FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

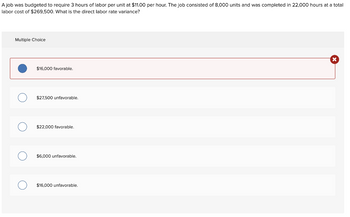

Transcribed Image Text:A job was budgeted to require 3 hours of labor per unit at $11.00 per hour. The job consisted of 8,000 units and was completed in 22,000 hours at a total

labor cost of $269,500. What is the direct labor rate variance?

Multiple Choice

$16,000 favorable.

$27,500 unfavorable.

○ $22,000 favorable.

$6,000 unfavorable.

$16,000 unfavorable.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Similar questions

- Flapjack Corporation had 7,704 actual direct labor hours at an actual rate of $12.30 per hour. Original production had been budgeted for 1,100 units, but only 957 units were actually produced. Labor standards were 7.8 hours per completed unit at a standard rate of $13.05 per hour. The direct labor rate variance is Oa. $5,778.00 unfavorable b. $5,778.00 favorable c. $3,523.81 unfavorable Od. $3,523.81 favorablearrow_forwardGiven the following information in standard costing: Standard 18,200 hours at $6.20 Actual 18,000 hours at $6.00 What is the direct labor rate variance?arrow_forwardA firm uses machine hours to allocate fixed overhead. During the period, budgeted fixed overhead is Rs. 30000. The budgeted machine hours is 100 hours for budgeted volume of 1000 units. The firm produced 1200 units consuming 150 hours and spent Rs. 28000 towards fixed overhead. The fixed overhead spending variance is Rs. 17000 favorable Rs. 17000 adverse Rs. 2000 favorable Rs. 8000 favorablearrow_forward

- Delmar Incorporated uses a standard cost system. Labor standards are 2.00 hours per widget at $13.40 per hour. During August, Delmar Incorporated paid its workers $227,070 for 16,820 hours. Delmar Incorporated produced 8,610 widgets during August Required: a. Calculate the direct labor rate variance. Note: Do not round your intermediate calculations. Indicate the effect of variance by selecting "Favorable", "Unfavorable", or "None" for no effect (i.e., zero variance). b. Calculate the direct labor efficiency variance. Note: Do not round your intermediate calculations. Indicate the effect of variance by selecting "Favorable", "Unfavorable", or "None" for no effect (i.e., zero variance). c. Calculate the direct labor spending variance. Note: Do not round your intermediate calculations. Indicate the effect of variance by selecting "Favorable", "Unfavorable", or "None" for no effect (i.e., zero variance). a. Rate Variance b.Efficiency Variance c. Spending Variancearrow_forwardA firm uses machine hours to allocate overhead cost. During the period, budgeted variable overhead is Rs. 10000 and budgeted machine hours is 100 hours for budgeted volume of 1000 units. The firm produced 1200 units consuming 150 hours and spent Rs. 15000 towards variable overhead. The total variable overhead cost variance is Rs. 3000 favorable Rs. 5000 favorable Rs. 5000 adverse Rs. 3000 adversearrow_forwardGreen Garden Supply budgeted three hours of direct labour per unit at $20.00 per hour to produce 500 units of product. The 500 units were completed using 1,600 hours of direct labour at $20.50 per hour. What is the direct labour price variance at Green Garden Supply? A. $800 favourable B. $750 unfavourable OC. $800 unfavourable D. $750 favourablearrow_forward

- Overhead costs are applied using direct labour hours. The following were budgeted for the year: Planned production (units) 50,000 Direct labour hours 200,000 Variable overhead 1,000,000 Fixed overhead 600,000 The following were the actual results: Actual production (units) 48,000 Direct labour hours 195,000 Variable overhead 950,000 Fixed overhead 610,000 Calculate the variable overhead efficiency variance. Select one: a. $15,000 U b. $25,000 U c. $25,000 F d. $15,000 Farrow_forwardPlease help me with all answers thankuarrow_forwardValaarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education