Calculate the total monthly cost of the sales representative's salary for each of the following months. Month Number of units sold i Total variable cost Total fixed cost Total salary cost $ April 210 0 $ May 120 0 $ June 220 0 $ July 130 0arrow_forwardDenton Company manufactures and sells a single product. Cost data for the product are given: Variable costs per unit: Direct materials $ 5 Direct labor 10 Variable manufacturing overhead 3 Variable selling and administrative 1 Total variable cost per unit $ 19 Fixed costs per month: Fixed manufacturing overhead $ 108,000 Fixed selling and administrative 169,000 Total fixed cost per month $ 277,000 The product sells for $48 per unit. Production and sales data for July and August, the first two months of operations, follow: Units Produced Units Sold July 27,000 23,000 August 27,000 31,000 The company's Accounting Department has prepared the following absorption costing income statements for July and August: July August Sales $ 1,104,000 $1,488,000 Cost of goods sold 506,000 682,000 Gross margin 598,000 806, 000 Selling and administrative expenses 192,000 200,000 Net operating income $ 406,000 $ 606,000 Required: 1. Determine the unit product cost under: a. Absorption costing. b. Variable…arrow_forward

- Fanning Corporation paid one of its sales representatives $4,000 during the month of March. The rep is paid a base salary plus $11 per unit of product sold. During March, the rep sold 150 units. Required Calculate the total monthly cost of the sales representative's salary for each of the following months. Month April May June July Number of units sold Total variable cost Total fixed cost Total salary cost 190 100 200 110 24 $arrow_forwardCopland Components manufactures an electronic device for vehicle manufacturing. The current standard cost sheet for a device follows: Direct materials, ? ounces at $2.80 per ounce Direct labor, 0.4 hours at ? per hour Overhead, 0.4 hours at ? per hour Total costs $ ? per device ? per device ? per device $ 30 per device Assume that the following data appeared in Copland's records at the end of the past month: Actual production Actual sales 96,000 units 90,000 units Materials costs (505,000 ounces) $ ? Materials price variance 63,000 U Materials efficiency variance 70,000 U Direct labor price variance 18,750 F Direct labor (37,500 hours) Overapplied overhead (total) There are no materials Inventories. 918,750 25,200 Required: a. Prepare a variance analysis for direct materials and direct labor. b. Assume that all production overhead is fixed and that the $25,200 overapplied is the only overhead variance that can be computed. What are the actual and applied overhead amounts? c. Complete…arrow_forwardShadee Corporation expects to sell 630 sun shades in May and 400 in June. Each shade sells for $138. Shadee’s beginning and ending finished goods inventories for May are 65 and 50 shades, respectively. Ending finished goods inventory for June will be 50 shades. Suppose that each shade takes three direct labor hour to produce and Shadee pays its workers $12 per hour. Additionally, Shadee’s fixed manufacturing overhead is $12,000 per month, and variable manufacturing overhead is $11 per unit produced. Required: Prepare Shadee’s direct labor budget for May and June. Prepare Shadee’s manufacturing overhead budget for May and June.arrow_forward

- Copland Components manufactures an electronic device for vehicle manufacturing. The current standard cost sheet for a device follows: Direct materials, ? ounces at $2.80 per ounce Direct labor, 0.4 hours at ? per hour Overhead, 0.4 hours at ? per hour Total costs $ ? per device ? per device ?per device $ 30 per device Assume that the following data appeared in Copland's records at the end of the past month: Actual production Actual sales Materials costs (505,000 ounces) Materials price variance Materials efficiency variance 96,000 units 90,000 units $ ? 63,000 U 70,000 U Direct labor price variance Direct labor (37,500 hours) Overapplied overhead (total) There are no materials Inventories. Required: 18,750 F 918,750 25,200 a. Prepare a variance analysis for direct materials and direct labor. b. Assume that all production overhead is fixed and that the $25,200 overapplied is the only overhead variance that can be computed. What are the actual and applied overhead amounts? c. Complete…arrow_forwardCopland Components manufactures an electronic device for vehicle manufacturing. The current standard cost sheet for a device follows: Direct materials, ? ounces at $2.80 per ounce Direct labor, 0.4 hours at ? per hour Overhead, 0.4 hours at ? per hour Total costs $ per device ? per device per device $ 30 per device Assume that the following data appeared in Copland's records at the end of the past month: Actual production Actual sales Materials costs (505,000 ounces) Materials price variance Materials efficiency variance Direct labor price variance Direct labor (37,500 hours) Overapplied overhead (total) There are no materials Inventories. Required: 96,000 units 90,000 units $ ? 63,000 U 70,000 U 18,750 F 918,750 25,200 a. Prepare a variance analysis for direct materials and direct labor. b. Assume that all production overhead is fixed and that the $25,200 overapplied is the only overhead varlance that can be computed. What are the actual and applied overhead amounts? c. Complete the…arrow_forwardFinch Corporation paid one of its sales representatives $6,500 during the month of March. The rep is paid a base salary plus $11 per unit of product sold. During March, the rep sold 120 units. Required Calculate the total monthly cost of the sales representative's salary for each of the following months: Month Number of units Total variable cost Total fixed cost Total salary cost $ April 160 0 $ LA May 70 0 $ June 170 0 $ July 80 0arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education