FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

Transcribed Image Text:Delph

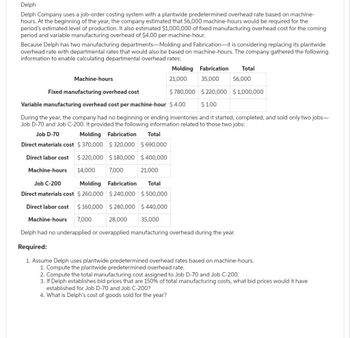

Delph Company uses a job-order costing system with a plantwide predetermined overhead rate based on machine-

hours. At the beginning of the year, the company estimated that 56,000 machine-hours would be required for the

period's estimated level of production. It also estimated $1,000,000 of fixed manufacturing overhead cost for the coming

period and variable manufacturing overhead of $4.00 per machine-hour.

Because Delph has two manufacturing departments-Molding and Fabrication-it is considering replacing its plantwide

overhead rate with departmental rates that would also be based on machine-hours. The company gathered the following

information to enable calculating departmental overhead rates:

Machine-hours

Molding

21,000

Fabrication

35,000

Total

56,000

Fixed manufacturing overhead cost

$ 780,000

$220,000 $1,000,000

Variable manufacturing overhead cost per machine-hour $ 4.00

$1.00

During the year, the company had no beginning or ending inventories and it started, completed, and sold only two jobs-

Job D-70 and Job C-200. It provided the following information related to those two jobs:

Job D-70

Molding

Fabrication Total

Direct materials cost $370,000

$320,000 $ 690,000

$180,000 $400,000

Direct labor cost $ 220,000

14,000

Machine-hours

7,000

21,000

Job C-200

Molding Fabrication Total

Direct materials cost $ 260,000 $240,000 $500,000

Direct labor cost $ 160,000 $280,000 $440,000

Machine-hours 7,000

28,000 35,000

Delph had no underapplied or overapplied manufacturing overhead during the year.

Required:

1. Assume Delph uses plantwide predetermined overhead rates based on machine-hours.

1. Compute the plantwide predetermined overhead rate.

2. Compute the total manufacturing cost assigned to Job D-70 and Job C-200.

3. If Delph establishes bid prices that are 150% of total manufacturing costs, what bid prices would it have

established for Job D-70 and Job C-200?

4. What is Delph's cost of goods sold for the year?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- [The following information applies to the questions displayed below.] Delph Company uses job-order costing with a plantwide predetermined overhead rate based on machine-hours. At the beginning of the year, the company estimated that 54,000 machine-hours would be required for the period’s estimated level of production. It also estimated $1,000,000 of fixed manufacturing overhead cost for the coming period and variable manufacturing overhead of $4.00 per machine-hour. Because Delph has two manufacturing departments—Molding and Fabrication—it is considering replacing its plantwide overhead rate with departmental rates that would also be based on machine-hours. The company gathered the following information to enable calculating departmental overhead rates: Molding Fabrication Total Machine-hours 23,000 31,000 54,000 Fixed manufacturing overhead cost $ 760,000 $ 240,000 $ 1,000,000 Variable manufacturing overhead cost per machine-hour $ 4.00 $ 1.00 During the year, the…arrow_forwardAngler Industries produces a product which goes through two operations, Assembly and Finishing, before it is ready to be shipped. Next year's expected costs and activities are shown below. Assembly 248,888 DLH Finishing 154,000 DLH 68,000 MH 448,800 MH $440,000 Direct labor hours Machine hours Overhead costs Assume that Angler Industries allocates overhead using a plantvide overhead rate based on machine hours. How much total overhead will be assigned to a product that requires 1 direct labor hour and 3.90 machine hours in the Assembly Department, and 4.00 direct labor hours and 0.6 machine hours in the Finishing Department? Multiple Chaises O O O $21.50 $17.60 $2.00. $18.10 $ 677,680 $13.20.arrow_forwardThe Gilster Company, a machine tooling firm, has several plants. One plant, located in St. Cloud, Minnesota, uses a job order costing system for its batch production processes. The St. Cloud plant has two departments through which most jobs pass. Plant-wide overhead, which includes the plant manager’s salary, accounting personnel, cafeteria, and human resources, is budgeted at $250,000. During the past year, actual plantwide overhead was $230,000. Each department’s overhead consists primarily of depreciation and other machine-related expenses. Selected budgeted and actual data from the St. Cloud plant for the past year are as follows. Department A Department B Budgeted department overhead (excludes plantwide overhead) $ 108,000 $ 329,000 Actual department overhead 120,000 344,000 Expected total activity: Direct labor hours 44,000 10,000 Machine-hours 18,000 47,000 Actual activity:…arrow_forward

- Post the relevant items from your journal entries to thes accounts. 3. Prepare a journal entry for item (g) above. 4. If 11,000 of the custom-made machined parts are shipped to the customer in February, how much of this job's cost will be inclu cost of goods sold for February? Answer is not complete. Complete the question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 If 11,000 of the custom-made machined parts are shipped to the customer in February, how much of this job's cost will be included in cost of goods sold for February? (Round your intermediate calculations to 2 decimal places and final answer to the nearest whole dollar amount.) Portion of job cost included in cost of goods sold 45 X < Required 3arrow_forwardMilan Manufacturing Company has identified three cost pools to allocate overhead costs. The following estimates are provided for the coming year: Cost Pool Supervision of direct labor Machine maintenance Facility rent Total overhead costs Cost driver Activity level 920,000 Overhead Costs $794,000 Direct labor-hours $140,000 Machine-hours 1,040,000 $216,000 $1,150,000 Square feet of area 130,000 The accounting records show the Mossman Job consumed the following resources: Cost driver Actual level Direct labor-hours 230 Machine-hours 1,547 Square feet of area 50 OA. $0.86 per direct labor-hour OB. $0.80 per direct labor-hour OC. $1.16 per direct labor-hour OD. $1.25 per direct labor - hourarrow_forwardHickory Company manufactures two products—13,000 units of Product Y and 5,000 units of Product Z. The company uses a plantwide overhead rate based on direct labor-hours. It is considering implementing an activity-based costing (ABC) system that allocates all $829,500 of its manufacturing overhead to four cost pools. The following additional information is available for the company as a whole and for Products Y and Z: Activity Cost Pool Activity Measure Estimated Overhead Cost Expected Activity Machining Machine-hours $ 246,000 12,000 MHs Machine setups Number of setups $ 137,500 250 setups Product design Number of products $ 89,000 2 products General factory Direct labor-hours $ 357,000 14,400 DLHs Activity Measure Product Y Product Z Machine-hours 7,500 4,500 Number of setups 40 210 Number of products 1 1 Direct labor-hours 8,500 5,900 Foundational 7-12 (Algo) 12. Using the ABC system, what percentage of the Machining costs is assigned to Product…arrow_forward

- The Gilster Company, a machine tooling firm, has several plants. One plant, located in St. Cloud, Minnesota, uses a job order costing system for its batch production processes. The St. Cloud plant has two departments through which most jobs pass. Plant-wide overhead, which includes the plant manager’s salary, accounting personnel, cafeteria, and human resources, is budgeted at $250,000. During the past year, actual plantwide overhead was $230,000. Each department’s overhead consists primarily of depreciation and other machine-related expenses. Selected budgeted and actual data from the St. Cloud plant for the past year are as follows. Department A Department B Budgeted department overhead (excludes plantwide overhead) $ 108,000 $ 329,000 Actual department overhead 120,000 344,000 Expected total activity: Direct labor hours 44,000 10,000 Machine-hours 18,000 47,000 Actual activity:…arrow_forwardThe Oswell Company manufactures products in two departments: Mixing and Packaging. The company allocates manufacturing overhead using a single plantwide rate with direct labor hours as the allocation base. Estimated overhead costs for the year are $579,800, and estimated direct labor hours are 260,000. In October, the company incurred 60,000 direct labor hours. Requirement 1. Compute the predetermined overhead allocation rate. Round to two decimal places. Begin by selecting the formula to calculate the predetermined overhead (OH) allocation rate. Then enter the amounts to compute the allocation rate. Predetermined OH ? ÷ ? = allocation rate ? ÷ ? = ? Requirement 2. Determine the amount of overhead allocated in October. Begin by selecting the formula to allocate overhead costs. Allocated mfg. ? × ? = overhead costs The overhead allocated…arrow_forwardMcewan Corporation uses a job-order costing system with a single plantwide predetermined overhead rate based on direct labor- hours. The company based its predetermined overhead rate for the current year on 46,000 direct labor-hours, total fixed manufacturing overhead cost of $322,000, and a variable manufacturing overhead rate of $4.80 per direct labor-hour. Job X941, which was for 50 units of a custom product, was recently completed. The job cost sheet for the job contained the following data: Total direct labor-hours Direct materials Direct labor cost 400 $ 800 $ 6,300 Required: Calculate the selling price for Job X941 if the company marks up its unit product costs by 20%. (Round intermediate calculations and final answer to 2 decimal places.) Selling price per unitarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education